[ad_1]

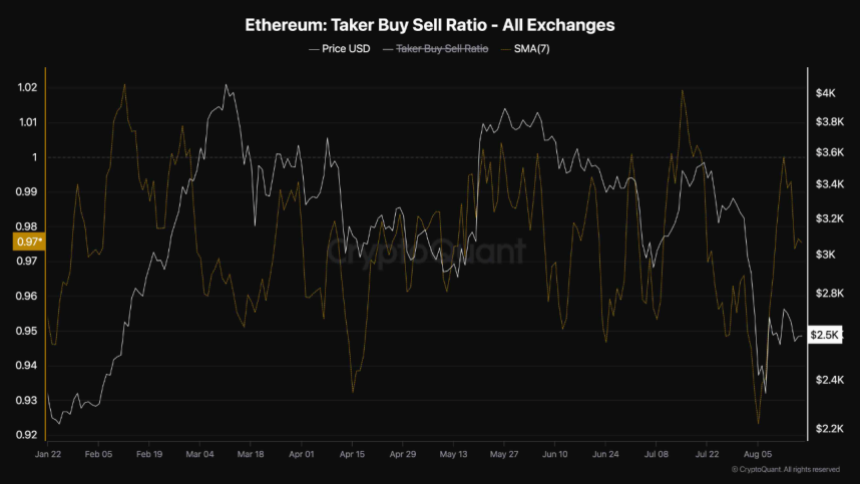

Welcome to your day by day dose of Ethereum information! Buckle up, as a result of it looks as if Ethereum is on a little bit of a rollercoaster journey these days, and we’re right here to interrupt all of it down for you. First off, the worth of Ethereum (ETH) has been a sizzling subject, particularly after it took a nosedive of about 30% earlier this month, hitting a low of $2,226. However maintain on! It managed to claw its method again into the $2,600 vary not too long ago. So, what’s the deal? Nicely, analysts are saying that regardless of the current restoration, Ethereum would possibly simply be gearing up for one more bearish pattern. In line with a report by NewsBTC, the Taker Purchase/Promote Ratio has dropped, indicating a possible dominance of sellers out there.

ShayanBTC, a CryptoQuant analyst, identified that this ratio is a vital indicator of market momentum. A ratio above one usually means patrons are in management, whereas a ratio under one alerts the alternative. Presently, the ratio is hovering within the zero area, suggesting that sellers are gearing as much as offload their belongings. This might spell hassle for Ethereum’s value, because the market wants a big uptick in demand to keep away from additional declines.

However that’s not all! In one other twist, Metalpha, a digital asset administration agency, has withdrawn a whopping 10,000 ETH (value round $26 million) from the staking platform Lido and transferred it to Binance. This type of motion might point out bearish sentiment, particularly since transferring belongings to an alternate usually means that the holder could be seeking to promote. So, should you’re holding ETH, you would possibly need to keep watch over this example!

On the worth entrance, Ethereum is at the moment buying and selling round $2,610, reflecting a slight achieve of 0.61% during the last day. Nonetheless, the efficiency over the previous month is lower than stellar, exhibiting a decline of almost 24%. If the shopping for stress can maintain up, ETH might probably break the $2,700 resistance degree, however with the present promoting stress, it might additionally dip again right down to $2,300.

And let’s not neglect about inflation! Ethereum’s provide has been a sizzling subject as properly, with the circulating provide surpassing 120 million ETH. Not like Bitcoin, which has a hard and fast provide, Ethereum is designed to be inflationary. Latest information exhibits that Ethereum’s provide has been rising, with over 210,000 ETH added to circulation not too long ago. This pattern might put downward stress on ETH’s value if demand doesn’t maintain tempo. In line with NewsBTC, the annual inflation fee for Ethereum is at the moment round 0.70%, which is one thing to look at.

In abstract, Ethereum is navigating a tough panorama proper now. With bearish sentiments looming because of the Taker Purchase/Promote Ratio, vital withdrawals from staking platforms, and ongoing inflation considerations, it’s a wild time to be concerned in Ethereum. Preserve your eyes peeled for extra updates, and keep in mind to remain knowledgeable!

[ad_2]

Source link