[ad_1]

The Bitcoin market seems to have taken an intriguing flip because the asset’s reserves on centralized exchanges have hit the bottom ranges since November 2018.

This improvement, highlighted by a CryptoQuant analyst often known as G a a h, factors out a notable change in BTC’s investor conduct inside the crypto house and likewise suggests fairly an fascinating pattern for Bitcoin.

Bitcoin Reserves On Exchanges Attain 5-Yr Low

In response to the analyst, Bitcoin reserves on exchanges have diminished considerably all through 2024, reflecting a shift in the direction of long-term holding strategies amongst market individuals.

This pattern means that buyers more and more transfer their assets to private wallets, lowering the availability out there for rapid sale and contributing to purchasing strain in a market already constrained by provide.

In response to G a a h, this conduct signifies a broader sentiment shift, with market individuals displaying elevated confidence in Bitcoin as a retailer of worth amidst “financial uncertainty and rising inflation.”

By shifting Bitcoin away from exchanges, buyers cut back the chance of sudden sell-offs, which might result in elevated value stability. Nonetheless, the decreased provide on exchanges may additionally result in heightened volatility, particularly if demand continues to develop or stays constant.

The CryptoQuant analyst famous:

With that stated, this situation alerts a probably extra risky however extra resilient Bitcoin market, with much less promoting strain and a rising dominance of long-term holders, which might open up house for brand new value peaks.

BTC’s Upward Momentum Cools Off

Following an all-time high (ATH) of $93,477 on Wednesday, November 13, BTC has confronted fairly a noticeable correction, now down by 4% from this peak. To this point, the asset has been unable to proceed its upward momentum and seems to be seeing extra sell-offs.

When writing, Bitcoin trades beneath $90,000 with a present buying and selling value of $89,779, down by 1.4% prior to now day. This value decline resulted in roughly $49 billion subtracted from its market capitalization valuation on Wednesday.

For context, as of right this moment, BTC’s market cap sits at $1.775 trillion, a virtually 5% lower from the $1.835 trillion valuation two days in the past. Bitcoin’s every day trading volume dropped from over $100 billion earlier this week to beneath $85 billion.

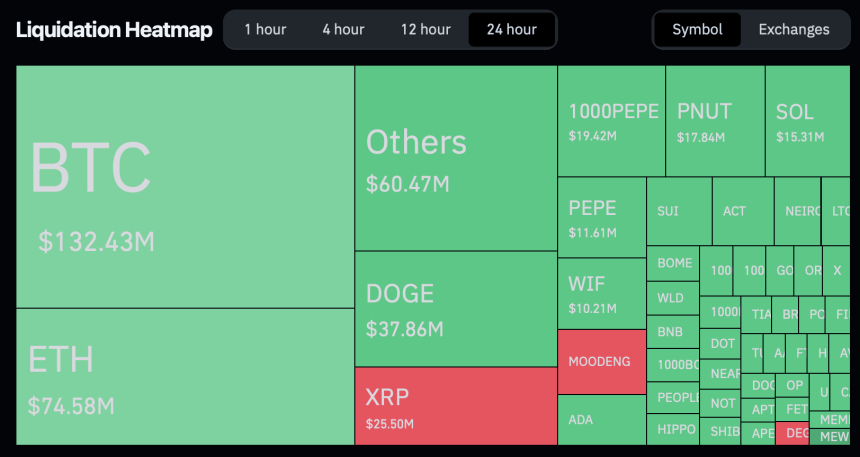

In addition to the implications on its market cap and buying and selling quantity, BTC’s decline has considerably impacted a handful of merchants. In response to data from Coinglass, prior to now 24 hours alone, roughly 170,215 merchants have been liquidated, bringing the whole liquidations within the crypto market to $510.13 million.

Out of those whole liquidations, Bitcoin accounts for $132.43 million, with the vast majority of the liquidations coming from lengthy positions—those that guess that the upward momentum would proceed.

Featured picture created with DALL-E, Chart from TradingView

[ad_2]

Source link