Bitcoin is agency, and establishments are shopping for much more BTC, trying on the inflows into IBIT, a spot Bitcoin ETF by BlackRock.

This week, an attention-grabbing factor occurred. Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

broke above $72,000, eased previous $73,000, and reversed lower than $300 away from all-time highs.

The previous of this enlargement was undoubtedly unprecedented. Nobody anticipated the coin to rally this quick and laborious.

The “Uptober” Blessings Arrive For Bitcoin ETFs

Though “uptober” usually comes with its “Bitcoin blessings“, value motion over the previous few weeks, particularly in early September, was painful to observe.

September marked a flip for the higher as Bitcoin exceeded historic performances earlier than racing laborious in October.

The digital gold is cooling off, down under $70,000 when writing.

The pullback could provide entries for the so-called permabulls to purchase extra at a reduction.

(BTCUSDT)

If something, establishments seem like popping in, scooping each BTC on sight.

Certainly, the approval of spot Bitcoin ETFs in america early this yr was a serious milestone.

For the primary time since BTC launched, establishments and different deep-pocketed traders can legally achieve publicity by shopping for shares backed by the coin.

Huge names are concerned: From Constancy, BlackRock, and even Grayscale, traders solely have to decide on a product that finest aligns with their backside line.

And, as BTC raced above $70,000, the massive boys jumped in.

Spot Bitcoin ETF issuers in america accelerated their buy of BTC on account of shopper demand.

DISCOVER: How to Buy Bitcoin Anonymously in 2024 – No KYC Guide

BlackRock And IBIT Grew The Quickest Than Any Different ETF

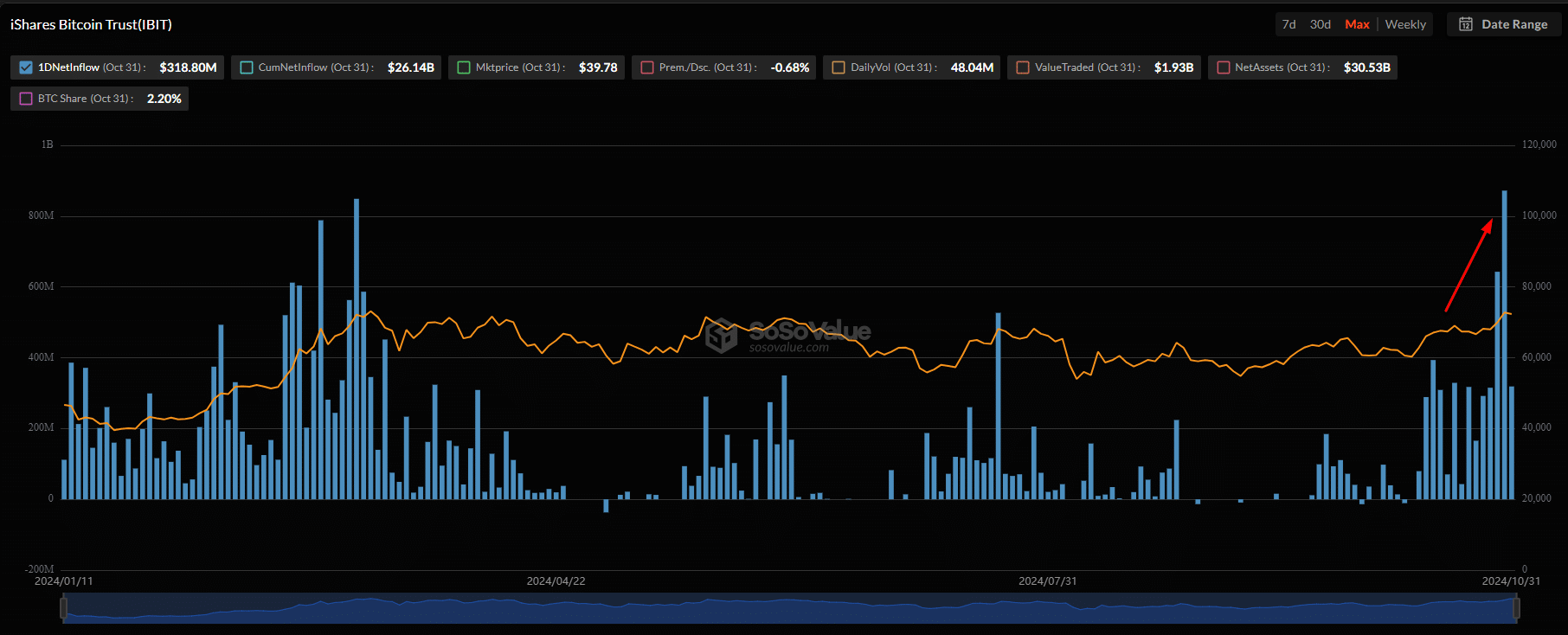

There was particularly an enormous uptick in BTC purchases by BlackRock by way of its iShares Bitcoin Belief (IBIT).

As costs soared and analysts known as for the moon, establishments loosened their purse strings, splashing thousands and thousands of {dollars} into BTC by shopping for IBIT shares.

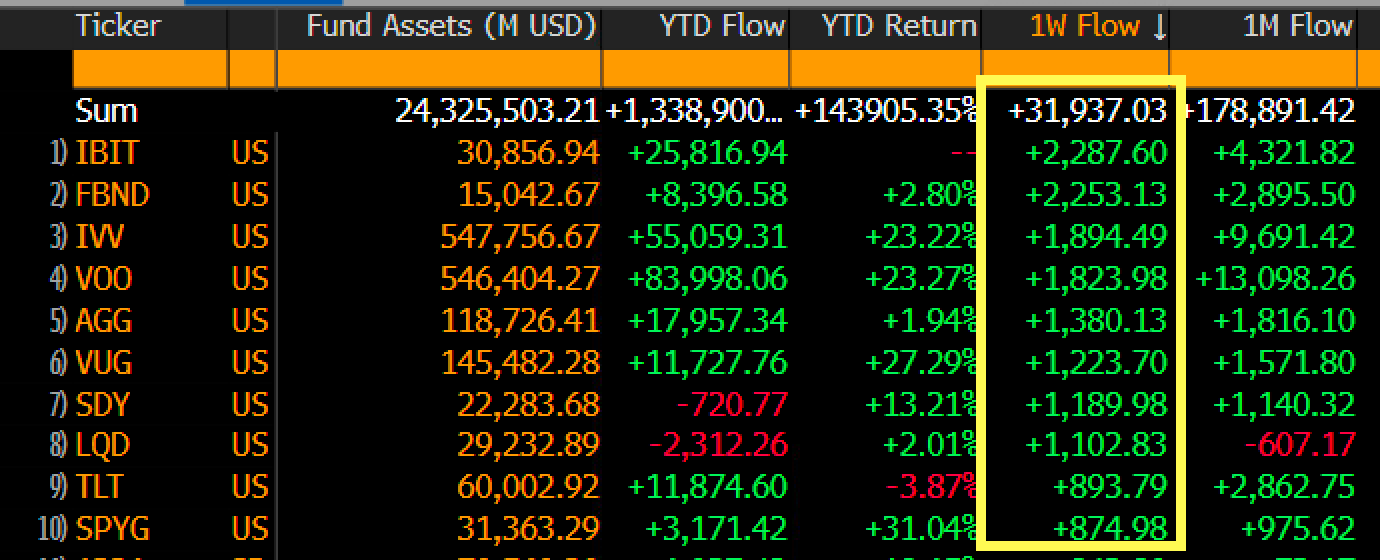

This exceptional improvement meant that IBIT scooped probably the most cash of all ETFs on this planet.

(Source)

Buyers purchased over $315 million of shares on Monday earlier than including $642 million of IBIT shares on Tuesday.

A day later, on Wednesday, a document $872 million of shares.

(Source)

The quantity fell to $318 million on Thursday however inside vary of their common purchases from mid-October.

If you happen to take into account that there are 13,227 ETFs worldwide, together with Vanguard’s monitoring the S&P 500 or a number of others monitoring america bond market, the money splash is large for BTC.

What’s extra?

BlackRock’s IBIT is breaking data and is barely a yr outdated.

This endorses Bitcoin as an asset and divulges a rising urge for food for crypto publicity on Wall Road.

The large boys are prepared to dive in, conscious that Bitcoin is extra risky than conventional belongings backing VOO or IVV ETFs, for instance.

For the neutrals, what occurred this week is nothing however a paradigm shift the place conventional fairness and bond ETFs are more and more dealing with stiff competitors from the extra “profitable” crypto-backed belongings.

DON’T MISS: The Hottest ICOs to Sccop in November 2024

Will Wall Road Create A Provide Disaster?

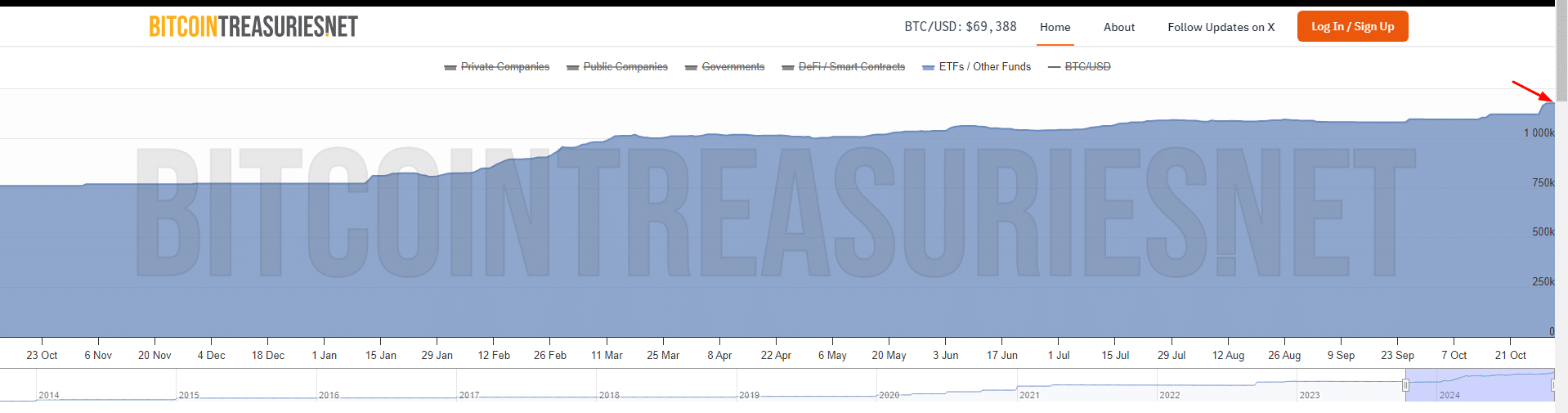

Altogether, all spot Bitcoin ETFs in america added $2.2 billion price of BTC, pushing belongings underneath administration to over $70 billion.

Parallel knowledge from Bitcoin Treasuries reveal that every one Bitcoin ETFs now management over 1.1 million BTC.

(Source)

That is greater than cash the founder Satoshi Nakamoto held, standing at 1 million BTC.

As establishments circulation again, it could possibly be time for retail to contemplate “getting this share” earlier than hovering demand constrains provide.

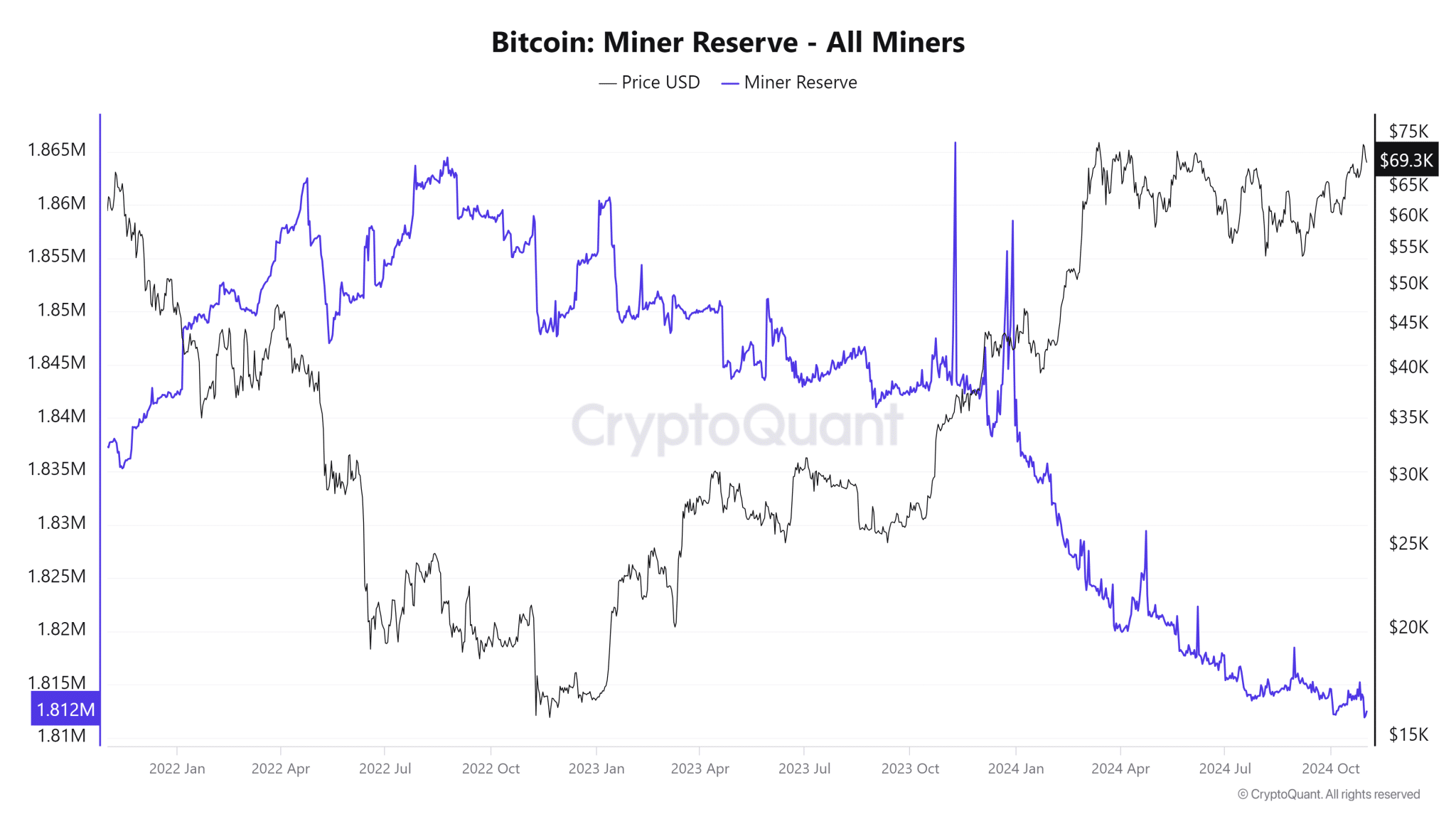

Miners have been holding prior to now few weeks and are mining even fewer cash after the Halving on April 20.

EXPLORE: Crypto PACs Are Here to Stay: Coinbase is Already Positioning For 2026 US Mid-Terms

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Bitcoin Milestone: BlackRock and IBIT Took in More Cash than Any Other ETF in the World appeared first on .