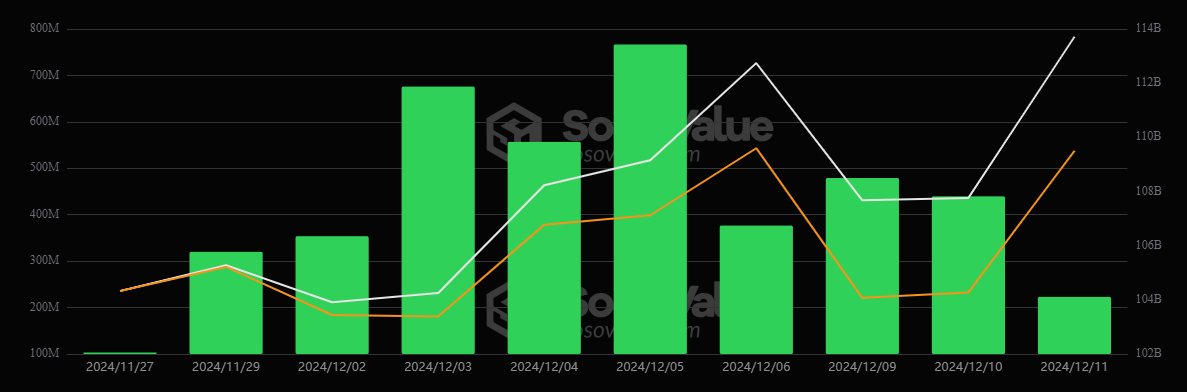

Ethereum and Bitcoin ETFs are stealing the present, with weeks of robust inflows signaling a transparent surge in investor urge for food. Institutional gamers are leaping in, and retail traders are diversifying their bets, pushing this section into the highlight.

Main the cost, Bitcoin spot ETFs have racked up a 10-day streak of inflows, pulling in $223 million on December 11 alone. Constancy’s Bitcoin ETF (FBTC) carried a lot of the load, throwing down $122 million on Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

in a single day.

Bitcoin ETFs Lead With Regular Momentum

iShares Bitcoin Belief (IBIT) has emerged because the dominant participant, managing $51.1 billion in belongings. Constancy’s FBTC follows carefully, with $20 billion beneath administration. Each ETFs have posted a strong 138% progress since February, far outpacing the broader market index.

“We consider many advisors and traders make the most of Bitcoin ETFs for a small portion of their portfolios, leveraging them in a risk-on capability,” stated Todd Rosenbluth, analysis head at TMX VettaFi.

EXPLORE: Buying and Using Bitcoin Anonymously / Without ID

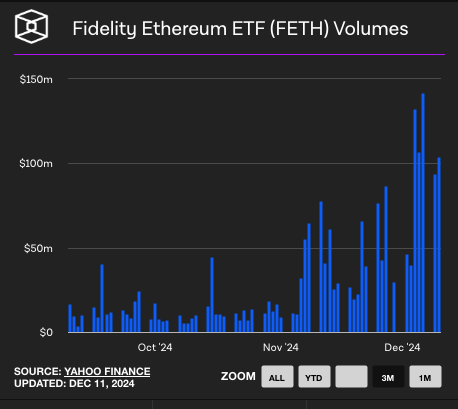

Ethereum ETFs Be part of the Rally

To not be outdone, Ethereum-focused ETFs have loved their very own influx streaks, with 13 consecutive days of optimistic web flows. Over this era, $1.95 billion has poured into Ethereum ETFs, elevating their web belongings to $13.18 billion.

Blackrock’s Ethereum ETF (ETHA) led on December 11, bringing in $74.1 million. Such constant inflows reveal the rising institutional acceptance of Ethereum as a core asset class alongside Bitcoin. Ethereum ETFs now account for two.86% of the cryptocurrency’s world market capitalization, solidifying their rising market relevance.

The variations between spot and futures-based ETFs stay crucial to this market shift. Spot ETFs, favored for his or her direct monitoring of cryptocurrency costs, have delivered larger returns, with high performers like FBTC and IBIT up 138% since February.

Futures ETFs like ProShares’ BITO, in the meantime, flash an eye catching 52.3% yield because of tax tips, however there’s a slight hitch with its two-year efficiency stalling at 28% ROI, leaving spot ETFs wanting just like the smarter decide for the lengthy haul.

“Futures-based ETFs had been initially the go-to possibility, however investor desire has shifted in direction of spot ETFs, which higher monitor precise market efficiency,” Rosenbluth added.

Market Implications and Rising Adoption For Bitcoin ETFs

Bitcoin and Ethereum ETFs have earned over $6 billion in current weeks, shifting gears within the crypto market and capturing institutional focus. These funds aren’t nearly diversification anymore—they’re evolving into income powerhouses. Take WisdomTree’s BTCW ETF, which has earned a staggering 95% of the agency’s income, cementing ETFs because the go-to resolution for asset managers trying to thrive.

The continual progress in ETF inflows for Bitcoin and Ethereum underscores their maturing function in world monetary techniques. Buyers are monitoring whether or not these developments will translate into sustainable worth will increase and broader adoption in mainstream monetary portfolios.

All eyes are on whether or not these inflows will drive additional innovation on this quickly rising funding class.

EXPLORE: 17 Best Crypto to Buy Now in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Ethereum and Bitcoin ETFs See Record-Breaking Inflows appeared first on 99Bitcoins.