[ad_1]

Ethereum is struggling for traction as extra ETH strikes out of crypto exchanges. Nonetheless, this may very well be an indication of an imminent Ethereum bull run if the appropriate components fall into place.

Wanting on the candlestick association within the day by day chart, there are pockets of energy, however there should be a robust printout for uptrend affirmation.

Ethereum Value Caught In A Vary

Total, ETHUSDT continues to be caught contained in the bear vary of Q3 2024, and bulls have to show to the markets that they’re in cost.

Though the consensus is that ETH is undervalued, not solely should costs pull again strongly and breach $3,000, however this enlargement should have first rate engagement.

For now, that is lacking.

Till there’s a shut above the bear vary, risk-off merchants can keep on the sidelines till there’s a clear alternative to load up.

Whereas ETH value is struggling for momentum, market knowledge factors to a potential accumulation.

Over 300,000 ETH Moved From Exchanges

Based on CryptoQuant knowledge shared by one analyst on X, over 300,000 ETH have been moved from prime exchanges in a single week.

With extra cash transferring from exchanges like Binance and Coinbase, it means extra ETH is below the management of holders.

For now, it might probably’t be decided what precisely these holders are doing with their cash. They is likely to be holding them on chilly wallets like Ledger and Trezor or partaking in DeFi. In these protocols, they preserve management through MetaMask and different non-custodial wallets.

Total, the extra ETH strikes from exchanges, the extra scarce it turns into, which is a large optimistic for patrons.

Technically, ETH has help at across the $2,300 and $2,400 zone.

The identical analyst predicts that if bears fail to interrupt beneath this degree, ETH can simply float above $3,000 and all-time highs to over $6,000 within the coming months.

What Will Affect An ETH Bull Run To $6,000?

Whereas ultimate, the trail to recent all-time highs, manner above March highs, might be formed by a number of components.

High of the record might be how Bitcoin performs. Within the final bull cycle that noticed BTC breach $70,000, the leg up additionally fashioned the bottom for the ETH value to fly increased. As such, ETH and BTC rallied within the higher a part of This autumn 2023.

If Bitcoin bulls raise off, breaking $74,000, the bettering sentiment may even present tailwinds for altcoins.

Past value motion, inflows to identify Ethereum ETFs will form costs. Regardless of the joy of the US SEC approving this spinoff product, outflows far exceed inflows, weighing down bulls.

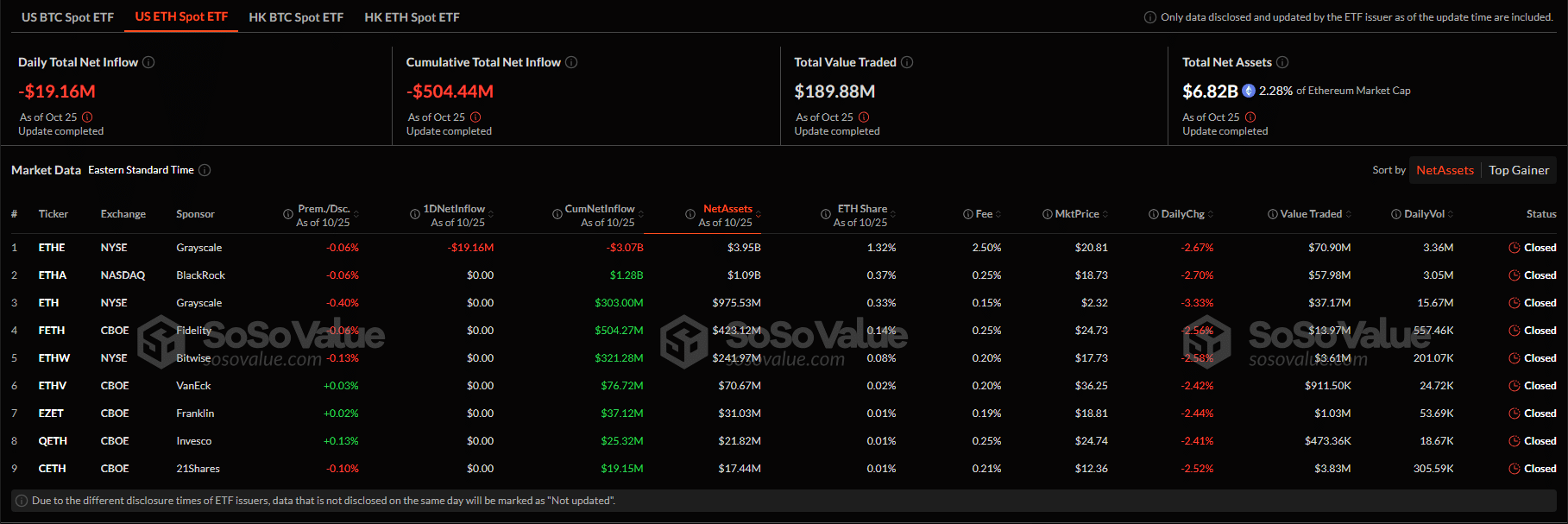

Based on SosoValue, all spot Ethereum ETF issuers in the US handle $6.8 billion value of property.

On October 25, there was a day by day complete internet outflow of over $19 million, largely from Grayscale’s ETHE redemptions.

Establishments didn’t purchase any spot Ethereum ETF shares on October 25.

Discover: dYdX Crypto Appoints New CEO: How Will DyDx Price React?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit Over 300,000 ETH Withdrawn from Exchanges In 7 Days: Ethereum Preparing For $6,000? appeared first on .

[ad_2]

Source link