[ad_1]

Solana has skilled a turbulent few days, with its worth fluctuating between yearly highs at $225 and native lows at $200. This volatility has sparked vital curiosity amongst merchants and buyers as Solana assessments key ranges important to its subsequent transfer.

Prime analyst and macro investor Carl Runefelt has weighed in with a technical evaluation, suggesting {that a} decisive break above the $225 resistance stage may ignite a rally towards $246. In keeping with Rubefelt, this stage represents a pivotal threshold, and surpassing it might result in accelerated bullish momentum.

Associated Studying

The broader crypto market provides one other layer of intrigue, with Bitcoin as soon as once more nearing its all-time excessive. Traditionally, Bitcoin’s actions have fueled market-wide rallies, and its present trajectory may present the momentum wanted for Solana to interrupt out of its vary and obtain new highs.

As merchants intently monitor each Solana’s and Bitcoin’s worth motion, the approaching days will seemingly set the tone for the subsequent chapter on this bullish cycle. Will Solana leverage market strength to surge past $225, or will resistance maintain, resulting in additional consolidation? The unfolding narrative guarantees to be essential for altcoin fans and market members alike.

Solana Testing Essential Provide

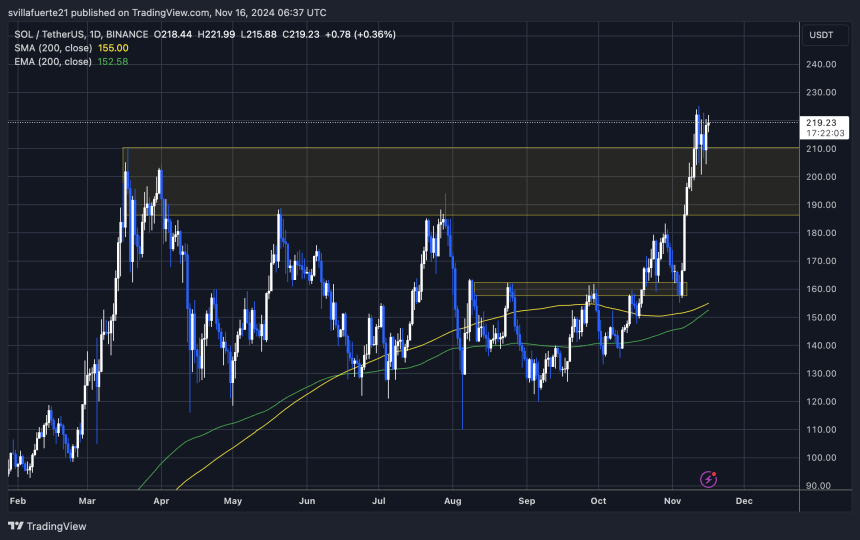

Solana is consolidating under important provide ranges that would act as a launchpad for testing its all-time excessive at $258. Presently buying and selling in a good vary, Solana’s worth motion displays indecision as merchants and buyers anticipate the subsequent huge transfer.

In keeping with key analyst Runefelt, the altcoin is positioned for a breakout. Sharing his technical analysis on X, Runefelt outlined a possible 12% surge, concentrating on the $246 resistance stage—an important hurdle earlier than Solana can problem its historic peak.

Breaking above this stage would sign sturdy bullish momentum and sure set the stage for a rally to new all-time highs. Nonetheless, for this situation to play out, Solana should not solely breach present ranges but additionally maintain them as assist. Consolidation above these key thresholds would reinforce confidence amongst market members and entice extra demand, additional fueling upward momentum.

Associated Studying

The broader market’s actions, significantly Bitcoin nearing its all-time highs, add one other layer of significance. If Bitcoin sustains its bullish trajectory, it may present the mandatory tailwind for Solana to interrupt via its consolidation section.

The approaching days might be essential in figuring out Solana’s route. A breakout to the upside may solidify its place as a number one altcoin this cycle, whereas failure to carry above present ranges may delay the rally.

Key Ranges To Watch

Solana (SOL) is at the moment buying and selling at $219 after 4 days of sideways consolidation slightly below the important $225 resistance stage. This consolidation displays a market ready for a decisive breakout as merchants eye the subsequent transfer. Holding above the $200 demand stage stays important for confirming the bullish outlook. This assist has acted as a basis for Solana’s latest uptrend, and a failure to keep up it may sign weak point and open the door for additional draw back.

Breaking and holding above the $225 resistance, nonetheless, is pivotal to affirm Solana’s bullish development. This stage serves as a psychological barrier and the bears’ final stronghold, with many prone to take earnings or provoke shorts. If Solana can overcome this resistance, it may set the stage for an aggressive rally to all-time highs, successfully ending promoting stress.

Associated Studying

A decisive breakout above $225 wouldn’t solely sign bullish power but additionally create a domino impact, attracting new patrons and fueling momentum. Such a transfer may result in a pointy climb, placing SOL on observe to problem its $258 all-time excessive and doubtlessly set new data. Within the coming days, all eyes might be on Solana’s capability to reclaim key ranges and construct on its bullish momentum.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link