[ad_1]

New information from market analytics agency Glassnode reveals that merchants are retaining their Solana (SOL) stacks amid expectations that its worth will proceed to rise.

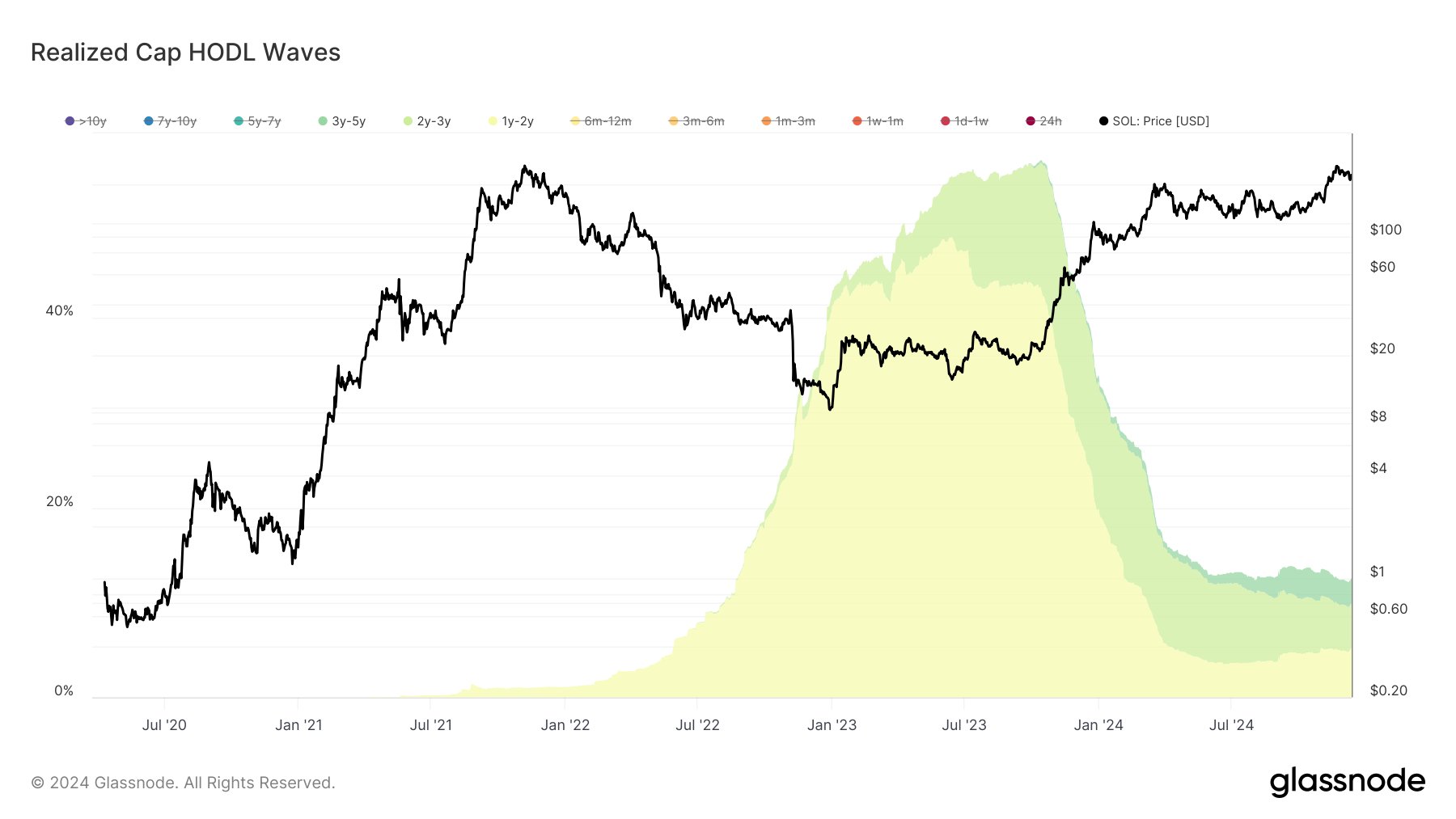

In a brand new thread on the social media platform X, Glassnode says that long-term holders now personal a big provide of SOL, believing that Solana’s bullish part is way from over.

“Solana traders are HODL-ing (holding on for expensive life) agency, anticipating greater costs. Lengthy-term holders’ share of wealth locked within the community is rising. The 6-12 month cohort now holds 27% of the availability, exhibiting conviction from 2024 rally patrons.”

However the information analytics agency notes that traders who collected SOL towards the top of the 2022 market cycle have massively unloaded their holdings. In line with Glassnode, the distribution of the 2022 investor cohort means that promoting stress for SOL is now weak.

“In the meantime, the 1-2 yr cohort has steadily diminished, dropping from 48% in June to simply beneath 5% now. These have been traders from the earlier bull run who largely took earnings throughout this yr’s rally. For now, those that needed to promote SOL have possible offered.”

Earlier this week, the co-founders of Glassnode predicted that Solana is due for a serious rally.

“SOL hit the marked zone and rebounded towards $230. If it surpasses $235 on a every day timeframe, it may break the value compression, concentrating on the earlier excessive of $264.

Key Alerts: Each day RSI (relative power indicator) is impartial, removed from overbought territory – favorable for a transfer greater.”

Solana is buying and selling for $224 at time of writing, a 3% lower over the last 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney

[ad_2]

Source link