Welcome again, crypto lovers! Right now’s dive into the world of Ethereum brings us some juicy updates that you simply gained’t wish to miss. So seize your favourite beverage, and let’s unpack the newest Ethereum information right now!

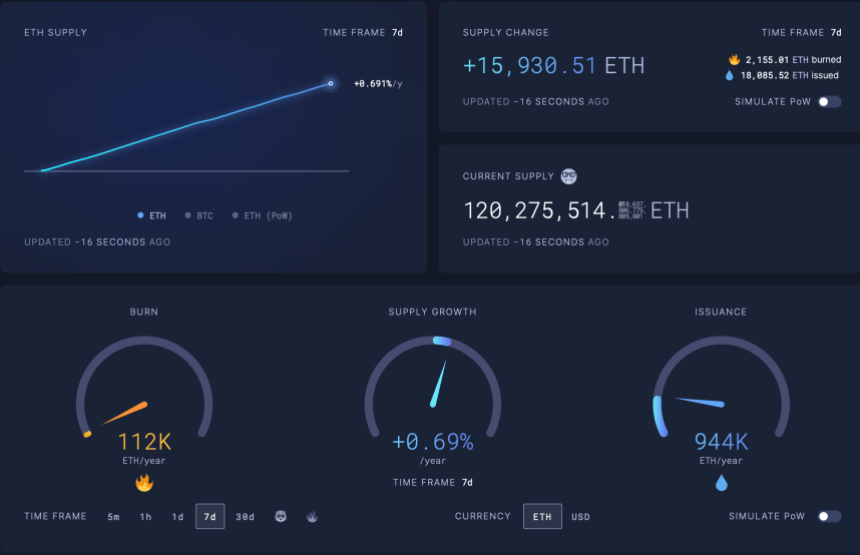

First up, we’ve a report from NewsBTC that raises some eyebrows: Ethereum’s circulating provide has soared to over 120.72 million ETH! Sure, you heard that proper! This spike is basically attributed to the adoption of Ethereum’s proof-of-stake (PoS) mannequin, which has led to a major improve within the community’s exercise. Up to now month alone, Ethereum issued 77,102 ETH whereas burning 19,402 ETH, leading to a web improve of roughly 57,653 ETH. Discuss a provide surge!

However maintain your horses! This improve in provide isn’t essentially a nasty factor for ETH. It displays a shift within the community’s dynamics, which some analysts imagine may pave the best way for brand spanking new alternatives. With round 33.9 million ETH at present staked, members are raking in substantial rewards. This huge-scale staking is contributing to the rise in Ethereum’s whole provide, making a compounding impact as rewards are reinvested again into the community.

Now, let’s speak market efficiency. Ethereum has seen a gradual value improve just lately, climbing from $2,500 to $2,652—a nifty 9.3% uptick in only a week! This value surge coincides with an almost $20 billion spike in its market cap. Nonetheless, it’s not all sunshine and rainbows; every day buying and selling quantity has dropped from over $21 billion to about $12.8 billion. Regardless of this, many analysts stay bullish on Ethereum’s future. A widely known analyst has even set a $3,000 goal for ETH, suggesting that the asset is gearing up for a serious rally!

Subsequent, we flip our consideration to a different insightful piece from NewsBTC, the place market researcher DeFi Ignas discusses the elements behind Ethereum’s latest underperformance. Regardless of a tough patch, Ignas believes there are a number of key catalysts poised to drive a comeback for ETH. He highlights the rising curiosity in Ethereum’s decentralized finance (DeFi) ecosystem, which boasts probably the most mature setup within the crypto house.

Furthermore, Ethereum’s decentralization and safety have attracted main institutional gamers like BlackRock and PayPal, who’re testing blockchain settlement on the platform. Ignas additionally factors out that Ethereum’s first-mover benefit and the community results it enjoys solidify its place because the main good contract platform.

Wanting forward, Ignas emphasizes the upcoming Pectra improve, set to launch within the first quarter of 2025. This improve guarantees to reinforce person expertise by means of Account Abstraction and enhance staking and scalability. Ignas believes that the market is underestimating the potential impression of this improve, which could possibly be a game-changer for Ethereum’s adoption.

As we wrap up right now’s Ethereum information, it’s clear that whereas the highway forward could have its bumps, the basics supporting Ethereum stay robust. With a stable ecosystem, rising institutional help, and thrilling technical upgrades on the horizon, Ethereum’s bullish case is wanting more and more compelling. So, hold your eyes peeled, of us—Ethereum may simply shock us all!