[ad_1]

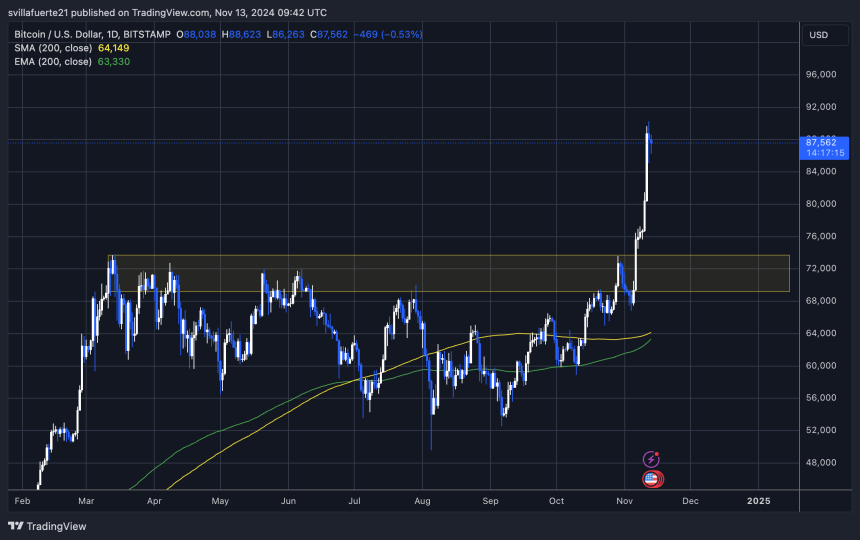

Bitcoin has reached a brand new all-time excessive of $90,243 following every week of relentless upward momentum. After days marked by euphoria and fast good points, the value is now coming into a consolidation section, offering a much-needed pause for the market.

Key knowledge from CryptoQuant signifies reasonable promoting stress is rising, which can sign a quick pullback or stabilization under the $90,000 mark.

Associated Studying

This week might be pivotal in figuring out Bitcoin’s subsequent steps as merchants and buyers watch if BTC will maintain close to the $90,000 provide stage or retreat to check help round $80,000. With sturdy market fundamentals and continued curiosity from bullish buyers, the potential for an additional rally stays excessive.

Nonetheless, a brief consolidation interval may supply more healthy groundwork for BTC’s long-term ascent. All eyes might be on whether or not Bitcoin can sustain its current levels or if this cooling-off section will permit patrons to re-enter decrease demand zones, setting the stage for the following main value transfer.

Bitcoin Promoting Strain Nonetheless Far From Peak Ranges

Bitcoin has reached a neighborhood high after setting a recent all-time excessive, signaling a possible pause in its latest surge. Analysts and buyers are watching carefully, as BTC has a historical past of creating aggressive strikes as soon as it begins trending upward. Regardless of this bullish momentum, many are exercising warning, anticipating that Bitcoin may want time to consolidate earlier than pushing larger.

According to key data from CryptoQuant analyst Axel Adler, the market is now experiencing reasonable promoting stress. Adler’s evaluation factors to a doable consolidation section, as short-term holders take income. He particularly examines the short-term holder realized revenue and loss knowledge, which reveals that the present promoting stress is comparatively delicate in comparison with historic peak promoting intervals.

In Adler’s view, this reasonable stress means that BTC’s latest rally may not finish. He highlights clusters of intense promoting seen in earlier peaks, marked as Clusters #1, #2, and #3 on his chart, displaying ranges of promoting stress considerably larger than what we see at this time. This knowledge implies that whereas some profit-taking is underway, it’s nowhere close to the extraordinary ranges seen at previous tops.

Associated Studying

As Bitcoin approaches consolidation, this subdued promoting stress may set the muse for a extra steady rally. Buyers are eyeing this second to gauge whether or not BTC will collect energy for the following leg up or proceed cooling off, forming a stable base round present ranges earlier than one other potential breakout.

BTC Testing New Provide Ranges (Once more)

Bitcoin has formally entered a much-anticipated value discovery section, not too long ago marking a brand new all-time excessive of $90,243. Presently buying and selling round $87,500, BTC has skilled days of intense shopping for stress and record-setting highs. Nonetheless, the market might even see a interval of consolidation under the $90,000 threshold as merchants assess new demand ranges, doubtlessly round $80,000.

The approaching days might be vital in figuring out BTC’s short-term path. If Bitcoin holds above the $85,000 mark, this is able to sign resilience and sure encourage a push towards larger provide zones as bullish momentum builds. Nonetheless, if BTC loses this stage, a retracement to decrease demand of almost $82,000 may come into play, permitting for a extra steady basis earlier than the following rally try.

Associated Studying

Analysts view this consolidation section as essential after BTC’s fast ascent, because it permits the market to ascertain help. Holding inside the present vary would sign energy, suggesting that BTC is well-positioned for additional good points. Buyers at the moment are watching carefully, gauging whether or not BTC will safe its latest good points or discover a transient reset earlier than aiming for brand new heights.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link