[ad_1]

The Reserve Financial institution of India (RBI) is in superior discussions with a number of nations to increase its cross-border fee platform and set up seamless fee linkages throughout Asia.

According to Bloomberg, this integration is anticipated to boost transaction effectivity, simplifying worldwide commerce and monetary actions for people and companies whereas making certain a safe and controlled surroundings.

As a part of the initiative, India will likely be partnering with neighboring nations like Sri Lanka, Bhutan and Nepal. In the meantime, nation’s efforts to determine related preparations with different Asian nations, together with the UAE, conitnues.

The Reserve Financial institution of India (RBI) plans to increase its immediate cross-border funds platform by together with companions from Asia, the Center East, and the UAE.

Present agreements cowl Sri Lanka, Bhutan, and Nepal. pic.twitter.com/K1xmwmHK3G

— Neel (Crypto Jargon) (@Crypto_Jargon) November 24, 2024

The hassle is reportedly a part of India’s broader technique to enhance the pace, accessibility, and safety of worldwide transactions.

EXPLORE: India May Grant Clearance to Two More Offshore Crypto Exchanges for Operations

Increasing Digital Cost Networks In Asia And Past

Talking at a convention within the Philippines, RBI Deputy Governor T. Rabi Sankar emphasised on India’s current association with Sri Lanka. There are ongoing discussions with different neighboring nations together with the UAE to increase its fee community and improve regional monetary integration.

Presently, the present platform facilitates environment friendly cross-border transactions inside South Asia. With the UAE’s inclusion the RBI seeks to widen affect within the Center East.

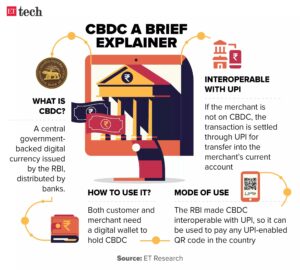

Nonetheless, the initiative won’t be restricted to conventional fee methods alone. The RBI is actively exploring to combine central financial institution digital currencies (CBDCs) for cross-border settlements.

Highlighting on India’s dedication to construct requirements for cross-border funds utilizing CBDCs, RBI Governor Shaktikanta Das had acknowledged earlier that digital currencies can present cost-effective options for remittances, commerce, and monetary transactions.

The RBI’s give attention to making a “plug-and-play” mannequin for CBDCs is basically aimed toward positioning India as a world chief in digital fee options.

EXPLORE: RBI Governor Reaffirms Support For CBDC In India For Cross-Border Payments

Indian Authorities Proceed Resisting Crypto

The RBI has all the time maintained a cautious strategy towards cryptocurrencies, citing issues about investor safety, market integrity, and potential misuse.

In April 2018, the RBI had issued a circular prohibiting regulated entities, together with banks, from offering providers to cryptocurrency-related companies.

In March 2020, the Supreme Courtroom of India overturned this directive, ruling it unconstitutional. The courtroom’s determination successfully allowed banks to renew providers for cryptocurrency exchanges and customers.

Regardless of the Supreme Courtroom’s ruling, the RBI has continued to specific apprehensions about cryptocurrencies. It has repeatedly issued public notices highlighting dangers related to worth volatility, lack of regulatory oversight, and potential misuse for illicit actions reminiscent of cash laundering.

The central bank has conducted studies and pilot projects to guage the feasibility of a digital rupee, aiming to leverage blockchain’s benefits for safe and environment friendly transactions, exploring the potential of blockchain expertise and CBDCs.

Furthermore, with a give attention to safeguarding market individuals whereas addressing cybersecurity and systemic threat, RBI plans to foster innovation in digital monetary methods whereas sustaining strict oversight of personal cryptocurrencies.

EXPLORE: Who Is Chirag Tomar? Indian National Handed Prison Sentence For $20 Million Coinbase Scam

Strengthening Regional Ties with Digital Forex

The RBI’s cross-border fee initiative is aimed toward fostering regional partnerships. By integrating Southeast Asian and Center Japanese nations into its fee community, India seeks to strengthen financial ties and promote monetary inclusion.

Moreover, the RBI can also be engaged on offline options to increase digital rupee utilization to rural areas with restricted connectivity making certain equitable entry to fashionable monetary instruments, particularly in underbanked areas.

Speaking at the ‘RBI@90 Global Conference’ on 26 August, 2024, Das mentioned “It is very important emphasize that there shouldn’t be in any rush to roll out system-wide CBDC earlier than one acquires a complete understanding of its impression on customers, on financial coverage, on the monetary system and on the economic system.”

In the course of the RBI@90 World Convention, Shri Shaktikanta Das, Governor of the Reserve Financial institution of India (#RBI), make clear their #CBDC progress and the way they envision #digitalcurrencies will form the way forward for their monetary ecosystem. Learn extra

https://t.co/nF31SMPvrp pic.twitter.com/yz9a5g74R5

— Digital Pound Basis (@digitalpoundfdn) August 26, 2024

RBI’s digital rupee, launched as a part of a pilot program in 2022, is central to its imaginative and prescient of modernized fee methods. Initially centered on bank-to-bank settlements, the digital rupee pilot has since expanded to draw over 5 million customers, as per August 2024 knowledge.

“The programmability characteristic of CBDC may function a key enabler for monetary inclusion by making certain supply of funds to the focused person,” Das added.

With no definitive timeline for a nationwide rollout, the RBI’s technique will embody growth of an interoperable CBDC framework to facilitate seamless transactions with international methods.

The submit Reserve Bank Of India Expands Digital Payment Connectivity To Asia, Middle East appeared first on .

[ad_2]

Source link