Solana (SOL) has been making waves within the cryptocurrency trade, reaching an all-time excessive of $265 on November 23, 2024. The surge of Bitcoin towards the $100,000 mark and the passion for meme currencies have been the catalysts for this outstanding rally.

Associated Studying

Solana-based tokens have skilled substantial positive aspects previously month, with some exceeding a twofold enhance in worth. Within the crypto house, Solana’s presence is changing into more and more evident, as proven by its $121 billion whole market capitalization.

Solana’s Excellent DEX Exercise

Day by day buying and selling quantity over $6 billion has made Solana’s decentralized exchanges (DEXs) extremely in demand. This displays a forty five% market share. The low transaction charges of Solana helped the platform to face out as a big various to Ethereum, Binance Coin (BNB), and Polygon.

Investor optimism has been additional bolstered by this stage of exercise, as analysts have recognized the potential for ongoing enlargement. Solana’s place within the DeFi sector has been additional solidified by the community’s Total Value Locked (TVL) rising to $9.35 billion, surpassing BNB Chain’s $6.21 billion.

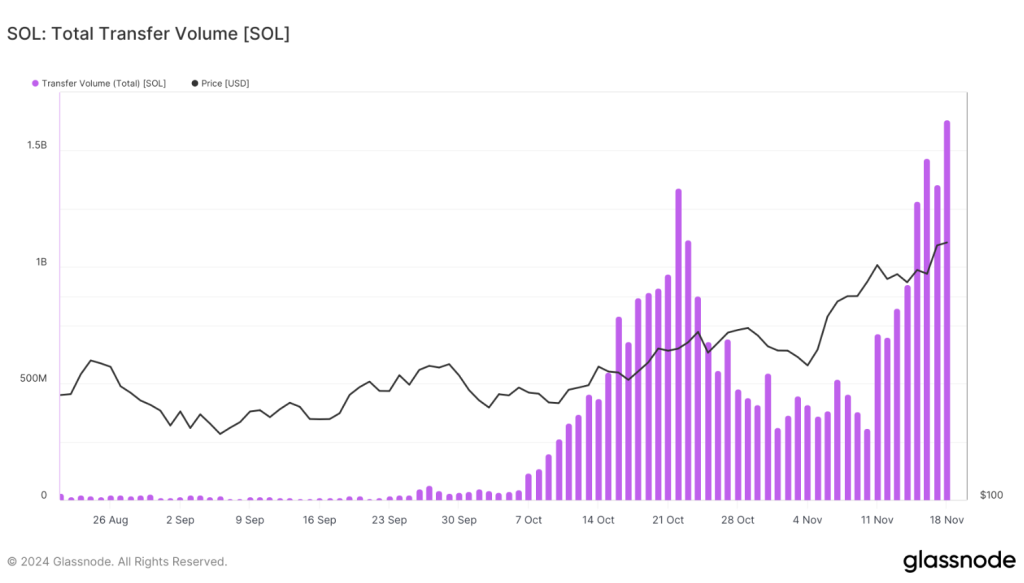

Moreover, Solana reached a historic $318 billion in switch quantity, setting a brand new file for the blockchain. Regardless of some indicators of bot-driven exercise inflating these figures, this excessive throughput demonstrates Solana’s capability to deal with huge transactions.

On November sixteenth, Solana’s switch quantity hit an all-time excessive of $318 billion, while the variety of lively addresses spiked to over 22 million.

Nevertheless, imply and median transaction volumes dipped throughout the identical interval. This sample of community exercise inflation could also be… pic.twitter.com/RJcE6Kjnkn

— glassnode (@glassnode) November 19, 2024

Market Dangers And Resistance Ranges

Solana’s current efficiency has been noteworthy; nevertheless, analysts warning that the coin is approaching crucial resistance strains. SOL is at the moment buying and selling at $261, representing a 2.60% enhance previously 24 hours.

A breakout level has been recognized by sure consultants above $226, with key resistance ranges at $271 and $309. Solana has the potential to advance into new territory if it might probably maintain momentum and overcome these resistance ranges.

Nevertheless, some are anxious in regards to the overbought situations and have even speculated that consolidation might happen earlier than SOL accomplishes its purpose. The Relative Power Index (RSI) is getting near its higher restrict, which can point out a short market correction is imminent.

Associated Studying

A Constructive Prognosis With Some Reservations

Many analysts anticipate that Solana’s value will proceed to extend, with a forecasted 8.70% enhance to $275 by December 25, 2024. The value is at the moment exhibiting a robust favorable momentum.

The Worry & Greed Index at the moment stands at 80, which signifies robust investor confidence and heightened avarice. Although the general temper is upbeat, traders want to remember the dangers and volatility of the market.

It may be stated that the expansion story of Solana is but to be written absolutely, as seen by the current buying and selling quantity and value motion fluctuations. It would, nevertheless, want cautious maneuvering because it continues its ascent.

Featured picture from MoneyCheck, chart from TradingView