[ad_1]

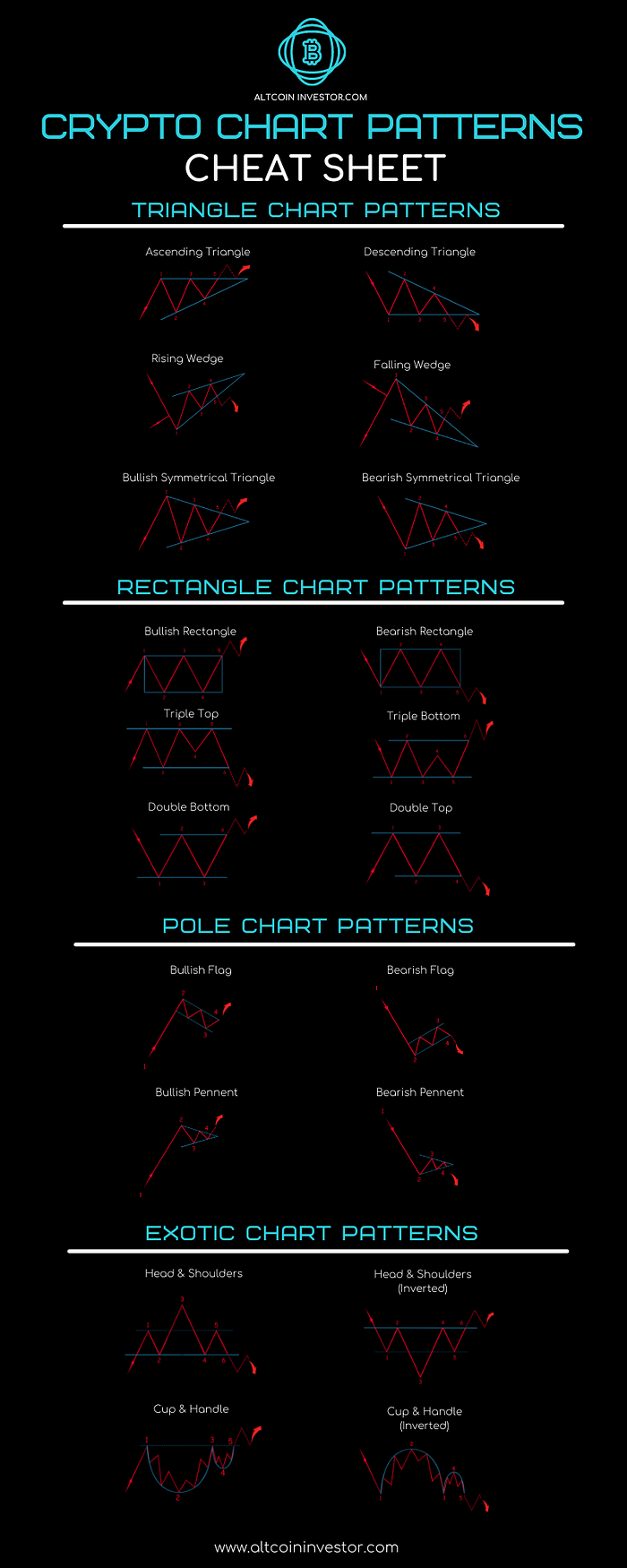

On this article, we cowl the highest 20 most typical crypto chart patterns and what they imply.

What are Chart Patterns?

A chart sample is a form inside a worth chart that means the subsequent worth transfer, based mostly on the previous strikes. Chart patterns are the idea of technical evaluation and assist merchants decide the possible future worth path.

Reading chart patterns have been round for so long as buying and selling has existed and predates the cryptocurrency market.

The patterns described and illustrated on this article should not new. They’ve been borrowed from the technical analysis, going again to the early 1900s, and are related patterns and phrases generally utilized in each the inventory and Forex markets at this time.

High 20 crypto chart patterns:

Though 20 patterns could sound like loads, it’s solely 10 totally different patterns (because the others are inverted).

These twenty buying and selling patterns are categorized into 4 groupings:

- Triangle Chart Patterns (6)

- Rectangle Chart Patterns (6)

- Pole Chart Patterns (4)

- Unique Chart Patterns (4)

TRIANGLE CHART PATTERNS (6)

There are six patterns that fall into triangle patterns. Half of those patterns are their inverted counterparts.

Ascending Triangle

It is a bullish indicator and signifies the continuation of an upward development. The ascending triangle is a quite common sample seen in bullish markets.

In an uptrend, first resistance is discovered (1) and the value reverses till it finds its first help (2). Worth reverses path and continues its upward motion till the second resistance is discovered (3) which is close to or stage to the primary resistance stage and likewise varieties the horizontal line on this sample.

The value reverses path and finds its help barely larger than earlier than (4).

The sample completes when the value breaks by way of the preliminary resistance stage as set out on this sample (5).

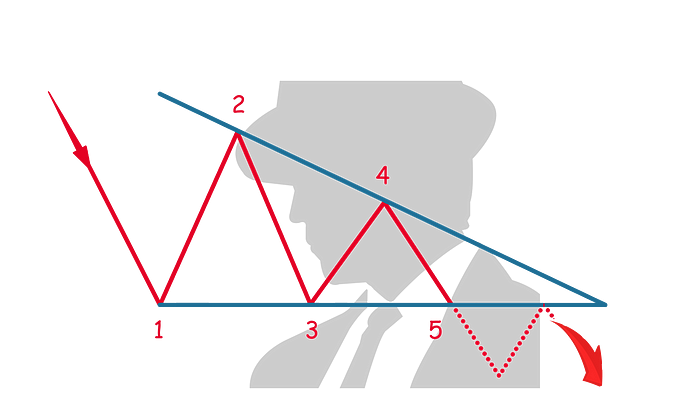

Descending Triangle

It is a bearish indicator and signifies the continuation of the downward development. Additionally it is the inverse of an ascending triangle.

In a downtrend, the primary resistance is encountered (1) setting the horizontal resistance for the remainder of the sample. The value reverses path and finds its first help (2) which would be the highest level on this sample.

The value reverses and finds its second help (3) at an identical stage to the primary resistance (1). The value once more reverses and finds its resistance at a decrease stage than earlier than (4), forming the descending angle of the triangle.

The sample completes when the value reverses once more and breaks beneath (5) the established horizontal line on this sample.

Bullish Symmetrical Triangle

Because the identify suggests, it is a bullish indicator and signifies the continuation of the upward development. The bullish asymmetrical triangle is a typical sample seen in bullish markets.

In an uptrend, the value finds the primary resistance (1) which would be the highest worth within the sample. The value reverses and finds its first help (2) which would be the lowest level on this sample. The value reverses from the primary help (2) and finds the second resistance (3) which is decrease than the primary resistance. These two resistance factors create the downward angle of the symmetrical triangle.

The second help stage (4) is larger than the primary help (2) and varieties the upward angle of the symmetrical triangle.

The sample completes when the value reverses path from the second help (4) and breaks the triangle’s higher line (5).

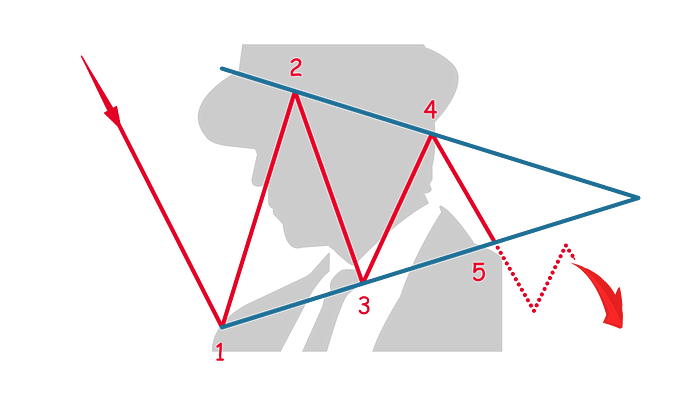

Bearish Symmetrical Triangle

Because the identify suggests, this sample is bearish and signifies the continuation of the downward development. The bearish symmetrical triangle is a typical sample seen in bearish markets.

In a downtrend, the value finds its first help (1) which is the bottom worth on this sample. The value reverses and finds its first resistance (2), which is the very best level on this sample.

The second help (3) is larger than the primary help (1) and creates the upward angle of this sample. The value reverses path and the second resistance (4) is decrease than the primary resistance (2) creating the downward angle of this sample.

The sample completes when the value reverses previous the underside angle of the sample (5) and anticipates a decrease low and bearish development.

Rising Wedge

The rising wedge is a bearish indicator and might be present in both an uptrend or a downtrend. It isn’t a typical sample.

In both an uptrend or downtrend, the primary level on this sample (1) varieties the primary help stage and likewise the bottom level within the sample. As the value reverses, the primary resistance stage (2) is ready and can also be the bottom resistance stage within the sample.

As the value reverses, the second help (3) is discovered and the primary (1) and the second help (3) type the underside angle of the rising wedge.

The value reverses and the second resistance stage (4) is at a degree larger than the primary resistance stage (2).

The sample completes when the value reverses (4) and breaks by way of the underside of the rising wedge (5).

Falling Wedge

The falling wedge is a bullish indicator that may be present in both an uptrend or downtrend. The falling wedge just isn’t a quite common sample. The falling wedge can also be the inverse of the rising wedge.

This chart sample might be fashioned after both an uptrend or a downtrend the place the primary resistance (1) marks the very best level on this sample. The value reverses, discovering the primary help (2) which can also be the very best help stage on this sample.

The value reverses, shifting upward till hitting the second resistance stage (3) which is decrease than the primary resistance level (1). These two factors additionally mark the highest angle of the falling wedge.

The value reverses discovering the second help (4) which can also be decrease than the primary help stage (2), marking the underside angle of the falling wedge.

The sample completes when the third resistance stage (5) breaks by way of the higher angle of the falling wedge.

RECTANGLE CHART PATTERNS (6)

There are six patterns that fall into the rectangle chart sample. Half of those patterns are their inverted counterparts.

Bullish Rectangle

The bullish rectangle is a typical sample that signifies the continuation of an uptrend.

In an uptrend, the value finds its first resistance (1) which is able to type the idea for a horizontal line which would be the resistance stage for the remainder of the sample.

As the value reverses, it finds its first help (2) which will even type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value strikes upward from its first help (2), it finds the second resistance stage (3) which is on the similar or related stage as the primary resistance.

The value reverses path shifting downward and finds help (4) on the similar or related stage as the primary help.

The sample completes when the value reverses its path, shifting upward and breaking the higher border of the sample (5).

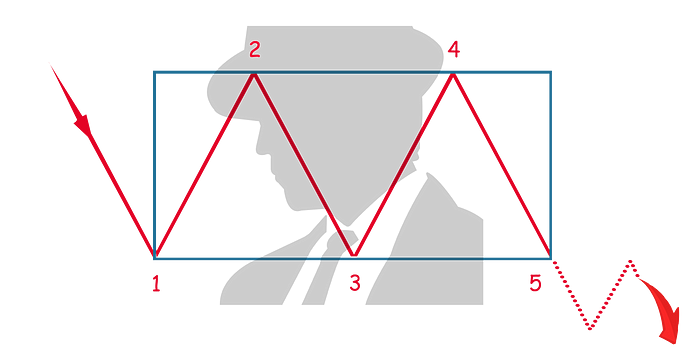

Bearish Rectangle

The bearish rectangle is a quite common sample that signifies the continuation of a downtrend. Additionally it is the inverse of the bullish rectangle.

In a downtrend, the value finds its first help (1) which is able to type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value reverses, it finds its first resistance (2) which will even type the idea for a horizontal line that would be the resistance stage for the remainder of the sample.

The value reverses, shifting downward till it finds the second help stage (3) which is on the similar or related stage of help as the primary (1).

The value reverses path, shifting upward till it finds the second stage of resistance (4) which is on the similar or related stage of resistance as the primary (2).

The sample completes when the value reverses path, shifting downward till it breaks the decrease border of the sample (5).

Double High

A double prime is a quite common sample and signifies a reversal in worth path.

In an uptrend, the value finds its first resistance (1) which is able to type the idea for a horizontal line that would be the resistance stage for the remainder of the sample.

As the value reverses, it finds its first help (3) which will even type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value reverses and strikes upward, it finds the second resistance (3), which is on the similar related resistance as the primary resistance (1).

The sample completes when the value reverses path, shifting downward till it breaks the help stage set out within the sample (4).

Double Backside

A double prime is a quite common sample and signifies a reversal in worth path. Additionally it is the inverse of the double prime.

In a downtrend, the value finds its first resistance (1) which is able to type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value reverses, it finds its first resistance (2) which will even type the idea for a horizontal line that would be the resistance stage for the remainder of the sample.

As the value reverses and strikes downward, it finds the second help (3), which is on the similar help stage as the primary help (1).

The sample completes when the value reverses path, shifting upward till it breaks the resistance stage set out within the sample (4).

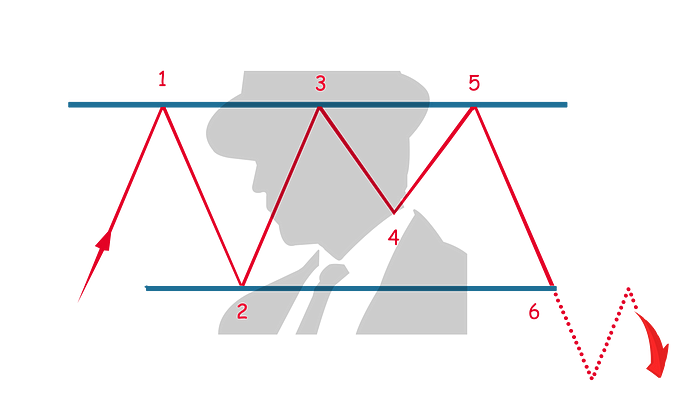

Triple High

A triple prime is a bearish indicator and a much less widespread sample. It signifies a reversal in worth path.

In an uptrend, the value finds its first resistance (1) which is able to type the idea for a horizontal line that would be the resistance stage for the remainder of the sample.

As the value reverses, it finds its first help (2) which will even type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value reverses and strikes upward, it finds the second resistance (3), which is on the similar resistance stage as the primary resistance (1).

As the value reverses and strikes downward, it finds the second help (4), which might be larger or decrease than the primary help (2).

The value motion reverses and strikes upward till it hits the resistance stage (5) which is on the similar resistance stage as the primary resistance (1).

The sample completes when the value reverses path, shifting downward till it breaks the help stage set out within the sample (6).

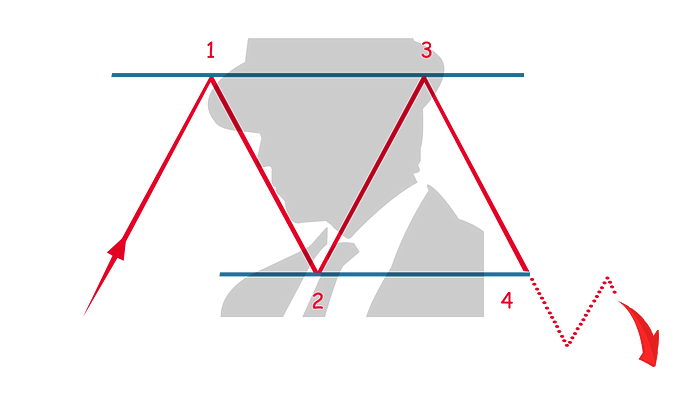

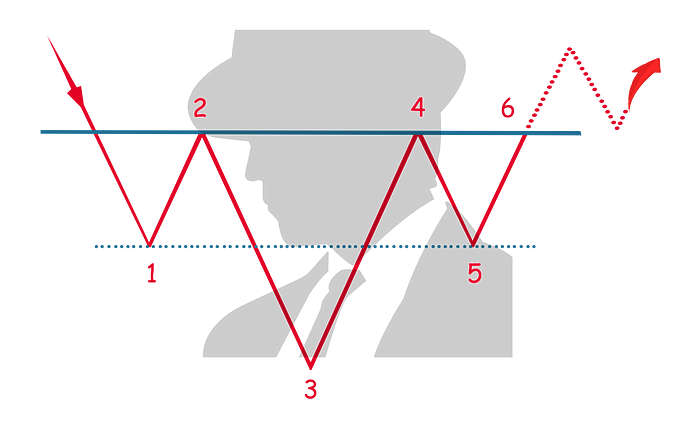

Triple Backside

A triple backside is a bullish indicator and a much less widespread sample. It signifies a reversal in worth path. Additionally it is the inverse of a triple prime.

In a downtrend, the value finds its first help (1) which is able to type the idea for a horizontal line that would be the help stage for the remainder of the sample.

As the value reverses, it finds its first resistance (2) which will even type the idea for a horizontal line that would be the resistance stage for the remainder of the sample.

As the value reverses and strikes downward, it finds the second help (3), which is on the similar help stage as the primary help (1).

As the value reverses and strikes downward, it finds the second resistance (4), which might be larger or decrease than the primary resistance (2).

The value motion reverses and strikes upward till it hits the help stage (5) which is on the similar help stage as the primary help (1).

The sample completes when the value reverses path, shifting upward till it breaks the resistance stage set out within the sample (6).

POLE CHART PATTERNS (4)

There are 4 patterns that fall underneath this class. Half of those patterns are their inverted counterparts.

Bullish Flag

A bullish flag, because the identify suggests is a bullish indicator and a quite common sample.

In a pointy and extended uptrend, the value finds its first resistance (2) which is able to type the flag’s pole of this sample.

As the value reverses, in brief increments of worth reversal, the flag-like formation of the sample will seem. That is recognized by decrease highs and decrease lows till help is lastly discovered (3).

The sample completes when the value reverses path, shifting upward till it breaks out of the flag-like sample (4).

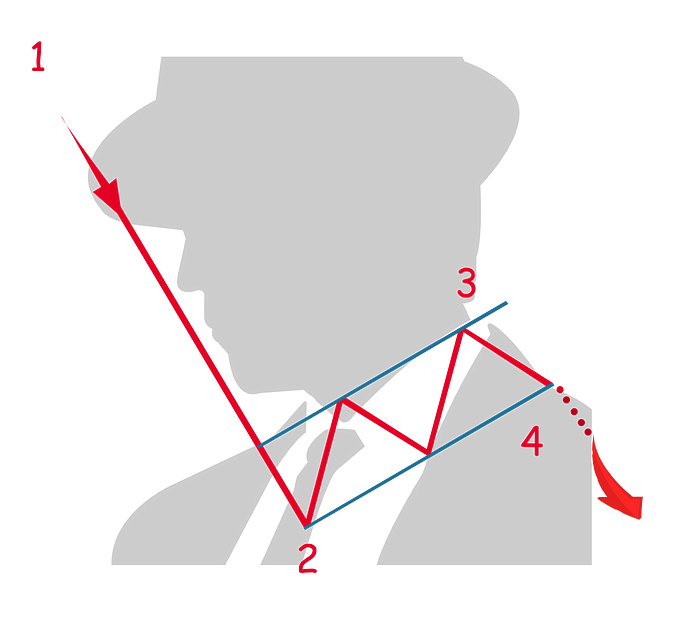

Bearish Flag

A bearish flag, because the identify suggests is a bearish indicator and a quite common sample. Additionally it is the inverse of the bullish flag.

In a pointy and extended downtrend, the value finds its first help (2) which is able to type the inverted flag’s pole of this sample.

As the value reverses, in brief increments of worth reversal, the flag-like formation of the sample will seem. That is recognized by larger lows and better highs in a slender flag-like formation till the very best resistance stage is discovered (3).

The sample completes when the value reverses path, shifting downward till it breaks out of the flag-like sample (4).

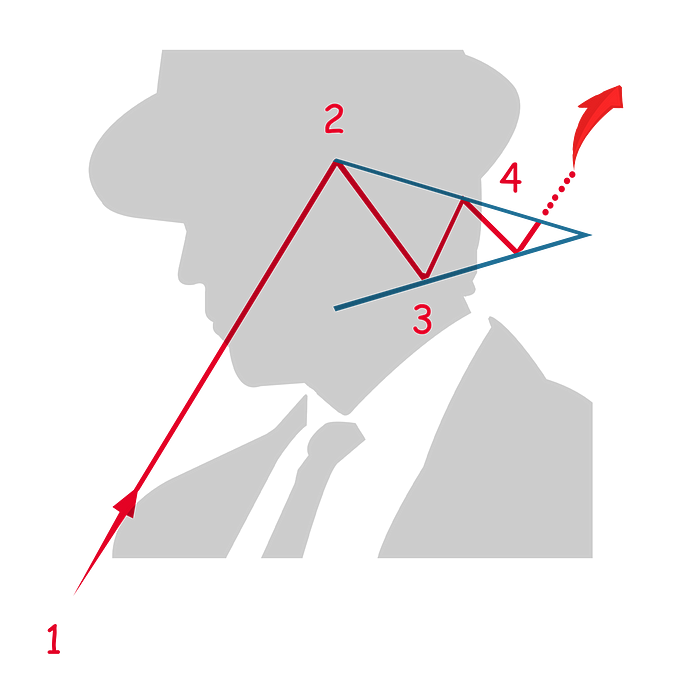

Bullish Pennant

A bullish pennant, because the identify suggests is a bearish indicator and a quite common sample.

In a pointy and extended uptrend, the value finds its first resistance (2) which is able to type the pole of the pennant.

As the value reverses, in a brief increment, it finds its first help stage (3).

In brief increments of worth reversal, the pennant-like formation of the sample will seem. That is recognized by decrease highs and better lows in a slender pennant-like formation.

The sample completes when the value reverses path, shifting upward till it breaks out of the higher a part of the pennant-like formation (4).

Bearish Pennant

A bearish pennant, because the identify suggests is a bearish indicator and a quite common sample. Additionally it is the inverse of the bullish pennant.

In a pointy and extended downtrend, the value finds its first help (2) which is able to type the pole of the pennant.

As the value reverses, in a brief increment, it finds its first resistance stage (3).

In brief increments of worth reversal, the pennant-like formation of the sample will seem. That is recognized by decrease highs and better lows in a slender pennant-like formation.

The sample completes when the value reverses path, shifting downward till it breaks out of the decrease a part of the pennant-like formation (4).

EXOTIC CHART PATTERNS (4)

There’s a group of patterns that aren’t quite common and that don’t properly match into the abovementioned classes.

Head & Shoulders

The top and shoulders sample is a bearish indicator and signifies a reversal of path. It isn’t a quite common sample.

In an uptrend, the value finds its first resistance (1) which varieties the left shoulder of the sample.

As the value reverses, in a brief increment, it finds its first help stage (2), finishing the formation of the left shoulder.

The value reverses and strikes upward, it finds the second resistance (3), forming the top, which have to be larger than the primary resistance (1).

The value reverses and strikes downward till it finds the second help (4), close to the identical worth as the primary help (2) finishing the top formation.

The value reverses and strikes upward till it finds the second resistance (5), which is close to to the identical worth as the primary resistance (1). This varieties the fitting shoulder of the sample.

The sample completes when the value reverses path, shifting downward till it breaks out of the decrease a part of the fitting shoulder sample (6).

Head & Shoulders Inverted

The top and shoulders Inverted, because the identify suggests is an inverted model of the top and shoulders sample. It signifies a reversal of path (bullish) and isn’t a quite common sample.

In a downtrend, the value finds its first help (1) which varieties the left shoulder of the sample.

As the value reverses, in a brief increment, it finds its first resistance stage (2), finishing the formation of the (inverted) left shoulder.

The value reverses and strikes downward, it finds the second help (3), forming the (inverted) head, which have to be decrease than the primary help (1).

The value reverses and strikes upward till it finds the second resistance (4), close to to the identical worth as the primary resistance (2) finishing the (inverted) head formation.

The value reverses and strikes downward till it finds the second help (5), which is close to to the identical worth as the primary help (1). This varieties the (inverted) proper shoulder of the sample.

The sample completes when the value reverses path, shifting upward till it breaks out of the upper a part of the (inverted) proper shoulder sample (6).

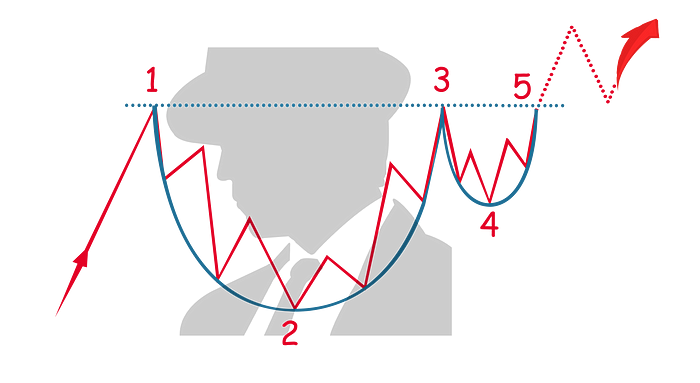

Cup & Deal with

The cup and deal with sample signifies the continuation of a sample and is a bullish indicator. It isn’t a quite common sample.

In an uptrend, the value finds its first resistance (1) which varieties the sting of the cup sample. The value reverses path and in brief increments and worth reversals, finds its help (2), the bottom level within the sample and forming the underside of the cup.

The value path reverses, shifting upward in brief increments till it finds the second resistance (3), which is at an identical stage to the primary stage of resistance (1), finishing the cup formation.

The deal with formation is created when the value strikes downward till it finds its help (4) which is larger than the primary help stage (2).

The sample completes when the value motion reverses, shifting upward (5) and breaks out of the cup and deal with formation.

Cup & Deal with Inverted

The cup and deal with inverted sample, because the identify signifies is an inversion of the cup and deal with sample. This sample signifies the continuation of a sample and is a bearish indicator. It isn’t a quite common sample.

In a downtrend, the value finds its first help (1) which varieties the sting of the (inverted) cup sample. The value reverses path and in brief increments and worth reversals, finds its resistance (2), the very best level within the sample and forming the (inverted) backside of the cup.

The value path reverses, shifting downward in brief increments till it finds the second help (3), which is at an identical stage to the primary stage of help (1), finishing the (inverted) cup formation.

The deal with formation is created when the value strikes upward till it finds its resistance (4) which is decrease than the primary resistance stage (2).

The sample completes when the value motion reverses, shifting downward (5) and breaking out of the (inverted) cup and deal with formation.

Obtain the Cheat Sheet:

For simple reference, a high-resolution infographic has been offered.

Get your personal copy and download this cheat sheet here

Using Chart Patterns & Technical Evaluation

Chart patterns and technical indicators are essential instruments within the evaluation of cryptocurrencies and different monetary markets. They assist traders and merchants to make educated selections by offering insights into the market dynamics.

This is a breakdown of how they’re utilized within the realm of crypto investing:

Understanding Market Sentiment:

- Chart patterns replicate the collective psychological demeanor of market members which is significant in understanding market traits. For instance, patterns like Head and Shoulders, or Double High/Backside, can point out a reversal in development, reflecting shifts in market sentiment.

Development Identification:

- Figuring out the prevailing development is key in technical analysis. Patterns like flags and pennants, or indicators like Moving Averages, assist in understanding whether or not a cryptocurrency is in an uptrend, downtrend, or a sideways development.

Help and Resistance Ranges:

- Each chart patterns and technical indicators assist in figuring out help and resistance ranges that are essential for entry and exit factors. As an example, a breakout above a resistance stage might signify a possible bullish run.

Predicting Future Worth Actions:

- By analyzing historic worth information, merchants can use chart patterns and technical indicators to make educated predictions on future worth actions.

Quantity Evaluation:

- Quantity indicators present insights into the energy or weak spot of worth actions. As an example, a worth motion accompanied by excessive quantity may signify a powerful development, which might be confirmed with different indicators or chart patterns.

Threat Administration:

- By figuring out potential reversal factors and development strengths, traders can set stop-loss and take-profit ranges, that are essential for danger administration within the risky crypto market.

Enhancing Buying and selling Methods:

- Combining chart patterns with technical indicators can refine buying and selling methods. As an example, utilizing a mixture of development indicators with chart patterns can present a extra sturdy understanding of market circumstances.

Affirmation:

- Using each chart patterns and technical indicators can present affirmation for commerce setups. For instance, a bullish chart sample together with a bullish crossover in Shifting Averages can present stronger affirmation for an extended place.

Historic Efficiency Evaluation:

- Technical evaluation permits for the analysis of historic efficiency which can be utilized to fine-tune buying and selling methods for higher efficiency within the crypto market.

Comparative Evaluation:

- Evaluating totally different cryptocurrencies or different altcoins by way of technical evaluation may help in asset allocation and diversification.

In abstract, chart patterns and technical indicators, when used successfully, can present a sturdy framework for navigating the complexities of the cryptocurrency market, enabling higher decision-making and probably extra worthwhile trading strategies.

You Could Additionally Like:

What is Technical Analysis & Why YOU Need to Know It!

Technical Analysis is a method of evaluating crypto assets and predicting their future movements.

Top “Technical Indicators” for Crypto – MUST READ!

Technical indicators are mathematical calculations based on the price, volume, or open interest of a financial asset.

💸 Crypto Cashflow: 10 Ways to Grow Your Crypto Empire

From Hodl to High Yield: Top 10 ways to grow your crypto assets.

[ad_2]

Source link