Why is Ethereum taking place? In keeping with Circle Squared Different Investments CEO Jeff Sica, Bitcoin is the Mick Jagger of crypto. On the identical time, Ethereum performs Keith Richards—a comparability as daring as their affect available on the market.

BTC’s

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

function as a digital gold store is well-trodden territory. Nonetheless, Ethereum’s emergence as a versatile, use-case-driven participant has some calling it “digital silver.” One other to name ETH “Digital Silver,” Deutsche Financial institution economist Marion Laboure says collectively, BTC and ETH are carving out distinct paths within the new monetary order.

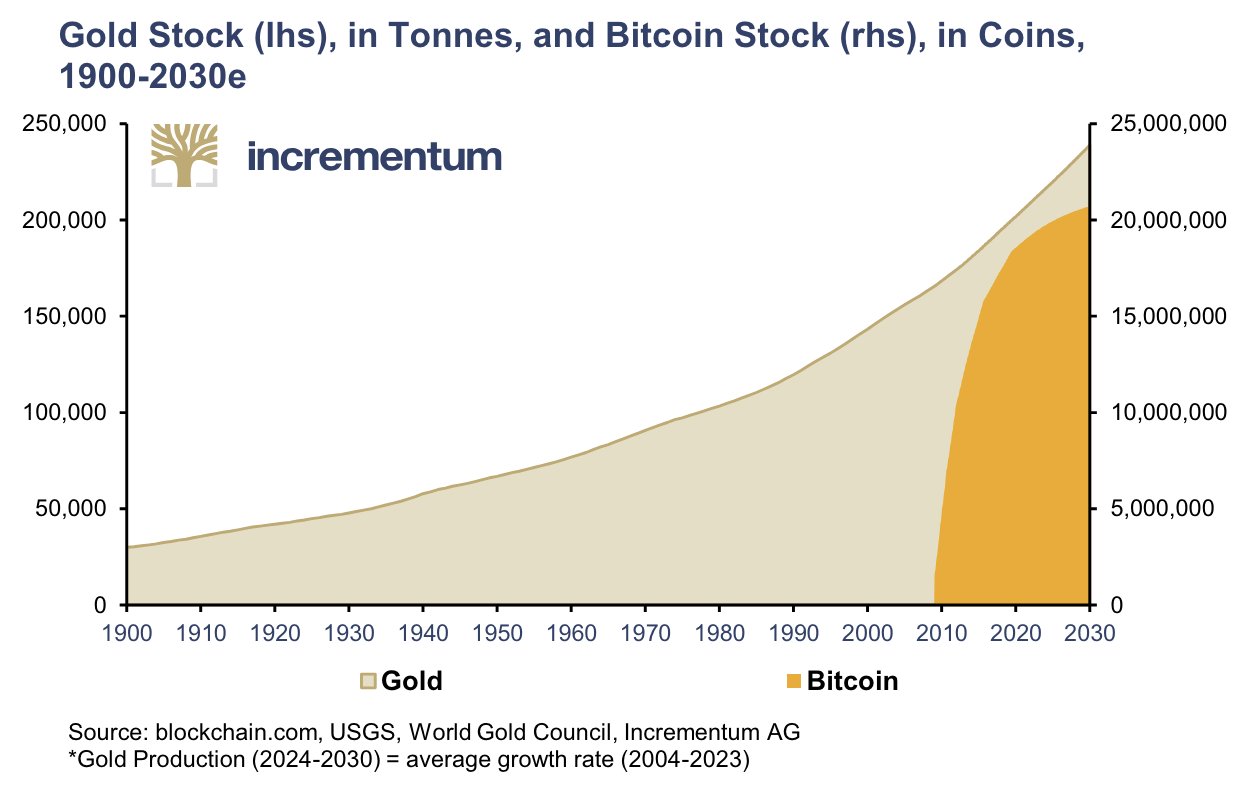

Can Bitcoin Exchange Gold as a Protected-Haven Asset?

All through historical past, folks have sought to guard their wealth in property unlinked to authorities management, with gold changing into the final word secure haven. In keeping with Laboure, Bitcoin might obtain the same standing within the digital age as a result of its decentralized nature and finite provide.

“Till just lately, gold has been this major asset. So I might envision bitcoin to be a sort of digital gold the place folks can retailer their worth as properly,” Laboure mentioned.

This angle isn’t new. Bitcoin is moving into gold’s sneakers, quick changing into the go-to inflation hedge for a brand new wave of buyers navigating an unstable economic system. J.P. Morgan strategists add weight to the shift, arguing that the youthful crowd’s urge for food for digital property may push Bitcoin into gold’s territory in fashionable portfolios.

Furthermore, Jerome Powell just lately said that Bitcoin is a competitor to gold.

Ethereum Isn’t Digital Silver, It’s Digital Oil

The place Bitcoin locks itself in as a price retailer, Ethereum stretches out because the spine for a brand new digital ecosystem. It’s digital oil, if something. Ethereum nonetheless runs the present for DeFi initiatives, NFT marketplaces, and past, giving it way more utility than simply transferring cash.

This has earned it the second slot by market worth, half of Bitcoin’s, however powered by greater than hypothesis—it’s the muse of decentralized functions and a complete new wave of expertise.

Deutsche Financial institution has arrived late to the crypto get together, taking the rostrum with a take so fundamental it’s like listening to a freshman clarify Ethereum after watching one YouTube video.

Their soundbite, rooted in market cap comparisons, smacks of the “silver to gold” cliché that’s been tossed round since Litecoin slugged its manner onto the scene. However right here’s the rub—Ethereum isn’t silver. It’s oil fueling an enormous ecosystem of sensible contracts and decentralized innovation.

The Digital Silver Debate

If something, Litecoin, one of many earliest cryptocurrencies, is extra so the silver to Bitcoin. Nevertheless, its lack of innovation left it sidelined as different protocols surpassed its performance and relevance.

Whether or not Bitcoin solidifies its place as digital gold or Ethereum actually turns into the digital silver, one factor is definite—their roles within the monetary ecosystem are simply starting to take form. They each stay central to shaping the way forward for decentralized finance and investments.

EXPLORE: Elon Musk’s Hedgehog SHRUB Meme Coin Pumps +30%: Is This Best Animal Coin HODL?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit If Bitcoin is Digital Gold, Is Ethereum Really Digital Silver? appeared first on 99Bitcoins.