[ad_1]

In three quick months after two flash crashes in early August and September, Bitcoin rose almost 90%.

The dip on 5 August 2024 compelled the coin to as little as $49,000, however since then, Bitcoin has almost doubled, lifting the crypto market with it.

Of notice, the leg up was perpendicular. As merchants sought equilibrium after $74,000 was obliterated in early November, costs rapidly rose after Donald Trump received the hotly contested presidential elections in the USA.

The breakout above March 2024 might need led to a short squeeze, contemplating all of the dump and expectations of extra losses by quick sellers after the uneventful value motion in early Q3 2024.

Bitcoin Rally And Dip

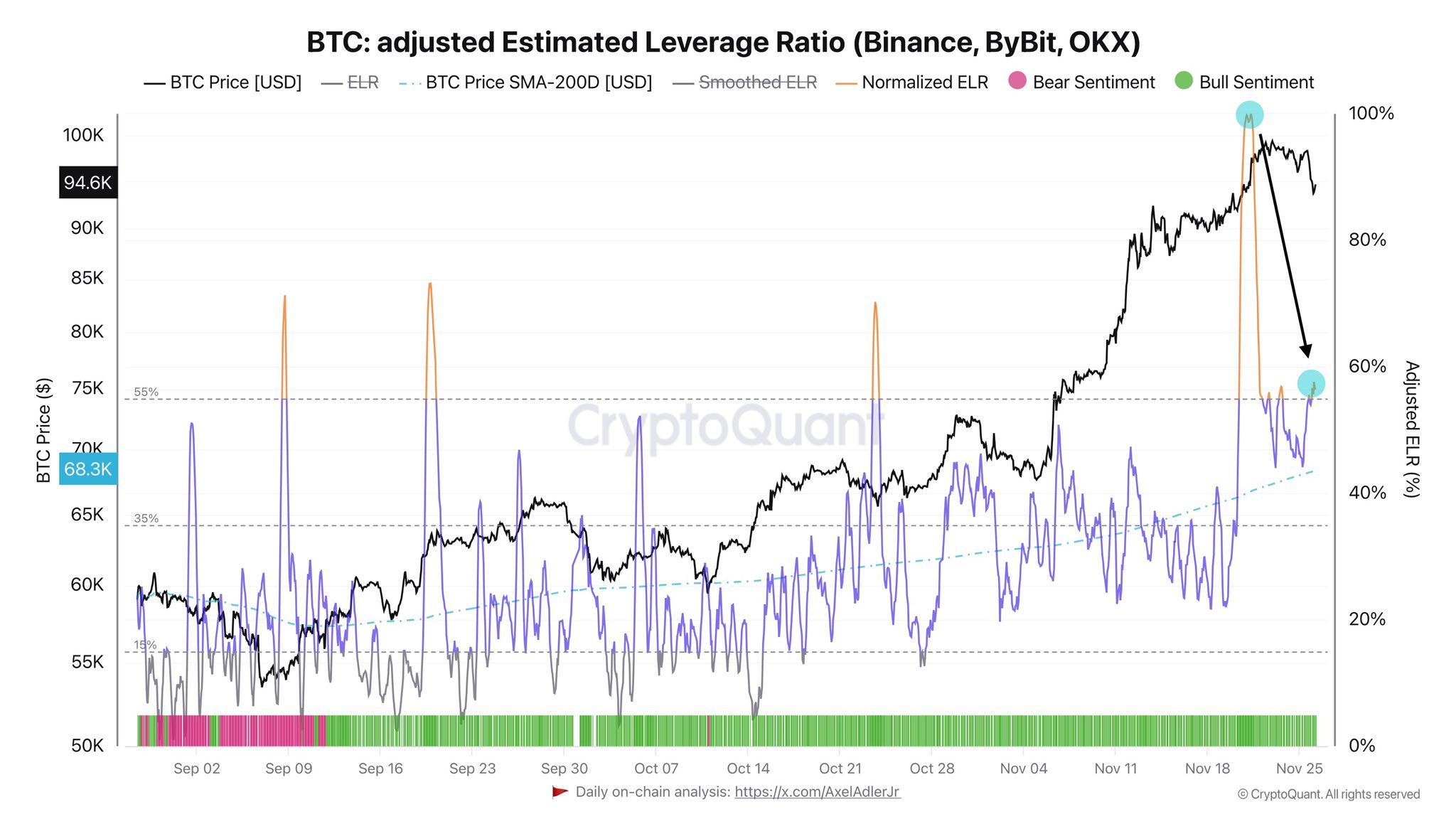

From the each day chart, the leg up from $74,000 to $85,000 was quick and “violent.” Holders did nothing however noticed their features improve quickly. Speculators, then again, pushed their leverage greater, maximizing value swings and volatility.

After the “enjoyable,” it appears to be like like Bitcoin is now taking a welcomed breather. The excessive “octane” rally and frenzy are subsiding, and normalcy is again.

Yesterday, on November 25, Bitcoin corrected after stagnation, falling to as little as $92,600 sooner or later.

Whereas such corrections might usually spark concern, one analyst, taking to X, thinks this pullback is simply one of many many anticipated well being phases within the coin’s long-term development cycle.

Pointing to market knowledge from CryptoQuant, the analyst mentioned the correction might even kind a base for stronger features sooner or later.

Understanding The Drop!

Bitcoin is cooling off, printing a double-bar bearish formation within the each day chart, fully wiping out minor features posted over the weekend.

Nonetheless, this ought to be anticipated.

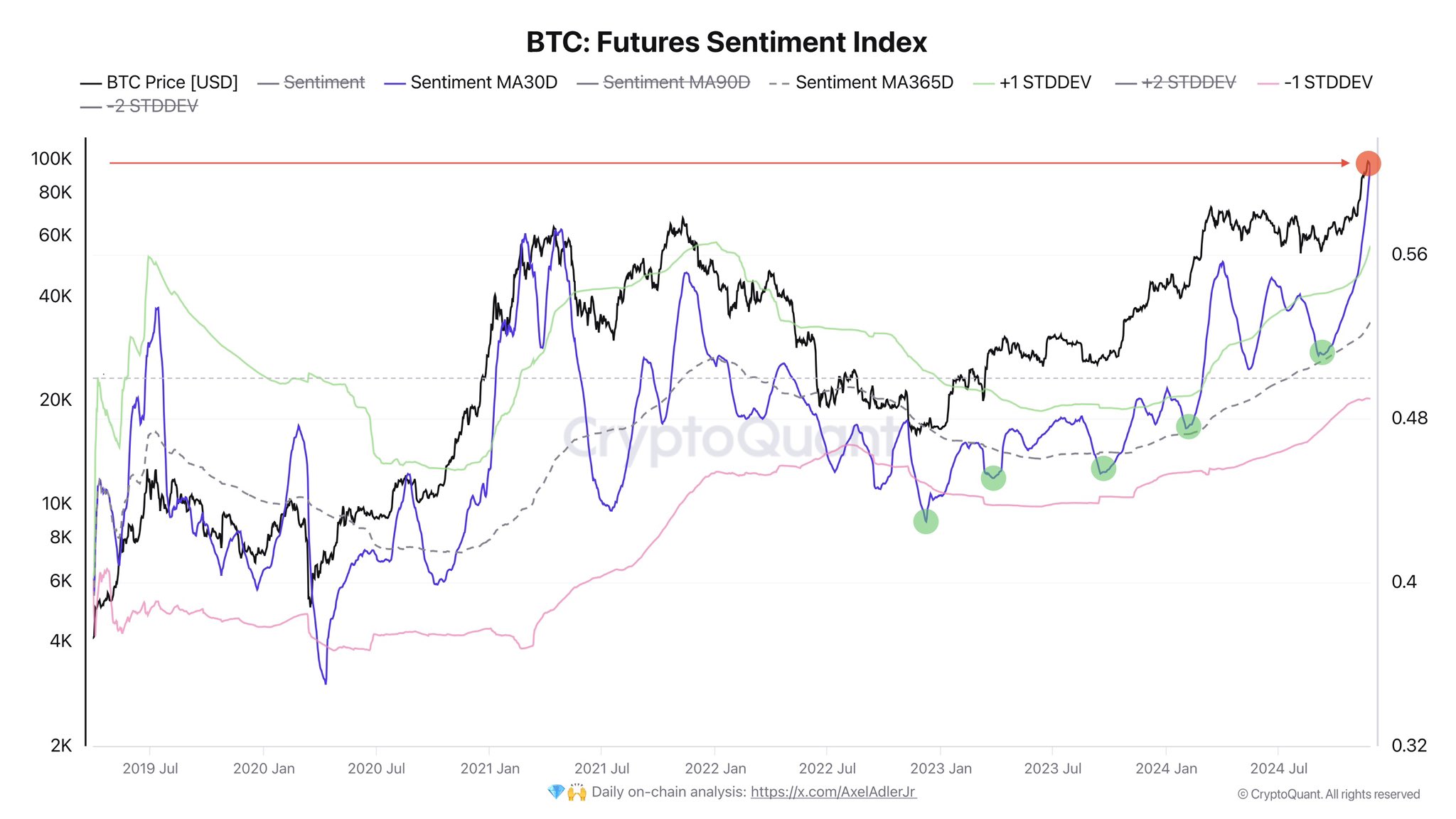

It comes when the futures market, the analyst defined, is highly leveraged.

As issues stand, the spot market is the dominant value driver, whereas the futures market is straining because of the excessive leveraging. This state of value motion is show that bulls nonetheless have what it takes to push greater regardless of the latest drop.

Leverage stays at multi-month highs, and the market seems ripe for a deleveraging occasion.

This flush-out might set off a cascade of liquidations.

Why The Dip Is Not A Concern?

Though Bitcoin would possibly publish extra losses at present and even this week, there ought to be no cause for concern.

Market knowledge reveals that Bitcoin stays on a stable footing.

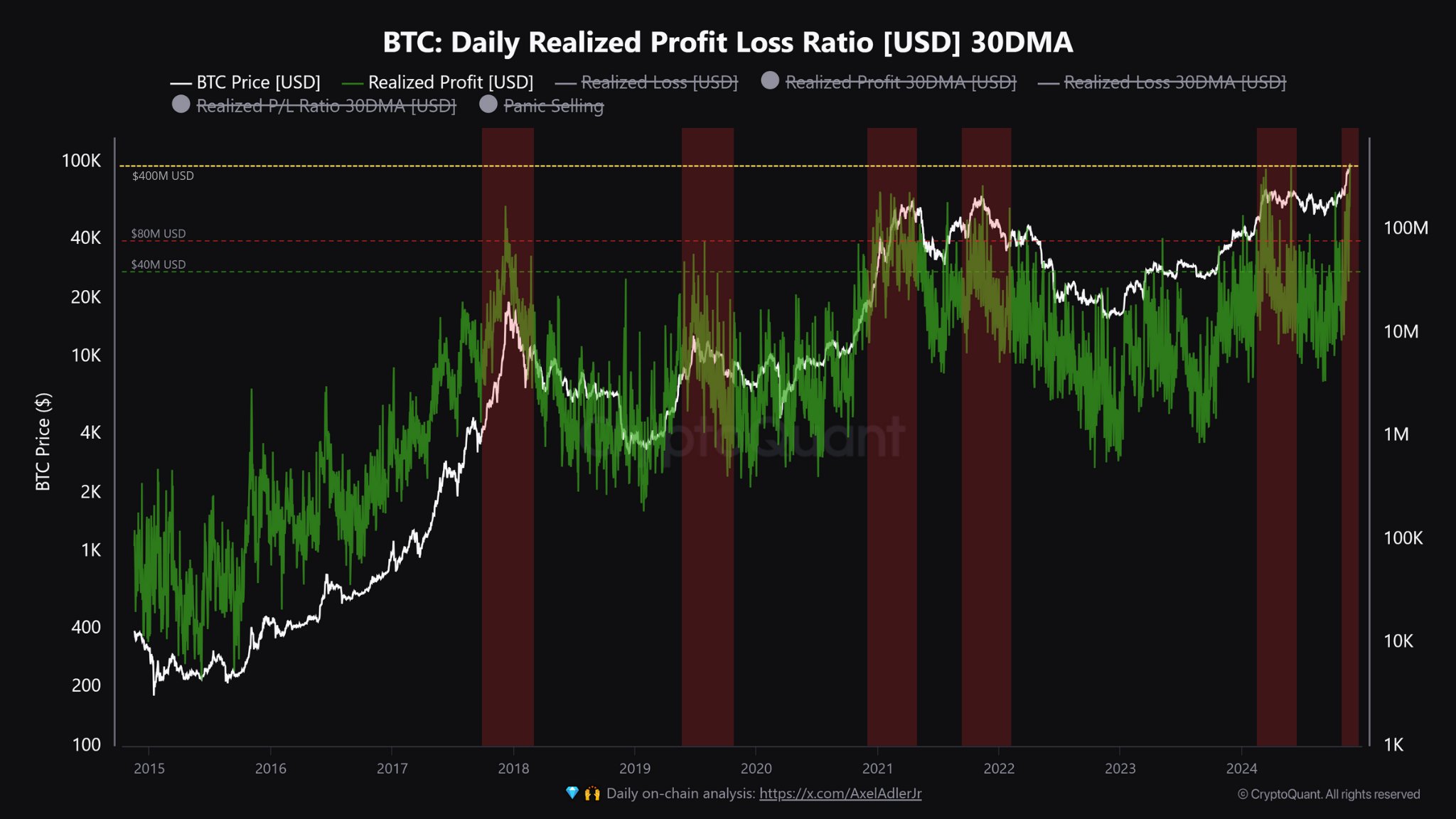

For now, the realized profit/loss ratio is high, suggesting that the anticipated profit-taking might worsen the sell-off within the quick time period. Normally, the realized revenue/loss ratio rises to the present highs when costs are topping. Due to this fact, taking a look at historical past, the cool-off is a part of the ebbs and flows of Bitcoin.

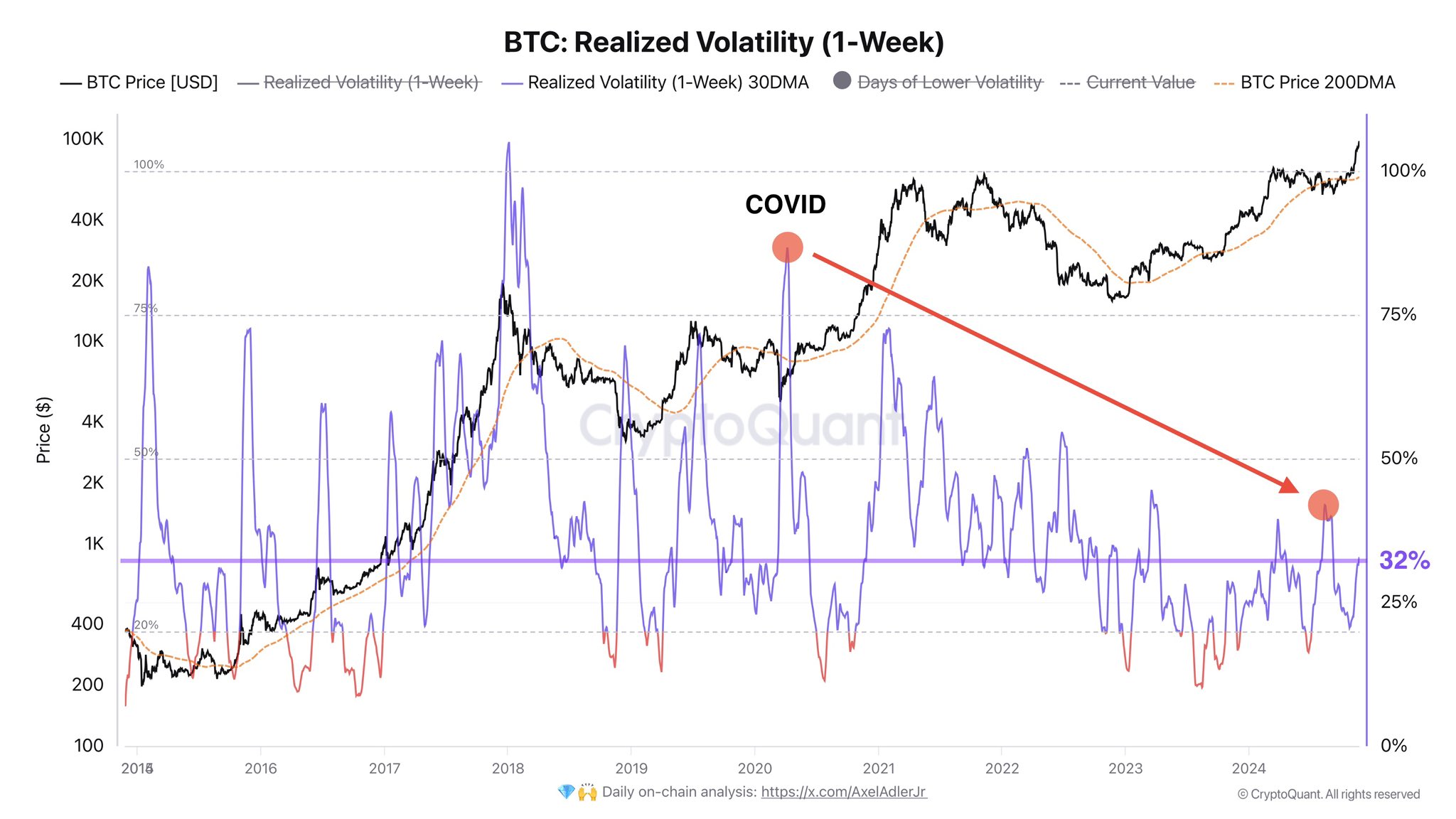

Furthermore, the coin’s realized volatility is low, dropping from COVID-19 ranges. The large boys, together with establishments and governments, might take into account getting publicity to the asset.

Although the low volatility might hold away speculators (which is nice), the involvement of companies and enormous companies might regular costs in the long run.

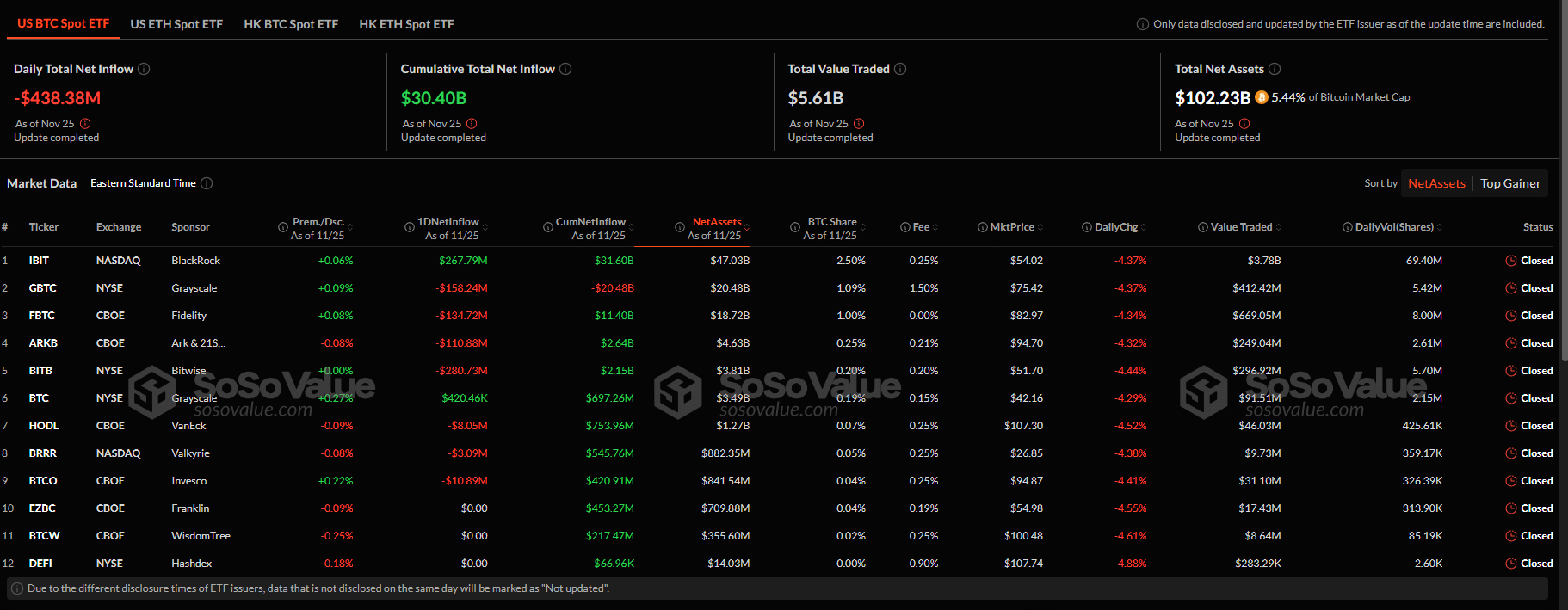

SosoValue knowledge shows that establishments are shopping for, taking a look at inflows to identify Bitcoin ETFs. By November 25, all issuers managed over $102 billion value of Bitcoin-backed shares.

Even so, contemplating the value drop yesterday, over $438 million value of BTC-backed shares have been redeemed.

What’s Subsequent For Bitcoin?

Bitcoin could be correcting, however market knowledge reveals that the dip received’t be prolonged.

Good establishments and corporations like MicroStrategy are profiting from the low costs to purchase.

https://x.com/saylor/standing/1861033309934862601

In the meantime, analysts anticipate Bitcoin to ease previous $100,000, even reaching $120,000 and $150,000 within the coming months.

EXPLORE: 20 New Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Bitcoin Corrects, Drops to $92,600: Here’s Why This Dip Won’t Hurt the Market appeared first on .

[ad_2]

Source link