[ad_1]

Bitcoin’s value has been persistently making increased highs and lows over the previous couple of months, approaching a brand new all-time excessive.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Each day Chart

On the day by day timeframe, the value has been rallying since its rebound from the $52K help degree.

Whereas the market has damaged above the important thing 200-day shifting common, situated across the $64K degree and the $68 space, it has failed to interrupt above the all-time excessive.

The worth is at the moment dropping towards the $68K help degree nevertheless it appears prone to rebound increased and make a brand new document excessive quickly, because the market construction remains to be bullish.

The 4-Hour Chart

Wanting on the 4-hour chart, the market has been trending increased inside an ascending channel. But, it has been rejected from the channel’s higher boundary lately and is at the moment testing the decrease trendline. If the vary holds, the market is prone to rally towards a brand new all-time excessive quickly.

Nonetheless, a breakdown may result in a correction towards the $64K and even the $60K degree within the coming weeks.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Bitcoin Funding Charges

The futures market has considerably influenced the BTC value motion over the previous few years. Subsequently, analyzing its mixture sentiment may also help anticipate future market tendencies extra precisely.

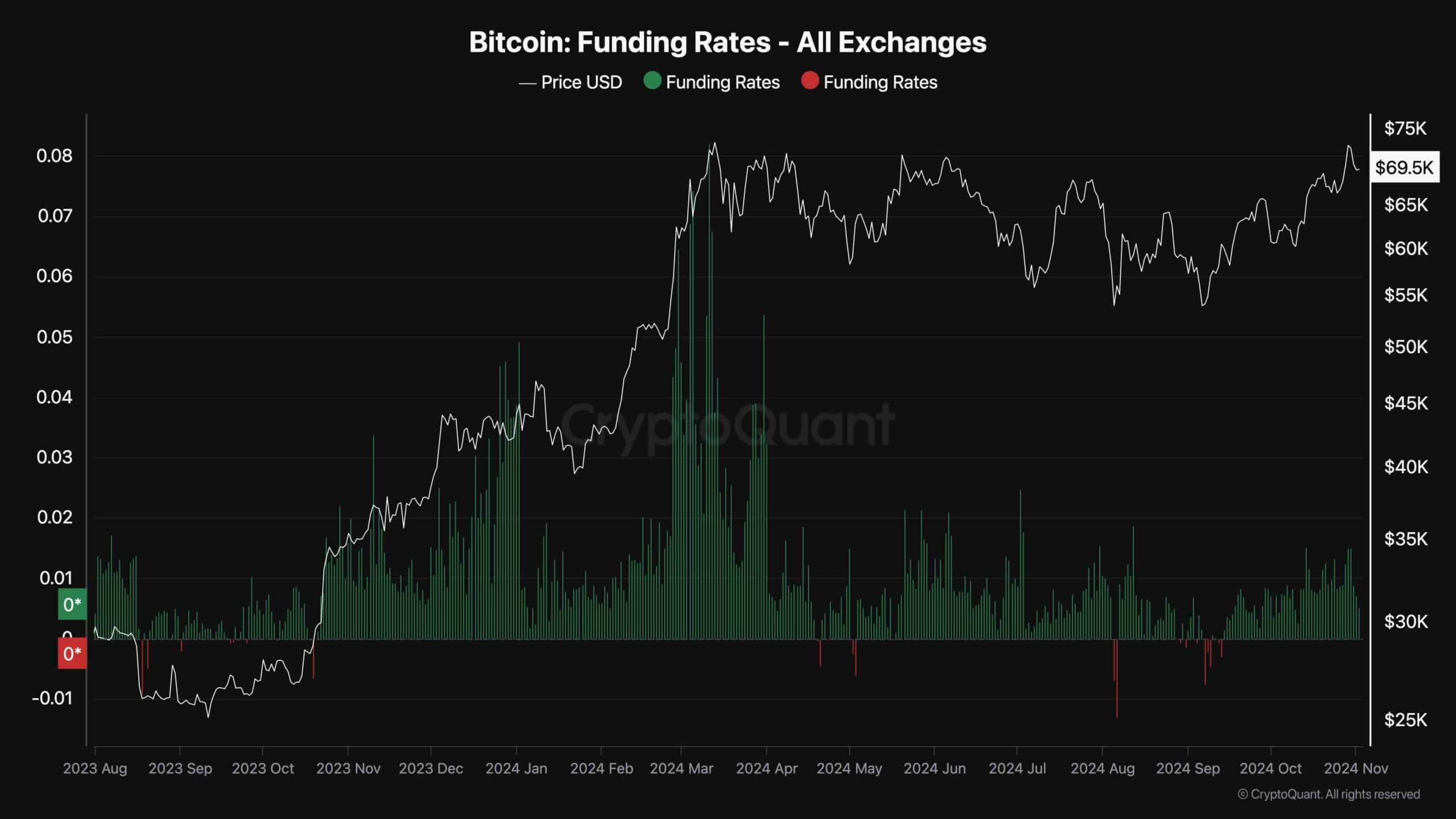

This chart presents the Bitcoin funding charges metric, which measures whether or not the patrons or the sellers are executing their leveraged positions extra aggressively. Constructive values point out bullish sentiment, whereas unfavorable values point out bearish expectations.

Because the chart shows, the funding charges have been printing constructive values in the course of the current uptrend.

But, these values are nonetheless a lot decrease than the funding charges witnessed over the past all-time excessive in March. Subsequently, it may be concluded that the futures market remains to be not overheated, and with ample spot demand, increased costs could possibly be anticipated within the coming weeks.

The submit Bitcoin Price Analytics: BTC Tumbles 3% Overnight but How Low Can It Go? appeared first on CryptoPotato.

[ad_2]

Source link