[ad_1]

Within the newest 99Bitcoin documentary, we take a scalpel to the affect of BlackRock, peeling again the layers of market manipulation which have quietly formed the monetary panorama. Now that Donald Trump is in workplace and the bull run is again on, Blackrock is once more making MASSIVE strikes.

Over the past month, BlackRock’s fifteenth largest ETF noticed inflows of 12,000 and 100,000 BTC, which is $40 billion in BTC they now management.

So what occurs when all of the bitcoin is held by like six highly effective folks?

That’s the query we’re going to reply at present.

2. BlackRock’s Plans For the Economic system & Crypto

BlackRock is the Orwellian Huge Brother you didn’t know existed. In 2008, BlackRock was the corporate the US government hired to fix the housing disaster. The entire US authorities was depending on Larry Fink and BlackRock. This gave Fink energy that different billionaires might solely dream of.

Within the early 90s, Larry Fink would discover his holy grail: Aladdin, the software titan of BlackRock. Armed with a community of 5,000 computer systems, Aladdin is an AI system that dissects markets and conducts threat analyses with razor-sharp precision.

This technique retains BlackRock two steps forward of everybody else.

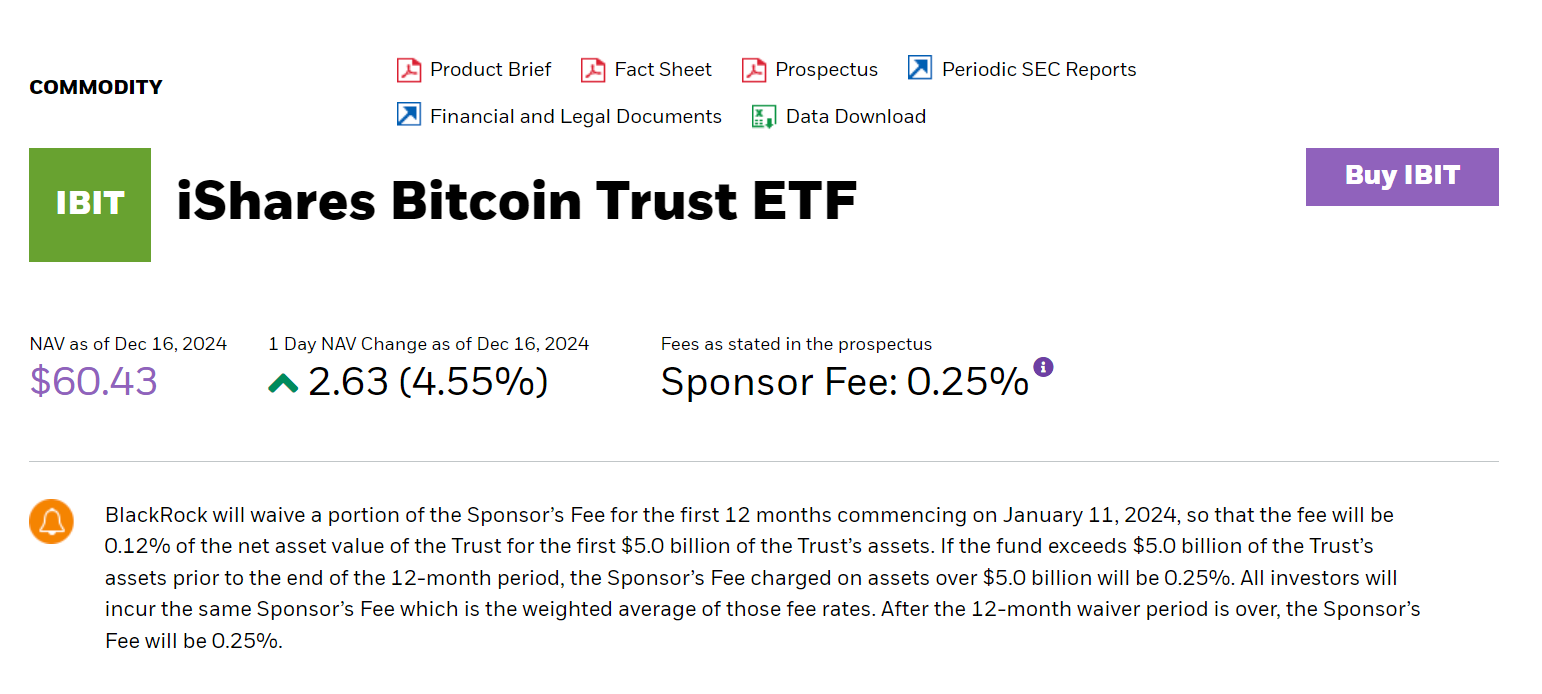

After Aladdin, BlackRock’s new plan for dominance was to take over cryptocurrency. As we speak, they’re the most recognizable ETF brand.

BlackRock doesn’t technically personal this Bitcoin; they handle it for his or her prospects. If you purchase BTC from their ETF, it’s technically yours, not theirs. Sounds truthful, proper?

The issue is having this a lot BTC below management has given Larry Fink and BlackRock 4 distinct benefits that can tilt the scales of how Bitcoin operates going ahead. Right here’s how.

How BlackRock Manipulates the Markets

A number of economists have pointed to video games occurring behind the scenes with the ETFs. Right here’s a conversation between former Goldman Sachs exec Raoul Pal and James Mullarney of Make investments Solutions speaking about this:

“I’m fascinated by these ETFs; I monitor them every day. Some folks inform me that they [ETFs] are unhealthy for the house. What I’m fearful about is that if all these ETFs have absolutely stacked wallets.”

“I’ve achieved an evaluation of this and there’s not less than 4 large situations the place flows didn’t match worth.”

Even when the market had its reddest days over the summer time, BlackRock reported no ETF outflows before Trump got in. This implies their prospects surprisingly saved shopping for although your entire market was promoting. At the least, that is what BlackRock desires you to imagine.

Our guess is {that a} completely different a part of the corporate is shopping for Bitcoin again, so it by no means hits the market. With that BTC, they’ll shorten the market, as some have already identified.

It’s not like BlackRock is a benevolent Wall St. tyrant; they’ve been caught trying to manipulate the markets earlier than. A brand new participant will now management the BTC worth.

Remaining Thought on BlackRock

Of their 2023 Global Outlook report, BlackRock stated three developments will outline the brand new period of investing: 1) Getting older populations will trigger governments to extend debt and deficits, resulting in larger inflation.

2) Fractured belief between international superpowers will result in the proliferation of commerce and forex wars, creating volatility.

3) A digital economic system, synthetic intelligence, and automation will remodel companies, investments, and society in new and fully chaotic methods.

It’s eerie to listen to BlackRock speaking like this.

It appears extra like an Alex Jones rant.

However that is why BlackRock is extra highly effective than Vanguard

They’ve woken up and smelled the espresso. They know the place the world is heading subsequent.

Watch Our Full Video BlackRock’s Secret Crypto Agenda EXPOSED

EXPLORE: Best RWA Projects to Buy in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit The Secret BlackRock Crypto Agenda EXPOSED – What We Know appeared first on 99Bitcoins.

[ad_2]

Source link