Bitcoin skilled excessive volatility yesterday after reaching a brand new all-time excessive of $104,088 on Wednesday. What adopted was a textbook “Darth Maul” candle on the each day chart, as BTC plummeted from $103,550 to as little as $90,500 earlier than stabilizing. Whereas some observers initially learn the transfer as a harsh rejection on the psychologically important $100,000 stage, main analysts recommend this might characterize a routine market flush-out somewhat than a cyclical peak.

May This Be The Bitcoin Cycle High?

Merchants and analysts on X current a unified narrative: the abrupt spike and subsequent plunge had been doubtless orchestrated by massive gamers capitalizing on high-leverage traders. Veteran dealer IncomeSharks (@IncomeSharks) said, “Bitcoin – Traditional Darth Maul. Right me if I’m improper however I don’t suppose we’ve seen an asset prime with that form of candle. Normally that’s the punish late longers, entice the shorters, and ship it greater candle.”

One other crypto analyst referred to as Astronomer (@astronomer_zero) added, “It’s simply whales utilizing the ‘rinse excessive leverage button.’ Earlier than persevering with no matter it was meant to do. I might need to see the draw back of that wick cleared, however that could possibly be it too.”

Associated Studying

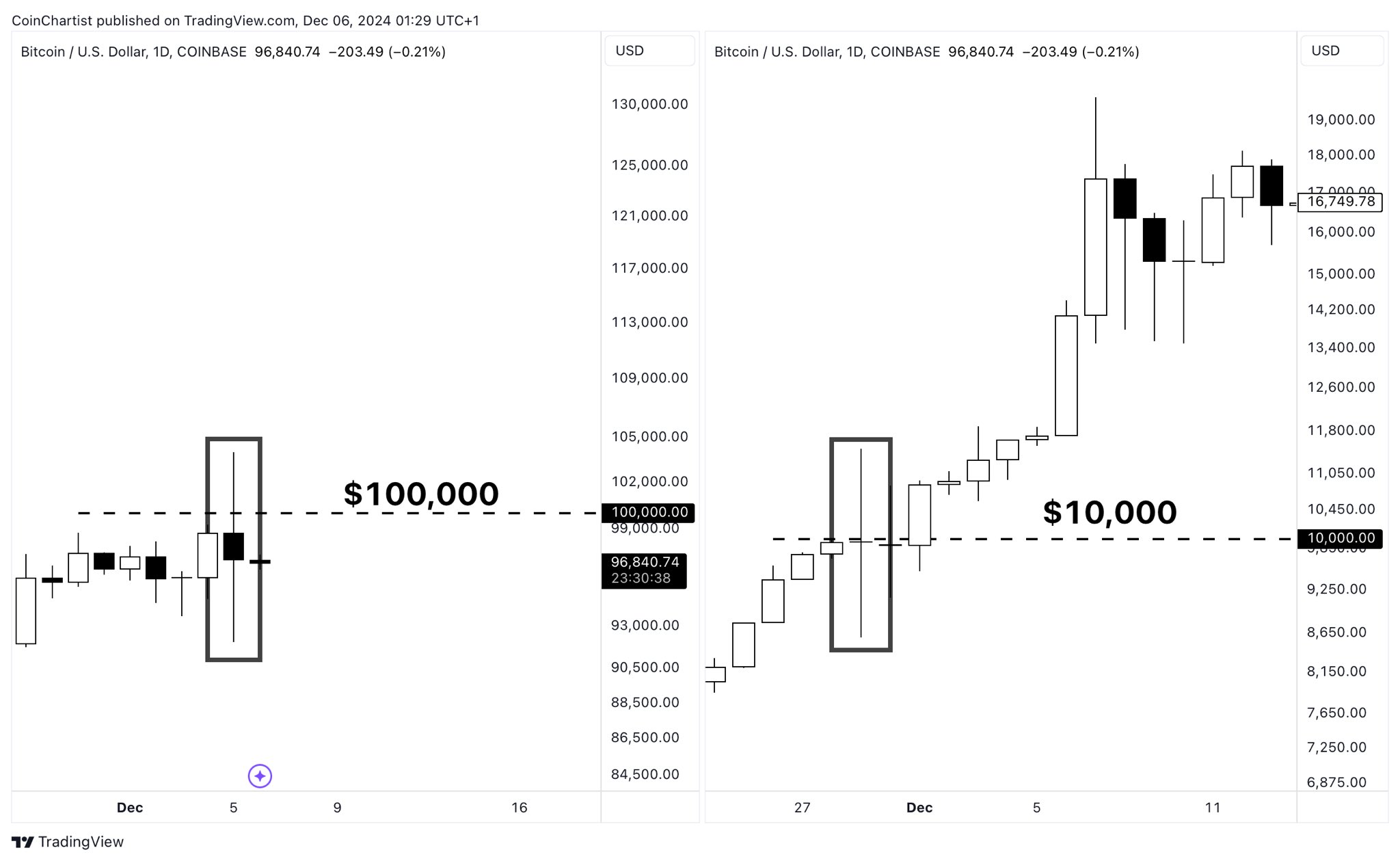

Tony “The Bull” Severino, CMT, underscored the dimensions of those strikes, noting: “An $11K ‘Darth Maul’ on the Bitcoin each day chart. Stops on each side had been run. Unimaginable intraday volatility in Bitcoin. Welcome to what it’s like for BTC to be $100K. $10,000 strikes in a day are actually a factor.”

He adopted up, “$100K Bitcoin is the brand new $10K,” sharing comparative charts from the 2020–2021 bull run and drawing parallels to the present value surroundings.

Charles Edwards, founding father of Capriole Investments, bolstered this historic context: “Bitcoin. Sure, that is regular.” Edwards posted the same chart, recalling the volatility when BTC was at $10,000 in addition to $1,000 in early 2017.

Key indicators additionally stay suggestive of additional upside. In keeping with Matthew Sigel, head of analysis at VanEck, prime indicators are scarce at these ranges. “Other than funding charges, which may keep elevated for a while, only a few of our ‘prime indicators’ indicators say the cycle is peaking. The trail of least resistance remains to be greater, for my part.”

Associated Studying

Sigel referenced 4 key metrics: the MVRV Z-Rating (nonetheless under 5), the Bitcoin Value SMA Multiplier (indicating room for additional development), subdued Google Traits, and Crypto Market Dominance at a mid-range stage. These information factors collectively indicate that the present cycle will not be approaching its apex.

Macro analyst Alex Krüger (@krugermacro) delivered one other perspective: “Being requested if that was the highest so enable me to share my view. In my ebook the primary levered flush out of a robust bull run, notably one pushed by robust fundamentals, doesn’t mark the highest.”

He famous that whereas the transfer was broadly anticipated on the whole phrases—albeit not exactly timed—it doesn’t alter the underlying energy of Bitcoin’s rally. Krüger added that the sudden retail pivot to older, “dino” altcoins might need signaled a neighborhood prime for these belongings, however not essentially for Bitcoin: “Nothing actually has modified imo. Would have preferred to see funding additionally reset on alts. Alas, we are able to’t get all of it.”

At press time, BTC traded at $98,146.

Featured picture created with DALL.E, chart from TradingView.com