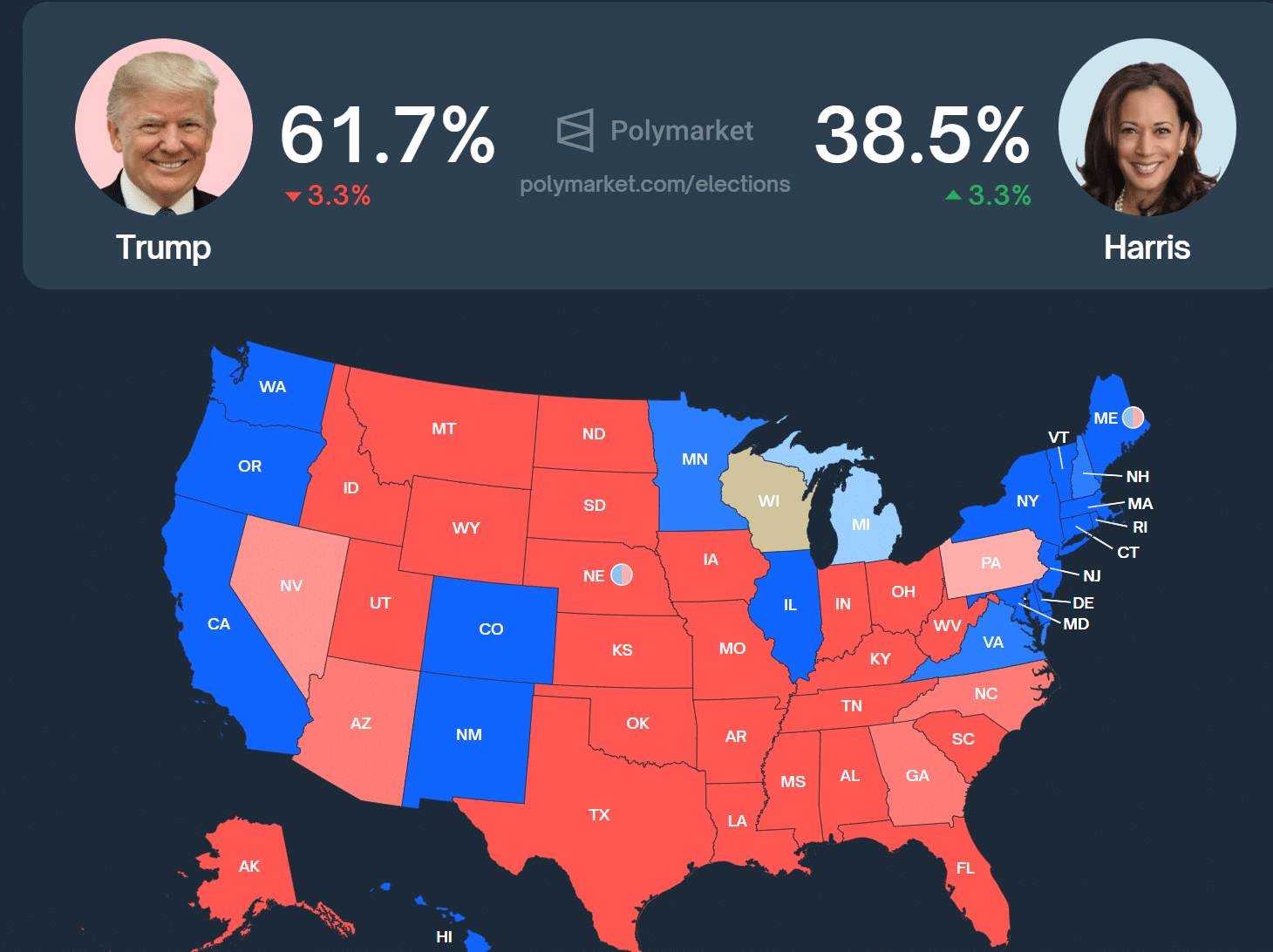

Because the U.S. presidential election approaches, the betting platform Polymarket is witnessing rising odds for Kamala Harris, along with her probabilities climbing from 33% to almost 39%.

Furthermore, October’s job report reveals the economic system is beginning to develop underneath Biden and Kamala. As they body it, “Vote for Kamala Harris to proceed the momentum!”

Right here’s who the Polymarket bettors suppose will win the election in gentle of recent data.

Kamala Harris: The Mechanics of Market Motion

Polymarket is a prediction market the place customers can wager on varied outcomes, together with political races. Merchants buy “shares” with the potential to earn $1 every if their predictions show right.

As of now, a surge in Harris’ share value signifies heightened expectations of her victory, regardless of Donald Trump sustaining a 62% likelihood, making him the present favourite.

Trump's odds are down 5.6% at present.

Trump • 60.9% likelihood

Harris • 39.1% likelihood

4 days to go. pic.twitter.com/FFzTdYgkTq

— Polymarket (@Polymarket) October 31, 2024

Harris’ rising odds are alleged to be a results of merchants hedging their bets. Massive trades exceeding $10,000 recommend vital investments in Harris, probably as a safeguard towards a possible Trump loss.

This hedging technique permits merchants to mitigate dangers related to electoral unpredictability.

In any case, Trump is already calling for election fraud in Pennsylvania and suing CBS for fraud as properly.

DISCOVER: Best New Cryptocurrencies to Invest in 2024 – Top New Crypto Coins

Affect of Voting Irregularities and Polls

Studies of voting irregularities (setting ballot boxes on fire) have additionally influenced market conduct, inflicting merchants to reassess their positions. These allegations, coupled with conventional polls displaying Harris main in battleground states like Michigan, Pennsylvania, and Wisconsin, may very well be swaying sentiment.

Newsweek highlighted the significance of those states, noting Trump’s must safe a minimum of one for a win.

The dynamic nature of Polymarket means each commerce impacts the percentages, resulting in potential volatility. Low liquidity may cause dramatic value swings, as seen when a big buy briefly drove Trump’s odds to 99%.

Crypto Betting Markets and Election Odds on Polymarket

Crypto is on the poll this election cycle, with each candidates outlining their approach to digital currencies. That stated, the fluctuating election odds have rippled into the crypto markets, with some attributing current downturns to Trump’s declining prospects on Polymarket.

The CoinDesk 20 Index, as an example, dropped 4.4% inside 24 hours, reflecting the intertwined nature of political occasions and crypto market reactions.

Notably, a person named Clumpyclumsy has invested over $250,000 in Harris “sure” shares, underscoring the excessive stakes concerned.

With the election looming, Kamala Harris’ climbing odds on Polymarket spotlight that this election can be nearer than anybody would really like. Why can’t we get a landslide victory for as soon as?! For merchants and spectators alike, cracking the code of those interactions is essential to surviving the wild journey of prediction markets. As for crypto, we’ll see if both candidate retains their promises.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Harris Odds Rise on Polymarkets: What Will Happen With US Election Crypto? appeared first on .