[ad_1]

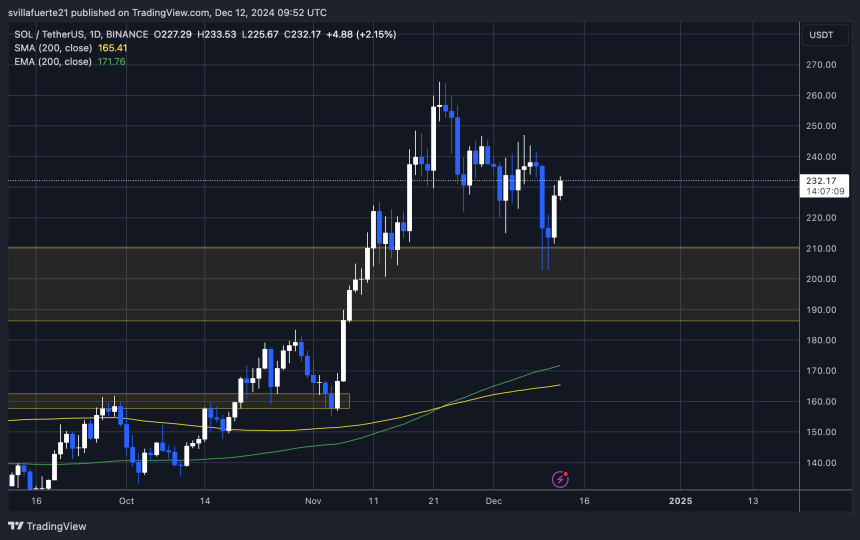

Solana (SOL) has confronted a 23% retrace after hitting new all-time highs at $264, testing the resilience of bullish momentum. Regardless of this pullback, SOL’s value construction stays robust, with the token holding firmly above a vital demand zone. This consolidation part signifies the market is gearing up for an additional potential breakout as bullish sentiment persists.

Associated Studying

Famend crypto analyst and investor Jelle not too long ago shared a technical evaluation on X, expressing optimism about Solana’s future value trajectory. In accordance with Jelle, the retrace is a wholesome correction that permits SOL to construct the power wanted for an additional vital rally. He predicts that Solana will attain new all-time highs earlier than Christmas, setting the stage for an thrilling near the 12 months.

With Solana maintaining its position above key ranges and investor curiosity remaining sturdy, all eyes are on the $264 mark as bulls put together to push the token into value discovery as soon as once more. The approaching weeks shall be pivotal, with the potential for SOL to reclaim its momentum and ship vital features. If the bullish predictions maintain true, Solana might solidify its place as one of many standout performers within the crypto market this cycle.

Solana Value Motion Indicators Energy

Solana (SOL) continues to point out bullish momentum, holding robust above $210, a vital help stage that beforehand acted as resistance. This value conduct alerts a wholesome retrace, permitting the market to reset earlier than one other potential transfer increased. Solana’s skill to keep up this stage reinforces the bullish narrative, suggesting that it’s making ready for an additional upward thrust.

High crypto analyst Jelle recently shared his insights on X, expressing confidence in Solana’s value trajectory. Jelle’s technical evaluation predicts that SOL will attain new heights earlier than Christmas, highlighting a value goal of $300 within the close to time period. He emphasizes that the present consolidation part is a constructive signal, because it permits for accumulation and builds the momentum obligatory for a breakout.

Nevertheless, regardless of the optimism, the potential of a chronic consolidation part looms if SOL fails to interrupt its all-time excessive (ATH). This state of affairs might result in a short lived stagnation in value motion, with SOL ranging sideways as merchants await a clearer market path. Such a consolidation part wouldn’t essentially be bearish however might delay the anticipated rally.

Associated Studying

For Solana to fulfill Jelle’s $300 goal, bulls should reclaim and maintain ranges above the ATH, signaling power and renewed purchaser curiosity. If profitable, Solana is poised to enter value discovery as soon as once more, securing its place as a top-performing crypto asset within the present market cycle.

SOL Testing Liquidity Ranges

Solana (SOL) is presently buying and selling at $232, displaying resilience after efficiently holding key demand ranges at $210. This vital help has confirmed very important in sustaining bullish momentum, permitting the worth to get well and consolidate above $222. The flexibility to remain above this mark has strengthened investor confidence, with the main focus now shifting to increased targets.

The subsequent key resistance for SOL is $246. Breaking above this stage wouldn’t solely signify a bullish breakout but in addition place SOL to problem and surpass its all-time excessive (ATH) of $264. A confirmed breakout above $246 would sign renewed momentum, probably driving Solana into uncharted territory and reigniting market pleasure.

Associated Studying

Nevertheless, the bullish state of affairs is determined by SOL’s skill to keep up its upward trajectory. If the worth struggles to interrupt above the $246 stage within the coming weeks, it dangers shedding momentum. This might result in a broader correction, with merchants eyeing the $210 demand zone as soon as once more as a vital space to observe.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link