[ad_1]

Holy cow! The market pumped on CPI outcomes immediately, and Bitcoin cracked $90,000 for the primary time, though the data wasn’t totally optimistic.

JPOW did it once more. Is there something he can’t do?

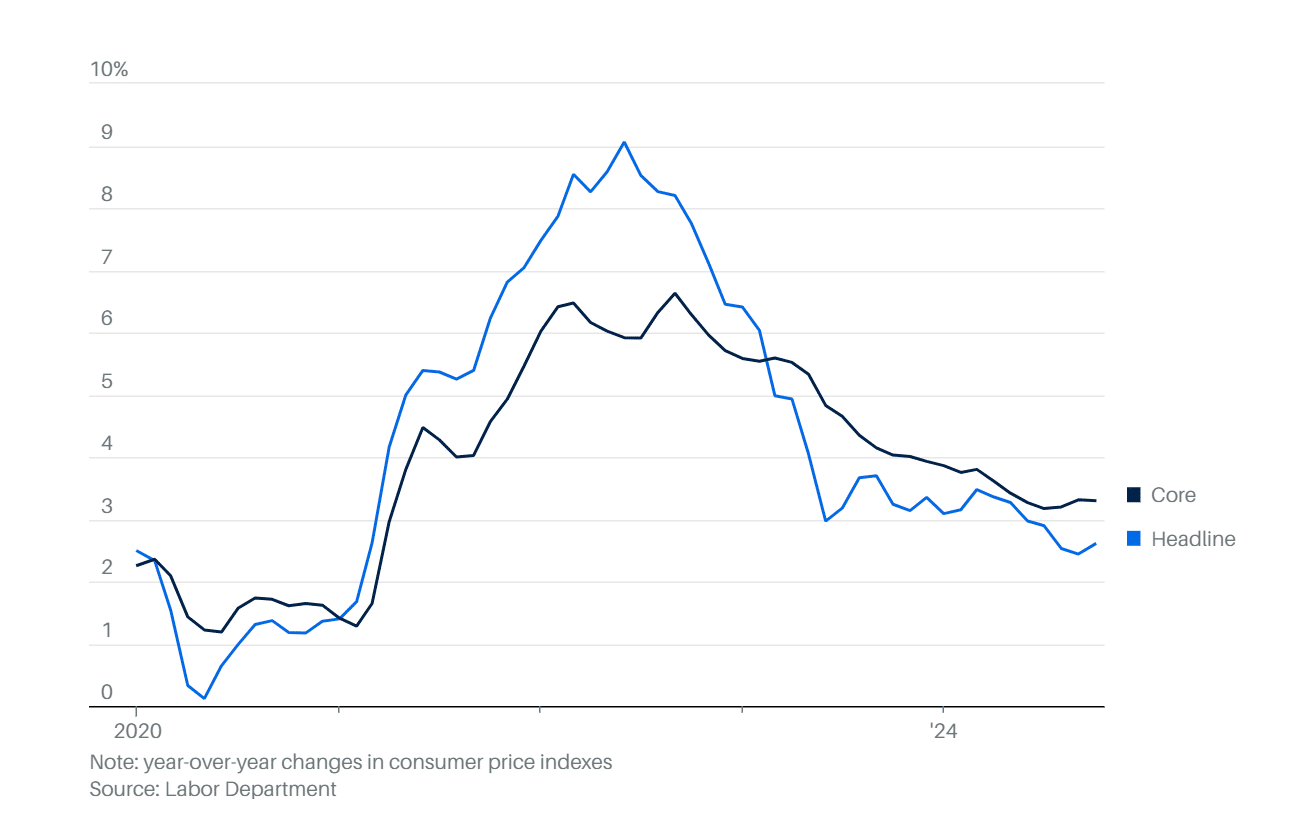

All jokes apart, inflation is retaking middle stage as indicators of the Trump rally slowing emerge. At present’s October CPI outcomes revealed a 2.6% enhance year-on-year, matching expectations. This report precedes the Fed’s December assembly, with markets betting 66% on a 3rd charge lower this yr.

Inflation was simply reported at 2.6%.

We’re headed within the fallacious route.

The American individuals simply elected a brand new President with the mandate to get inflation down now!

— Anthony Pompliano

(@APompliano) November 13, 2024

Trump’s win ignited a market frenzy that’s cooling off; his social media inventory DJT and the Russell 2000 have misplaced some steam. Just lately, inventory futures slipped, ending the S&P 500 and Nasdaq’s five-day streak, and treasury yields eased, settling the 10-year at 4.43%.

Moreover, Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

is lingering at practically $89,000 after breaking $90,000.

There are numerous individuals ready for a market pullback, however right here’s what’s more likely to occur to BTC now that the CPI outcomes are out.

CPI Outcomes At present: A Nearer Look

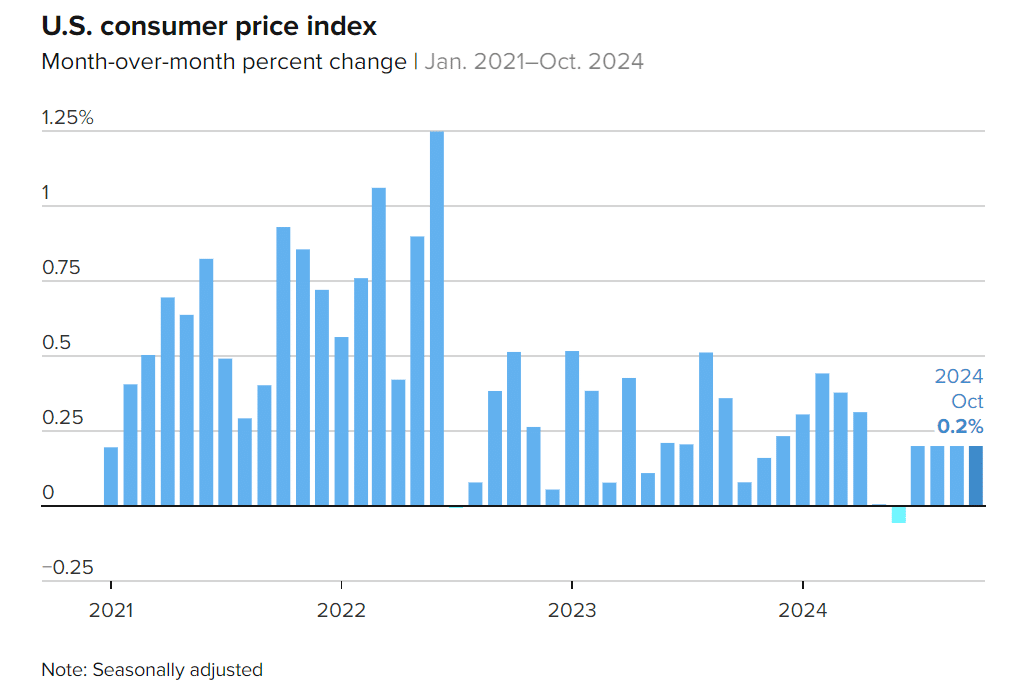

Earlier than the inflation report, analysts forecasted a refined 0.3% bump in October’s core client costs, the third month in a row for this climb. This sample underlines a cussed inflation scene, with core CPI regular at 3.3% year-over-year.

Samuel Tombs from Pantheon Macroeconomics predicts a “3.5% bounce in seasonally adjusted costs for used vehicles,” alongside a 2% rise in lodge and motel costs as a consequence of elevated demand from current hurricanes.

Rising inflation is complicating the Fed’s charge lower plans. The market now sees a 59% probability of a quarter-point lower in December, down from 77% earlier than the election.

Power costs dropped 4.9% yearly, whereas meals costs climbed 2.1%. Regardless of cooling inflation elsewhere, shelter prices fueled the CPI surge. The shelter index, a heavyweight within the index, rose 0.4% in October, doubling September’s transfer, and was up 4.9% yearly, contributing to greater than half the CPI’s acquire.

Used car costs ascended 2.7% this month, whereas motorcar insurance coverage fell 0.1% however remained 14% increased yearly. Airline fares soared 3.2%, and eggs plummeted 6.4% however stayed 30.4% above final yr. The BLS reported that inflation-adjusted hourly earnings inched up 0.1% for the month and 1.4% yearly. Inflation drifted farther from the Fed’s 2% goal, doubtlessly complicating financial coverage as a brand new administration steps in come January.

Fed Chief Jerome Powell insists inflation is on observe to hit the two% goal, regardless of some bumps. His feedback trace at a probable charge lower, however future strikes stay hazy. With regular inflation in non-housing sectors and little stress from the job market, warning is the watchword.

DISCOVER: Is Pepe Unchained The World’s Biggest Meme Coin Presale? Analysts Call PEPU Next PEPE

What’s Subsequent For Bitcoin and Tech?

The upcoming CPI report isn’t just about numbers; it’s a pulse test on the US financial system. The info will supply insights into client habits, worth stability, and the effectiveness of fiscal insurance policies.

Whereas inflation is predicted to inch nearer to the Fed’s goal, exterior components corresponding to fiscal coverage uncertainties beneath the brand new administration may introduce new variables.

With no surprises from the CPI, the Fed appears poised to chop charges once more in December. Subsequent yr’s outlook is murkier as a consequence of potential tariffs and the shifting Trump administration insurance policies.

In response to Ellen Zentner, Morgan Stanley Wealth Administration’s chief financial strategist, markets are already contemplating fewer charge cuts in 2025 and probably pausing as quickly as January.

EXPLORE: Italy Scales Back Crypto Tax Hike, Proposing 28% Capital Gains Levy

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up CPI Results Push Bitcoin Price to $90K: How Could Tomorrow’s PPI Hit Crypto Market? appeared first on .

[ad_2]

Source link