[ad_1]

Prime Cryptocurrency Exchanges

When diving into the world of digital property, selecting the correct cryptocurrency alternate is an enormous deal. I’ve delved into the highest platforms by rankings, transaction volumes, and their total market presence.

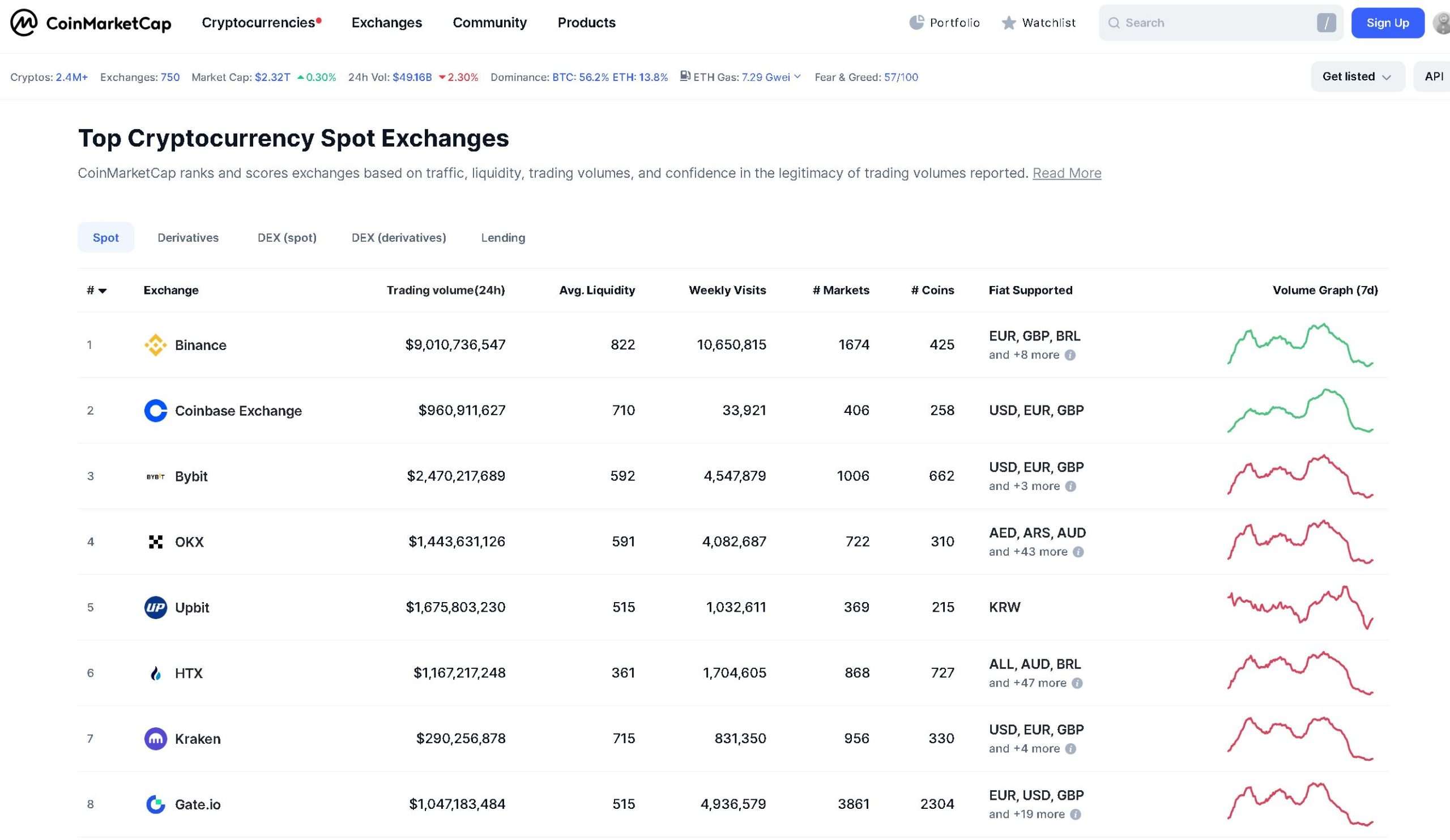

CoinMarketCap Rankings

In line with CoinMarketCap, exchanges are ranked primarily based on elements like visitors, liquidity, buying and selling volumes, and the reliability of reported buying and selling volumes. Proper now, they’re maintaining tabs on 253 spot exchanges with a complete 24-hour buying and selling quantity hitting round $747.86 billion.

Right here’s a fast breakdown of some high exchanges:

| Trade Title | 24-Hour Buying and selling Quantity (USD) |

|---|---|

| Binance | 36 billion (approx.) |

| Coinbase | 2 billion (approx.) |

| Gemini | 175 million (approx.) |

Binance: Main the Business

Binance is the massive canine within the crypto alternate world, main by commerce volumes. It shot to the highest, surpassing $36 billion in trades by early 2021 (CoinMarketCap). With a variety of cryptocurrencies and superior buying and selling options, it’s a fantastic selection for each newbies and seasoned merchants.

Binance is known for its low buying and selling charges and huge choice of digital property, making it simple for customers to discover varied funding choices.

Gemini: A Rising Presence

Based in 2014 by the Winklevoss twins, Gemini is making waves within the crypto market. With buying and selling volumes over $175 million, it’s positioned itself as a dependable alternate as detailed by CoinMarketCap. Recognized for robust safety, regulatory compliance, and a user-friendly interface, Gemini is a stable selection.

They even launched the Gemini Greenback token, including one other layer to its ecosystem. For these simply beginning out, Gemini affords a simple and safe atmosphere.

Coinbase: US Market Big

Since its inception in 2012, Coinbase has dominated the U.S. market, boasting the biggest buying and selling quantity amongst U.S. exchanges. With buying and selling volumes over $2 billion in early 2021, it’s cemented its standing as a market chief (CoinMarketCap).

Acknowledged for its intuitive design and easy onboarding, Coinbase is very accessible for newcomers. Plus, it affords quite a lot of cryptocurrencies, supporting customers as they diversify their portfolios.

Exploring completely different platforms is essential for anybody all for buying and selling. Particular person preferences for options, charges, and securities ought to information the selection of alternate. For extra insights, try our cryptocurrency exchange reviews and discover decentralized cryptocurrency exchanges for extra choices.

Key Options of Exchanges

Whereas exploring varied cryptocurrency exchanges, I found that sure options can significantly improve the buying and selling expertise. Right here, I’ll spotlight key choices from 4 exchanges: Huobi International, Kraken, Crypto.com, and KuCoin.

Huobi International: Derivatives Buying and selling

Huobi International is well-known for its intensive derivatives buying and selling choices, permitting customers to interact in futures and choices contracts. These choices allow merchants to take a position on value actions with out truly proudly owning the asset. That is notably interesting for these trying to hedge investments or amplify features.

Key Options:

| Characteristic | Description |

|---|---|

| By-product Choices | Futures, choices, and margin buying and selling out there |

| Superior Instruments | Analytical instruments for knowledgeable buying and selling selections |

| Person-Pleasant Interface | Simpler navigation for each freshmen and skilled merchants |

Kraken: Superior Choices

Kraken shines with its superior buying and selling options, providing a strong set of instruments for these diving deep into the crypto market. From margin buying and selling to futures and staking choices, Kraken is ideal for superior merchants who admire a complicated buying and selling atmosphere.

Key Options:

| Characteristic | Description |

|---|---|

| Margin Buying and selling | As much as 5x leverage out there |

| Staking Choices | Earn rewards on cryptocurrency holdings |

| Safety Measures | Robust deal with securing consumer property |

Crypto.com: Broad Cryptocurrency Choice

Crypto.com impresses with an unlimited choice of over 250 cryptocurrencies for buying and selling. This intensive providing permits customers to simply diversify their portfolios. The platform additionally gives distinctive perks and rewards for Crypto.com Visa Card customers, including additional incentives for normal merchants. Customers can even make the most of Cronos (CRO), the platform’s utility token, to decrease charges and earn advantages.

Key Options:

| Characteristic | Description |

|---|---|

| Number of Cryptocurrencies | Over 250 cryptos out there for buying and selling (Forbes) |

| Rewards for Card Customers | Additional advantages for utilizing the Crypto.com Visa Card |

| Payment Discount | Pay buying and selling charges with CRO for decrease prices |

KuCoin: Altcoin Entry

KuCoin is acknowledged for its deal with offering entry to a variety of altcoins. This alternate provides customers the chance to put money into lesser-known cryptocurrencies that might not be out there on different platforms. KuCoin additionally caters to a world viewers, providing varied buying and selling pairs and alternatives for people exploring various investments.

Key Options:

| Characteristic | Description |

|---|---|

| In depth Altcoin Choice | Entry to quite a few altcoins for buying and selling |

| Low Buying and selling Charges | Aggressive price construction for varied transactions |

| Person-Pleasant Design | Easy usability for newcomers and skilled merchants alike |

By inspecting these options, customers could make an knowledgeable selection when choosing a cryptocurrency alternate primarily based on their buying and selling wants. Every platform serves completely different focuses, so it’s important to think about what aligns finest with particular person funding methods.

Trade Safety Issues

Once I began my journey into cryptocurrency, one in all my main considerations was the safety of the exchanges I thought-about. With quite a few high-profile hacks prior to now, it’s essential to remain knowledgeable in regards to the safety panorama of cryptocurrency exchanges.

Historic Trade Hacks

Many exchanges have skilled vital safety breaches, impacting hundreds of customers and leading to monumental monetary losses. As an illustration, Coincheck was hacked in early 2018, shedding over $534 million in NEM attributable to storing all tokens in a single scorching pockets with out multisignature safety. The notorious Mt. Gox hack noticed the theft of 80,000 BTC in 2011 and one other 850,000 BTC in 2014, mixed losses amounting to round $29 billion in in the present day’s worth. Moreover, in 2018, Italian crypto alternate BitGrail misplaced 17 million NANO cash value $170 million, attributed to vulnerabilities in its code.

Even exchanges which might be usually deemed safe, like Binance, confronted assaults. In Could 2019, hackers stole roughly 7,000 BTC and delicate consumer information from round 60,000 accounts, revealing vulnerabilities even inside sturdy platforms.

| Trade | Yr of Hack | Quantity Misplaced | Trigger |

|---|---|---|---|

| Coincheck | 2018 | $534 million | Sizzling pockets insecurity |

| Mt. Gox | 2011 & 2014 | $29 billion | Unencrypted pockets information |

| BitGrail | 2018 | $170 million | Code vulnerabilities |

| Binance | 2019 | $40 million | Malware and safety flaws |

Significance of Safety Audits

Common safety audits are important for any cryptocurrency alternate. These audits assist establish vulnerabilities and be certain that the most recent safety practices are being carried out. They will additionally instill confidence in customers by confirming that an alternate has been completely evaluated by a 3rd social gathering.

I at all times search for exchanges which have up-to-date safety audits out there for public evaluate. Understanding their dedication to safety can affect my selection considerably.

Safe Storage Strategies

One of many important elements in maintaining cryptocurrency protected is the place the property are saved. Many exchanges supply custodial storage, the place they handle consumer property. In line with Investopedia, storing cryptocurrency personal keys on a good and controlled alternate might be as safe as utilizing a chilly pockets, particularly if the alternate affords insurance coverage in opposition to theft. Platforms like Coinbase and Gemini present custodial storage together with insurance coverage for his or her customers’ property.

| Storage Methodology | Safety Degree | Instance Exchanges |

|---|---|---|

| Sizzling Pockets | Much less safe, linked to the web | Binance, BitGrail |

| Chilly Pockets | Safer, offline storage | Ledger, Trezor |

| Custodial Storage with Insurance coverage | Safe and insured storage | Coinbase, Gemini |

Dangers of Trade Wallets

Utilizing alternate wallets carries inherent dangers. Whereas handy, alternate wallets might be susceptible to assaults. Even exchanges with robust safety measures can expertise breaches. Moreover, customers don’t have management over their personal keys, which might result in potential lack of funds if the alternate turns into bancrupt or suffers a hack.

For long-term investments, I desire to switch my property to a chilly pockets, making certain that my funds stay protected from the vulnerabilities that include utilizing alternate wallets.

In abstract, the safety of a cryptocurrency alternate is paramount to guard one’s investments. Consciousness of previous hacks, the significance of safety audits, safe storage strategies, and understanding the dangers related to wallets will assist me select safer choices within the risky world of cryptocurrency. For additional insights, I like to recommend trying out cryptocurrency exchange reviews.

Nation Laws and Legalities

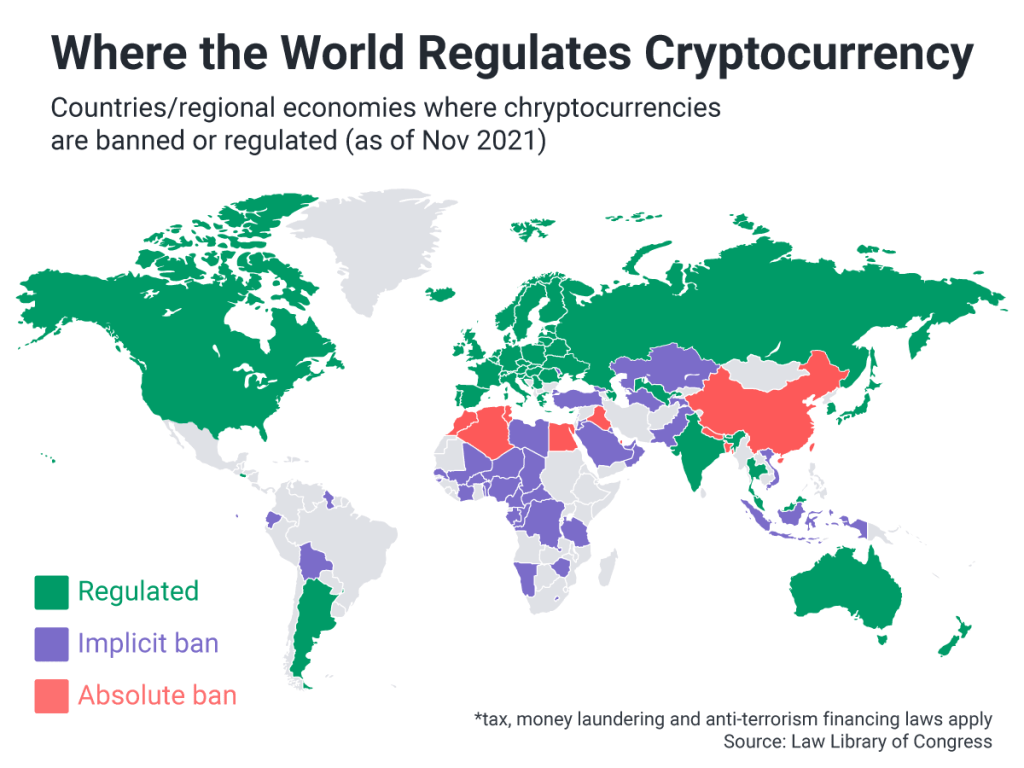

Understanding the authorized panorama of cryptocurrency is essential for anybody trying to make investments or commerce on varied platforms. Laws can significantly affect the functioning of exchanges and the way cryptocurrencies are perceived in numerous jurisdictions.

Cryptocurrency Authorized Standing Worldwide

The authorized standing of cryptocurrency varies considerably throughout the globe. As of June 2024, El Salvador stands out as the one nation that has formally accepted Bitcoin as authorized tender for financial transactions. Different nations have adopted various approaches. As an illustration, Japan has clear laws underneath the Cost Providers Act, whereas China has imposed a ban on cryptocurrency exchanges, transactions, and mining, pushing for its Central Financial institution Digital Foreign money (CBDC) as a substitute. In India, the authorized framework stays pending; nevertheless, there isn’t a present illegality, permitting exchanges to function. The European Union has taken steps to legitimize cryptocurrencies, with laws just like the European Fee’s Markets in Crypto-Belongings (MiCA) legislation set to standardize practices and shield customers (Investopedia).

| Nation | Authorized Standing | Noteworthy Factors |

|---|---|---|

| El Salvador | Authorized tender for Bitcoin | First nation to simply accept Bitcoin legally |

| Japan | Acknowledged underneath Cost Providers Act | Clear laws in place |

| China | Ban on exchanges and mining | Concentrate on CBDC |

| India | No present illegality | Awaiting framework |

| European Union | Authorized with laws | MiCA carried out for standardization |

Influence of Laws on Exchanges

Laws play a pivotal function in shaping the operations of cryptocurrency exchanges. In July 2023, a U.S. court docket dominated that cryptocurrencies bought by institutional consumers are thought-about securities, whereas these purchased by retail buyers on exchanges should not. This distinction represents a major step ahead for crypto fanatics, because it permits for extra freedom in buying and selling for most of the people. Nevertheless, exchanges are nonetheless topic to oversight by regulatory our bodies such because the Securities and Trade Fee (SEC), which governs coin choices and gross sales to institutional consumers (Investopedia).

| Regulation Kind | Influence |

|---|---|

| Institutional vs Retail | Completely different classifications can have an effect on buying and selling methods and authorized implications |

| SEC Oversight | Exchanges should adjust to laws for coin choices, particularly for institutional gross sales |

Authorized Tender Acceptance

The acceptance of cryptocurrency as authorized tender considerably impacts its use and legitimacy. El Salvador’s distinctive place units it aside, because it permits Bitcoin for use alongside the U.S. greenback for all transactions. This acceptance could contribute to better adoption and understanding amongst its residents.

In distinction, the shortage of acceptance in nations like China limits the potential for day-to-day transactions and closely restricts the market. Recognizing cryptocurrency as authorized tender can improve client confidence, affect buying and selling volumes, and promote broader acceptance into the monetary system (Investopedia).

| Nation | Authorized Tender Standing | Implications |

|---|---|---|

| El Salvador | Accepts Bitcoin as authorized tender | Enhanced adoption and client confidence |

| China | No authorized tender standing | Limits market potential and client use |

Understanding these laws and their implications will help inform my selections when navigating by means of completely different cryptocurrency exchanges and ensures that I stay compliant whereas exploring the world of digital property.

Transaction Charges Comparability

Understanding transaction charges is essential when choosing a cryptocurrency alternate. The prices related to shopping for, promoting, and buying and selling cryptocurrencies can significantly have an effect on one’s total funding technique. Under, I’ll break down the price buildings of a number of fashionable platforms, together with Binance, Coinbase, and Robinhood, in addition to spotlight varied price choices throughout exchanges.

Binance Payment Buildings

Binance, the biggest cryptocurrency buying and selling platform, employs a tiered price construction primarily based on buying and selling quantity over the previous 30 days. They categorize customers into “Makers” and “Takers.” Makers, who place restrict orders, sometimes take pleasure in decrease charges in comparison with Takers, who execute market orders.

| Buying and selling Quantity (30 days) | Taker Payment (%) | Maker Payment (%) |

|---|---|---|

| Lower than $50,000 | 0.10 | 0.09 |

| $50,000 – $1,000,000 | 0.08 | 0.07 |

| $1,000,000 – $10,000,000 | 0.06 | 0.05 |

Moreover, customers can go for a 25% low cost on charges by paying with Binance Coin (BNB) holdings (The Motley Fool).

Coinbase Payment Fashions

Coinbase incorporates a comparable price construction to Binance, the place transaction charges fluctuate relying on the consumer’s buying and selling quantity over the previous 30 days. Their charges are additionally break up between Takers and Makers, with Takers normally paying the next share.

| Buying and selling Quantity (30 days) | Taker Payment (%) | Maker Payment (%) |

|---|---|---|

| Lower than $10,000 | 0.50 | 0.00 |

| $10,000 – $50,000 | 0.40 | 0.00 |

| Over $50,000 | 0.25 | 0.00 |

In contrast to Binance, Coinbase doesn’t supply reductions for buying and selling charges by means of its personal cryptocurrency (The Motley Fool).

Robinhood Fee Setup

Robinhood adopts a singular strategy by providing commission-free cryptocurrency trades. This implies customers pay 0% charges whatever the order sort. Nevertheless, Robinhood generates income by means of transaction rebates moderately than executing trades straight. This could result in barely inflated shopping for costs and decrease promoting costs for its prospects (The Motley Fool).

Diverse Payment Choices Throughout Exchanges

The panorama of cryptocurrency exchanges additionally options platforms with different price buildings catering to completely different consumer preferences. As an illustration:

- BitMEX and FTX: These exchanges sometimes cost transaction charges under 0.1% for each Takers and Makers.

- eToro, ShakePay, and BlockFi: These platforms function fee-free cryptocurrency buying and selling choices, interesting to customers who prioritize minimal prices of their buying and selling.

When contemplating completely different exchanges, it’s very important to take transaction charges under consideration. A price that appears small can add up rapidly, particularly with excessive buying and selling volumes. For additional comparisons, you’ll be able to test our detailed cryptocurrency exchange reviews for extra insights into price buildings and different vital options.

Cryptocurrency Availability

When evaluating the supply of cryptocurrencies throughout completely different exchanges, I discover that the choice provided can considerably affect my buying and selling selections. Right here, I examine 4 notable platforms primarily based on their cryptocurrency choices.

Crypto.com’s Numerous Choice

Crypto.com is thought for its spectacular variety in cryptocurrency choices. The platform helps an intensive variety of cryptocurrencies, offering entry to each fashionable and rising digital property. This wide variety makes it an appropriate selection for merchants trying to discover past mainstream choices and diversify their portfolios. For particular numbers concerning out there currencies, I like to recommend checking Crypto.com’s official website.

Coinbase’s In depth Cryptocurrency Record

Coinbase stands out with its user-friendly interface and affords over 240 cryptocurrencies for buying and selling (NerdWallet). This intensive record contains main gamers like Bitcoin and Ethereum, in addition to quite a few altcoins. For freshmen, Coinbase’s easy design facilitates simple navigation by means of varied cryptocurrencies, making it a gorgeous choice for newcomers to the market.

| Trade Platform | Variety of Cryptocurrencies |

|---|---|

| Crypto.com | Huge choice |

| Coinbase | 240+ |

| Kraken | 200+ |

| Gemini | Restricted however specialised |

Kraken’s Broad Vary of Choices

Kraken gives over 200 cryptocurrencies, interesting to each newbie and superior merchants. As I explored its platform, I seen that Kraken affords notably low charges for superior buying and selling choices. The mixture of a large cryptocurrency choice and aggressive charges makes Kraken an interesting selection for these trying to maximize returns.

Gemini’s Crypto Buying and selling Specializations

Gemini has carved a distinct segment for itself by specializing in a extra restricted choice of cryptocurrencies. Whereas it might not have as many choices as among the different exchanges, Gemini’s choices are fastidiously curated. This specialization permits for a safer and dependable buying and selling expertise, notably for established cash.

In abstract, the cryptocurrency availability throughout these exchanges highlights the varied choices out there for these all for buying and selling cryptocurrencies.

[ad_2]

Source link