South Korea has as soon as once more postponed the implementation of its 20% tax on cryptocurrency positive aspects, marking the third delay because the tax was first proposed in 2021.

The newest resolution, announced on 1 December 2024, will push the tax implementation to 2025, following an settlement between the Democratic Celebration of Korea (DPK) and the ruling Folks Energy Celebration (PPP) throughout price range negotiations.

Initially deliberate for 1 January 2022, the tax has confronted repeated postponements attributable to regulatory issues and political debates.

NEW:

South Korea delays its 20% tax on crypto-asset positive aspects by two extra years till 2025 pic.twitter.com/dmW9QwDxNr

— Blockworks (@Blockworks_) June 20, 2022

The DPK Flooring Chief Park Chan-dae confirmed the delay at a press convention, emphasizing the necessity for extra institutional preparation earlier than imposing the tax.

“After in-depth discussions on the postponement of taxation on digital property, I believed that now could be the time for extra institutional overhaul,” he acknowledged.

The proposed delay shall be voted on throughout a plenary session of the Nationwide Meeting on 2 December.

Historical past Of Postponements Beginning 2021

The 20% tax on cryptocurrency positive aspects exceeding 2.5 million Korean received ($1,784) was first proposed in 2021 to handle the rising marketplace for digital property. Nonetheless, issues over market volatility and a scarcity of sturdy infrastructure led to its preliminary delay to 2023.

Subsequent political pressures and the necessity for regulatory refinement postponed the tax to 2025, and now additional to 2027.

Within the newest deliberations, the DPK argued for extra institutional preparation earlier than implementing the tax. “After deep dialogue, I believed that the digital asset tax deferral was a time when further institutional overhaul was mandatory,” stated Park Chan-dae, the DPK flooring chief, throughout a press briefing.

This sentiment was echoed by Ko Kwang-hyo, tax coverage chief on the Ministry of Economic system and Finance, who emphasised the necessity for extra complete market infrastructure earlier than imposing the tax.

The DPK had initially pushed for a better tax-deductible threshold of fifty million received ($35,714) to alleviate the burden on smaller traders.

Nonetheless, the newest resolution aligns with the federal government and ruling social gathering’s proposal for a two-year delay, favoring broader structural enhancements.

EXPLORE: South Korean Authorities Uncover $232M Crypto Fraud, YouTube Star In Spotlight

South Korean Merchants Drive XRP Surge

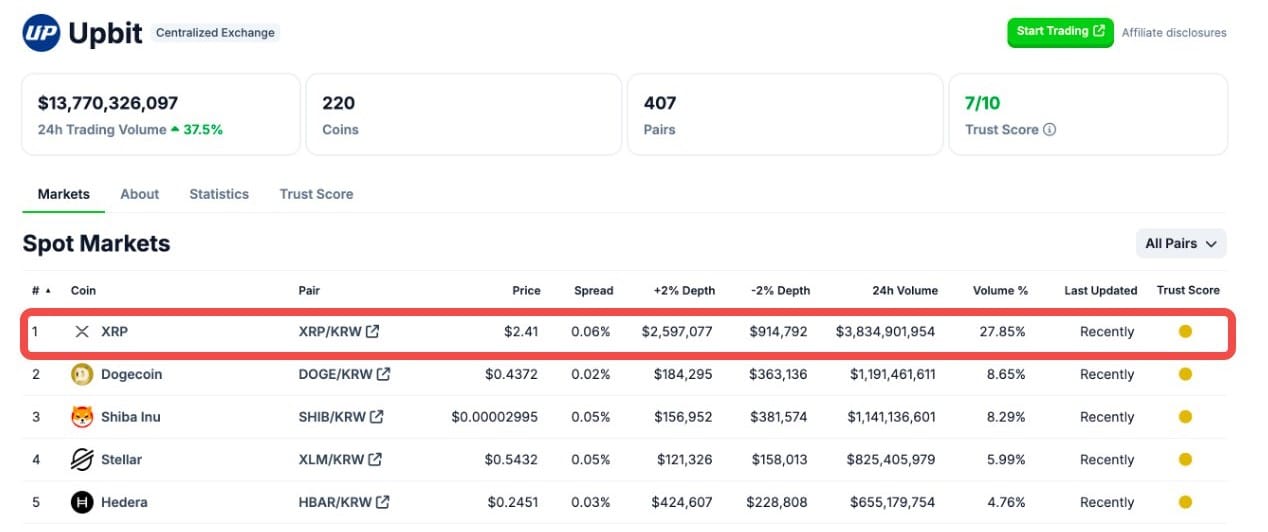

South Korea is house to one of many world’s most energetic retail cryptocurrency markets, with exchanges like Upbit rating among the many high 5 international spot exchanges. Upbit alone noticed over $11 billion in commerce quantity inside a 24-hour interval, highlighting the market’s sturdy exercise.

Blockchain analytics agency Scopescan reported that

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

/KRW buying and selling quantity on the South Korean alternate reached $3.8 billion within the final 24 hours—an quantity that outpaced Bitcoin trades by an astounding 11 occasions.

Equally, XRP exercise on Bithumb, one other main South Korean platform, hit $1.2 billion, accounting for 32% of the alternate’s complete buying and selling quantity.

Ryan Kim, co-founder of Hashed, attributed this loyalty to the nation’s early adoption of XRP, which started way back to 2014 by way of campaigns by Ripple Labs.

“Ripple Labs offered XRP to Korean Ajummas with a Ponzi scheme in 2014. It was known as ‘Ripple Market Korea.’ There have been so many individuals invested in XRP again then. Most likely they made a lot cash lol. There’s a real XRP group in Korea, and that’s why Koreans are shopping for XRP quite a bit,” Kim stated.

EXPLORE: Is It Possible to Get Free Crypto CATS? Here’s The Best Way to Stack CATs in Q4

Political Dynamics And Public Backlash

The postponement highlights the political sensitivities surrounding the taxation of cryptocurrency positive aspects in South Korea, a nation with one of the energetic retail crypto markets globally.

Opposition events have criticized the tax as a “youth tax,” arguing that it disproportionately impacts youthful traders who dominate the nation’s crypto market.

“Opinions throughout the social gathering differed till the tip, so we didn’t attain an general settlement,” a management official stated. The PPP argued that the tax would stifle the monetary aspirations of younger traders, a demographic essential to the nation’s financial future.

Throughout the press convention, Park Chan-dae additionally addressed broader fiscal insurance policies, rejecting proposals to decrease the highest inheritance tax price and separate taxation of dividend earnings. He described these measures as “tax cuts for the ultra-rich,” reiterating the social gathering’s give attention to equitable taxation.

The postponement could aligns with broader efforts to manage digital property, together with the Digital Belongings Fundamental Act, which is about to manipulate the issuance and itemizing of cryptocurrencies.

The submit South Korea Delays 20% Crypto Tax For Third Time, Cites Regulatory Refinement appeared first on .