[ad_1]

The US Securities and Change Fee (SEC) introduced that it secured $4.5 billion from Terraform Labs in a record-breaking $8.2 billion value of monetary cures for fiscal yr 2024.

According to a 22 November 2024 press release, Terraform Labs, Hyperfund and NovaTech accounted for 81% of the whole restoration which comprised of $6.1 billion in disgorgement together with $2.1 billion in civil penalties.

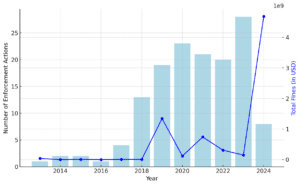

The #SEC set a brand new report in fiscal yr 2024, amassing $8.2B in fines and penalties (65.57% bounce from 2023).

Over half of this complete got here from the $4.47B settlement with Terraform Labs and #DoKwon, following the 2022 #TerraUSD and #LUNA collapse.

The variety of circumstances… pic.twitter.com/3sIyVCxvla

— TheNewsCrypto (@The_NewsCrypto) November 25, 2024

EXPLORE: SEC Returns $4.6 Million to Investors of Ethereum-Based BitClave ICO

Crypto Sector In Highlight, Terraform Labs Leads Restoration

Whereas enforcements had been part of the company’s broader effort to make sure compliance, the cryptocurrency sector remained a focus for the SEC’s enforcement actions.

A good portion of the restoration determine was pushed by the $4.5 billion judgment towards Terraform Labs and its co-founder Do Kwon. The case, involving one of many largest securities frauds in US historical past, accounted for 56% of the whole monetary cures secured.

In January, 2024 the SEC accused HyperFund of working a fraudulent pyramid scheme that raised over $1.7 billion from traders globally. In the meantime, NovaTech Ltd. confronted allegations of working a fraudulent crypto funding platform, amassing over $650 million from greater than 200,000 traders worldwide.

These two circumstances alone have accounted for over $2.2 billion in investor losses, with operators going through fees for working pyramid schemes disguised as crypto funding platforms.

The SEC also targeted Silvergate Capital, accusing the agency of deceptive traders about its compliance packages and its monitoring of high-risk crypto purchasers like FTX.

In complete, crypto-related enforcement actions accounted for a smaller proportion of circumstances however led to disproportionately giant monetary recoveries. Excessive-impact circumstances, resembling these towards HyperFund and NovaTech Ltd., have highlighted the company’s give attention to addressing large-scale fraud schemes.

Social Capital Markets reported a dramatic enhance in fines associated to crypto circumstances, up by over 3,000% in comparison with 2023.

The SEC additionally continued its crackdown on non-compliance with recordkeeping and advertising guidelines. Over $600 million in penalties had been imposed on corporations for recordkeeping violations, together with the primary circumstances towards municipal advisors.

Equally, the SEC focused funding advisers for promoting deceptive efficiency metrics with out correct safeguards, leading to vital settlements.

EXPLORE: Indian Police Arrest Suspect Tied to $234M WazirX Cyber Attack

SEC’s File Collections Regardless of Fewer Actions, Focus On Crypto Companies

The Fee filed a complete of 583 enforcement actions in fiscal yr 2024, a 26% drop from the 787 circumstances filed in 2023. These included 431 stand-alone circumstances, 93 follow-on proceedings to bar or droop people, and 59 circumstances concentrating on firms delinquent in required filings.

Based on the report, regardless of this decline, the monetary cures secured far surpassed prior years with a report breaking $8.2 billion in civil penalties. Was this attainable as a result of crypto corporations had been focused?

Gary Gensler, Chair of the SEC, who’s about to step down publish Trump’s victory mentioned “The Division of Enforcement is a steadfast cop on the beat, following the info and the regulation wherever they result in maintain wrongdoers accountable.”

EXPLORE: Bitcoin Surges to Record High as Trump Wins U.S. Election

Ripple’s Turning Level, XRP Soars Amid Settlement Hypothesis

Ripple’s authorized saga continued to attract consideration, with the neighborhood carefully monitoring each improvement. Gensler’s unexpected resignation has added gasoline to the hearth, sparking debates over its timing and implications.

In the meantime, XRP has seen a staggering rally in current days, surging almost 200% and reaching a multi-year excessive of $1.60. The fast worth escalation displays renewed investor confidence pushed by hypothesis over a Ripple-SEC settlement and broader optimism within the crypto market.

Analysts have highlighted this rally as a pivotal second, with XRP breaking essential resistance ranges and reigniting hopes of a return to its earlier all-time highs.

Market watchers speculate that Gensler’s departure may pave the best way for recent management on the SEC, probably shifting its stance on ongoing crypto circumstances. Nonetheless, seasoned analysts like Marc Fagel cautioned towards instant conclusions, citing the complexities concerned in finalizing a settlement.

Moreover, Scott Bessent’s appointment as Treasury Secretary has injected a wave of confidence amongst traders. Identified for his pro-crypto perspective, Bessent’s affect may steer the US towards extra favorable digital asset insurance policies.

For Ripple and XRP, these developments signify a essential juncture, one that might redefine its trajectory within the evolving regulatory surroundings.

The publish Terraform Accounts For Over 50% Of SEC’s 2024 Record $8.2 Billion Enforcement Efforts appeared first on .

[ad_2]

Source link