The Hong Kong Financial Authority (HKMA) cautioned the general public about sure abroad crypto companies misusing the phrase “financial institution” of their advertising and descriptions.

On 15 November 2024 HKMA stated, “Solely licensed banks, restricted license banks, and deposit-taking firms approved by the HKMA are permitted to conduct banking or deposit-taking actions within the area.”

Alert: Please be cautious about crypto companies which can have misused the phrase “financial institution”. Sure abroad crypto companies, in latest occasions in HK, have been reported to have made the illustration that the agency was a “financial institution” or supplied card product as “financial institution card” on the agency’s web site. pic.twitter.com/Va5ebhhbTI

— HKMA 香港金融管理局 (@hkmagovhk) November 15, 2024

Misusing Time period “Financial institution” Raises Considerations; May Mislead Shoppers

The HKMA reportedly recognized incidents involving two abroad crypto companies that made deceptive representations in Hong Kong.

Allegedly, one of many companies described itself as a “financial institution,” whereas the opposite referred to its card product as a “financial institution card” on its web site.

The HKMA expressed considerations round deceptive customers into believing that the companies are licensed banks working underneath supervision. “Such representations may mislead customers to imagine they’re licensed banks in Hong Kong and are underneath the HKMA’s supervision,” HKMA stated.

Moreover, utilizing the time period “financial institution” in names or product descriptions with out the authority’s written consent may probably be a felony offence for entities, revealed HKMA. “Below part 97 of the Banking Ordinance, no individual, apart from a licensed financial institution in Hong Kong or a central financial institution, could use the phrase ‘financial institution’ or its derivatives.”

The strict regulatory framework is being enforced to make sure the general public isn’t misled by unauthorized entities posing as professional banks.

EXPLORE: Binance Issues Warning On Clipper Malware Targeting Withdrawal Addresses

Crypto Corporations That Are Not Approved Establishments, Are Not Supervised By HKMA

The HKMA supplied sources to confirm approved establishments. This encourages customers to seek the advice of the HKMA’s register of authorized institutions or contact its Public Enquiry Service hotline for clarification.

Moreover, the HKMA reiterated its dedication to guard the general public from deceptive practices. It’s to make sure a transparent distinction between licensed banks and unauthorized entities. The authority stated, “Services or products with names carrying the phrase ‘financial institution’ should not essentially supplied by licensed banks in Hong Kong.”

With these measures, HKMA is aiming to mitigate potential dangers posed by unauthorized entities within the rising crypto sector.

EXPLORE: Hong Kong to Approve More Crypto Exchange Licenses Following Inspection Period

Hong Kong’s Evolving Crypto Panorama

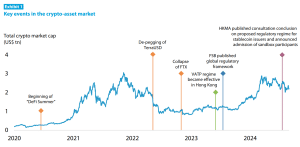

Hong Kong is making an attempt to place itself as a world chief in digital finance by introducing a strong regulatory framework for digital belongings.

Backed by the establishments just like the HKMA, the town is cultivating a thriving digital asset ecosystem and advancing innovation within the Web3 sector.

Certainly one of its main initiatives embody a forthcoming stablecoin regulatory framework, prioritizing fiat-backed stablecoins to make sure monetary stability.

The laws is ready to be launched by the top of 2024.

Just lately, in August, 2024, the HKMA had launched Project Ensemble Sandbox (the Sandbox), enabling interbank settlements by experimental tokenized cash, with an emphasis on transactions involving tokenized belongings.

Furthermore, by combining stablecoins with broader efforts like Challenge Ensemble, Hong Kong is constructing a complete framework for digital asset integration.

In the meantime, the HKMA has advanced its e-HKD pilot program to phase 2, collaborating with over 20 companies, together with outstanding entities like HSBC, Visa, Customary Chartered and DBS. This initiative explores the sensible use instances of a Central Financial institution Digital Foreign money (CBDC).

The forward-looking method aligns Hong Kong with world tendencies in digital foreign money adoption.

The submit This Week In Crypto Asia: Hong Kong Authorities Flag Overseas Crypto Firms For Misleading Claims appeared first on .