Bitcoin value spiked to document highs this week, smashing $90K, however as BTC cools off in a consolidation, it could not submit sharp losses to $70,000.

Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

would possibly drop almost 5% up to now 24 hours, dragging the entire crypto market cap by 5% to $3 trillion.

There are considerations that after the over $20,000 acquire from March 2024 excessive to all-time highs, a correction may be within the offing.

Bitcoin Could Appropriate: However Not To $69,000

Whereas the group braces for this cool-off, one analyst is defiant. Citing market information, he observes that Bitcoin trades above the short-term holder (STH) foundation of $69,000.

STH are people who purchased the coin lower than six months in the past and are sometimes thought of speculators.

It modifications when a holder has diamond arms and chooses to not promote for a minimum of six months. The entity turns into a long-term holder (LTH).

(Source)

Now that the STH foundation is at $69,000, most of those merchants are within the cash and will money out at spot charges, heaping extra strain on the coin.

Since costs are consolidating, clear in decrease time frames, it could spark a sell-off as patrons are fragile.

Whereas that is doable, the on-chain analyst mentioned ready is the perfect method. Dumping now may very well be exiting simply when the rally is beginning.

The one time Bitcoin might be thought of “stretched” is when the market worth to realized worth (MVRV) ratio breaks above the crucial threshold of 1.35.

In line with CryptoQuant, and as shared by the analyst, the MVRV ratio for Bitcoin is now at round 1.3.

Even when costs find yourself falling and speculators start to fall as they money out, there may be hope.

DON’T MISS: The 16 Best Altcoins to Buy in 2024

Donald Trump Wave: Institutional and Retail Demand Soaking Up Miner Liquidation

Most of those cash from “weak arms” might find yourself within the mouths of whales and aggressive spot Bitcoin ETF issuers, who’ve been quickly loading up over the previous couple of months.

Because of this, it’s uncertain whether or not costs will break decrease, dropping beneath $74,000 or March highs to as little as $69,000, which is the STH price foundation.

(BTCUSDT)

Donald Trump’s victory has prompted optimism and robust enthusiasm amongst retailers and establishments. They’re extremely assured that key pro-crypto coverage modifications will happen.

These embrace creating a good surroundings for miners, utilizing Bitcoin to handle the rising debt downside, and establishing a reserve.

And there may be proof throughout.

The analyst recommends monitoring spot buying and selling exercise on exchanges like Coinbase and Binance to gauge the power of bulls.

As Bitcoin soared to document highs, centralized crypto exchanges posted over $7.5 billion in month-to-month buying and selling quantity within the spot market. This spike factors to robust demand for the coin in addition to altcoins.

(Source)

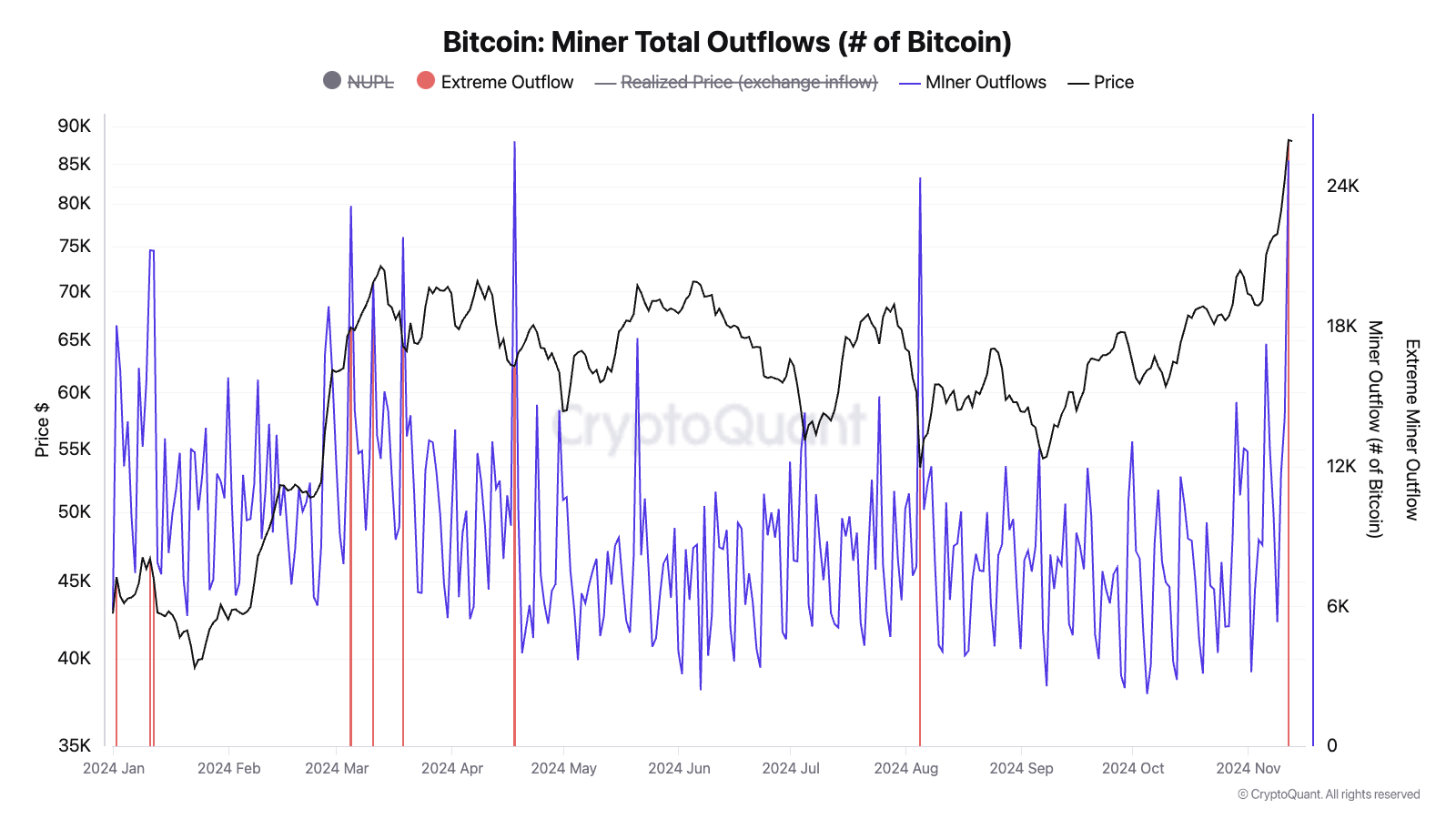

Whereas everyone seems to be watching value, miners have taken benefit of the spike to money in on the rally. When costs soared above $90,000, on-chain information confirmed miners offered 25,000 BTC.

(Source)

Taking a look at historic developments, particularly in June, miner liquidation tends to introduce momentary headwinds for bulls. Nevertheless, by promoting, they are going to be replenishing provide for insatiable spot Bitcoin ETF issuers.

EXPLORE: Miami’s Odell Beckham Jr Trolls No-Coiners as Stupid

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit Bitcoin Cooling Off – Prices Might Correct, But Not to $70,000: Here’s Why appeared first on .