[ad_1]

The enterprise capitalist Arthur Cheong is looking consideration to 1 decentralized change (DEX) altcoin he thinks is primed for a bullish trajectory.

The DeFiance Capital CEO, citing information from the analytics agency Nansen, points out to his 180,800 followers on the social media platform X that Coinbase Ventures has been closely investing in Aerodrome Finance (AERO).

“Coinbase Ventures traditionally do six-figure enterprise offers and infrequently went past $1 million investments till just lately. And now we have now the largest-ever funding made on a liquid token (>$20 million) purchased from the open market like each different market participant. Take into consideration why they’re so bullish and nonetheless shopping for extra.”

Aerodrome Finance is a buying and selling and liquidity market on Base, Coinbase’s Ethereum (ETH) layer-2 scaling resolution. The challenge is a fork of Velodrome, a buying and selling and liquidity market initially launched on Optimism (OP), one other Ethereum layer-2 scaler.

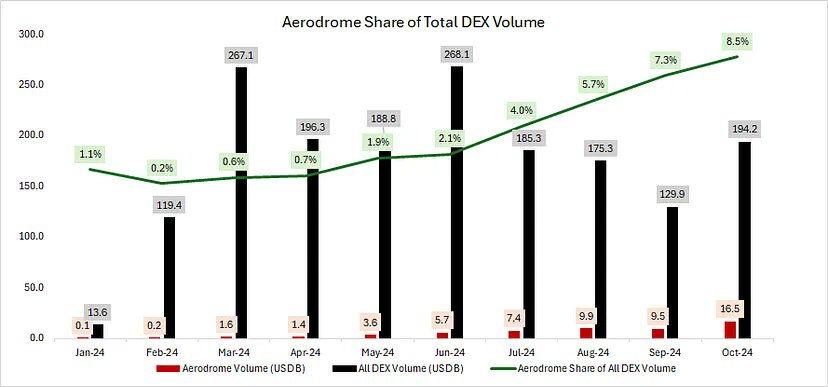

Cheong additionally calls attention to Aerodrome’s rising share of complete DEX quantity.

“Take into consideration how this may play out within the subsequent three to 6 months for Aerodrome Finance.”

Cheong and Bryan Tan, DeFiance Capital’s head of analysis, argue in a new analysis that Aerodrome’s complete worth locked (TVL) might triple and surge to $4 billion inside a 12 months, and so they suppose month-to-month volumes might swell to $50 billion.

TVL refers back to the quantity of capital deposited inside a protocol’s good contracts and is commonly used to gauge the well being of a crypto ecosystem.

AERO is buying and selling at $1.31 at time of writing. The 118th-ranked crypto asset by market cap is down practically 1.5% up to now 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney

[ad_2]

Source link