The bull market is again, and crypto is rallying. Most analysts assume Bitcoin value is on its technique to $100,000, pumped by spot Bitcoin ETFs, Donald Trump’s win, and FOMO.

Crypto, Bitcoin, Ethereum, and even upcoming tasks like Pepe Unchained—a meme coin-centric layer-2 on Ethereum—are on hearth.

Bitcoin is above $81,500 and defies gravity, whereas Ethereum is buying and selling above $3,000. Though far more is required, sentiment is bettering, and extra patrons are than sellers.

Whether or not FOMO kicks in now or is already underway, merchants and traders are clearly over the moon.

Bitcoin Pumping $100,000 Up Subsequent?

Optimism is so robust that some merchants count on Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

to ease previous $100,000.

(BTCUSDT)

A break above $90,000 this week, trying on the Bitcoin candlestick association within the day by day chart, might simply see the world’s most useful coin increase to 6 figures for the primary time since launching.

If that occurs, Bitcoin could have soared 5X from the 2017 ICO-induced rally and one other 30% from the DeFi-NFT bull run of 2021.

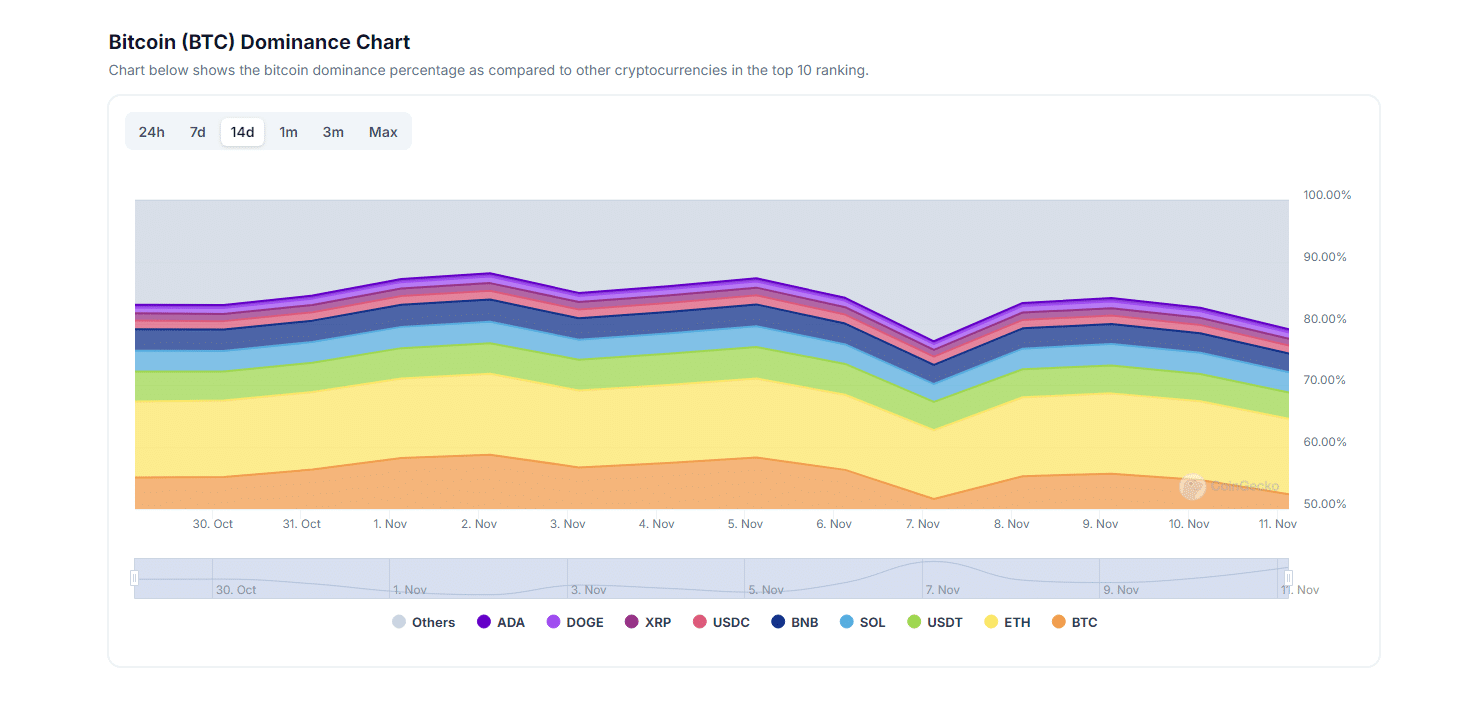

From Coingecko, Bitcoin instructions a 56% market share and maintains a optimistic correlation with altcoins.

(Source)

Because of this, an uptick in BTC to 6 figures immediately advantages altcoins. On this cycle, some tokens, particularly meme cash, would doubtless put up 100X or extra.

EXPLORE: 17 Best Crypto to Buy Now in 2024

What’s Driving Bitcoin Value Push to New All-Time Excessive?

The query now stays: What’s driving Bitcoin costs?

Prime of the checklist is FOMO–worry of lacking out.

Retailers are again, piggy-riding on the again of the large boys, largely establishments. After the approval of spot Bitcoin ETFs, their demand has formed the tempo at which costs tick increased or decrease.

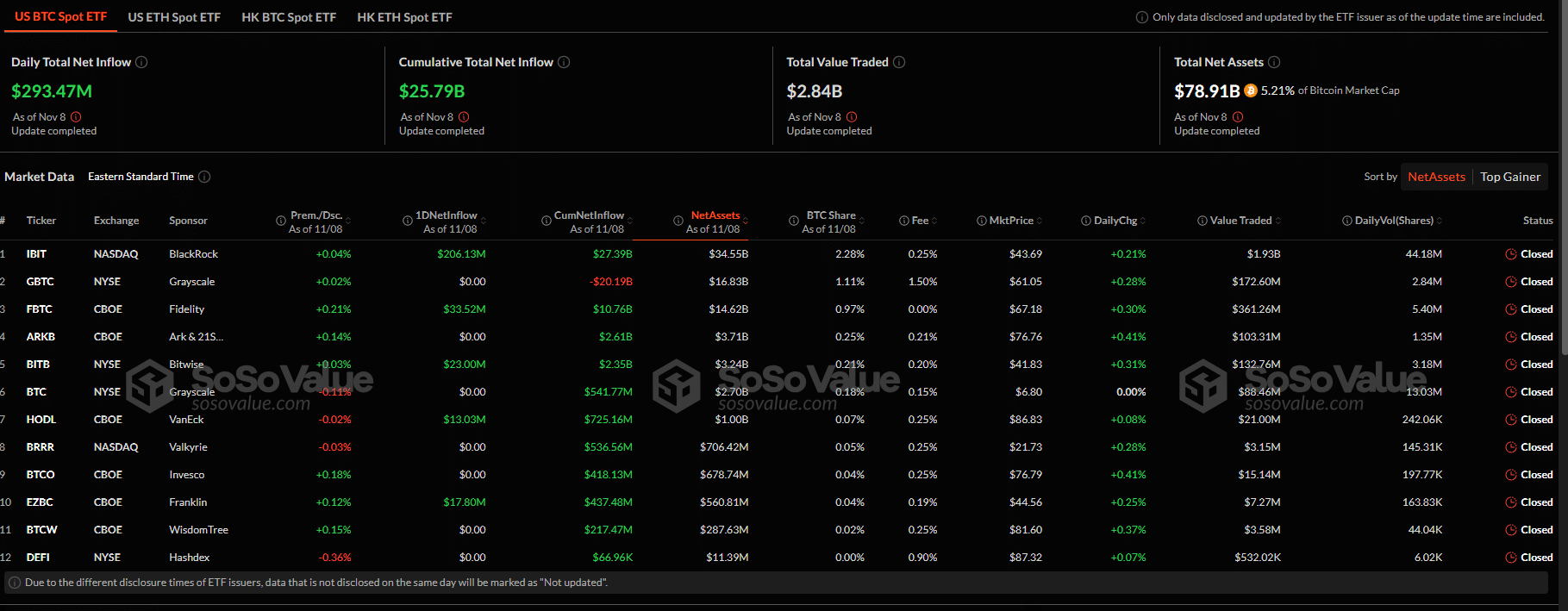

Taking a look at Soso Worth on November 11, spot Bitcoin ETF issuers in the US at present handle $78 billion value of property, shopping for over $293 million on November 8.

(Source)

The infusion of capital to Bitcoin through spot Bitcoin ETFs noticed costs soar above $72,000, then $74,000.

This breakout attracted retailers who’ve been shopping for on each dip for the reason that spike above March highs final week.

Whereas Skew analysts see resistance at round $82,500, the tempo of this development will depend on demand, largely from merchants in Europe and the US bidding increased.

(Source)

If this occurs and quantity will increase, Bitcoin might lengthen its parabolic development, springing increased after the consolidation and potential accumulation after the swing down from March to August 2024.

Already, Peter Brandt thinks Bitcoin is not going to solely attain $100,000 however spike to $125,000 by the top of the yr.

(Source)

Past value motion, politics will form how costs evolve.

EXPLORE: 15 Best No KYC Crypto Exchanges for 2024

Donald Trump Is Again: Will Bitcoin Reserve Gasoline $100K?

With Trump in energy, the Federal Reserve will proceed slashing charges even lower this December and 2025.

Decrease charges translate to an financial system flush with cash, forcing inflation increased. Bitcoin is digital gold; patrons will discover tailwinds to maintain the leg up from this standing.

Bitcoin and crypto would additionally doubtless pattern increased due to pro-crypto legislators who have been elected within the final election and Trump within the Oval workplace.

When campaigning, Trump promised to fireplace Gary Gensler, the US SEC chair, and substitute him with a pro-crypto and innovation appointee.

Moreover, the vocal president-elect plans to ascertain a crypto framework and probably add BTC as a strategic reserve.

EXPLORE: ETH Price Shifts Bullish Amid Monumental ETH ETF Inflows

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Why is Crypto Going Up Today? Will Bitcoin Break $100K In 2024? appeared first on .