[ad_1]

Donald Trump’s choose of Cantor Fitzgerald CEO Howard Lutnick for Secretary of Commerce has despatched ripples by way of monetary circles, particularly amongst crypto fans – with many questioning Howard Lutnick’s Bitcoin impression and Howard Lutnick’s crypto coverage affect.

Lutnick is a vocal supporter of digital property. He personally owns Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

and Tether, and his firm not too long ago held a convention at which Michael Saylor spoke. Saylor mentioned the Trump/Vance win and the concept of a Bitcoin strategic reserve.

Robert F. Kennedy Jr., Bitcoin advocate Anthony Pompliano, and crypto entrepreneur Gary Vee all voiced assist for Lutnick.

What Howard Lutnick Means For Bitcoin

Howard Lutnick just isn’t your typical Wall Road government. Main Cantor Fitzgerald, he’s been forward of the curve on crypto, specializing in Bitcoin and Tether. Underneath Lutnick since 2021, the agency’s been steering Tether’s US Treasury and bond portfolios, proving his push to merge digital cash with old-school finance.

In a latest assertion, he reaffirmed his perception in Bitcoin’s potential, emphasizing, “Bitcoin isn’t simply an American factor. It’s a world phenomenon.”

So what is going to a Howard Lutnick-led Division of Commerce appear to be for Bitcoin and crypto property?

Let’s begin with the loopy theories first.

Bear in mind we don’t know precisely, and we’re considering out loud. It’s attainable that Lutnick may assist Michael Saylor’s concept of the US authorities utilizing Bitcoin to sort out the debt disaster.

Absent that, Lutnick has additionally talked concerning the US promoting land rights to sort out the debt; for the reason that federal authorities owns a lot land, it does nothing with it.

Lutnick additionally means the US will get extra critical about rising US greenback hegemony by way of stablecoin utilization overseas. Protecting the greenback sturdy relative to different fiat currencies could be essential to the US, in addition to shopping for and holding bitcoin.

At minimal, nonetheless, we would see extra Bitcoiners get into positions of energy, which suggests the state is neutralized as a menace, a minimum of within the quick to medium time period.

The federal government has all the time been bitcoin’s “ultimate boss,” and it looks as if it may win that ultimate battle through the Trump administration.

Lutnick’s perception in Bitcoin’s potential to drive market growth will information his actions within the Trump administration.

The bull case in all that is nothing lower than Bitcoin unlocking the timeline of infinite simple profitable and upside. Shitcoins might not stand an opportunity of retaining tempo.

When Will Altcoin Season Rip?

We all know what Lutnick will do for Bitcoin, however what about altcoins? The Bull runs right here, however these altcoin baggage are napping.

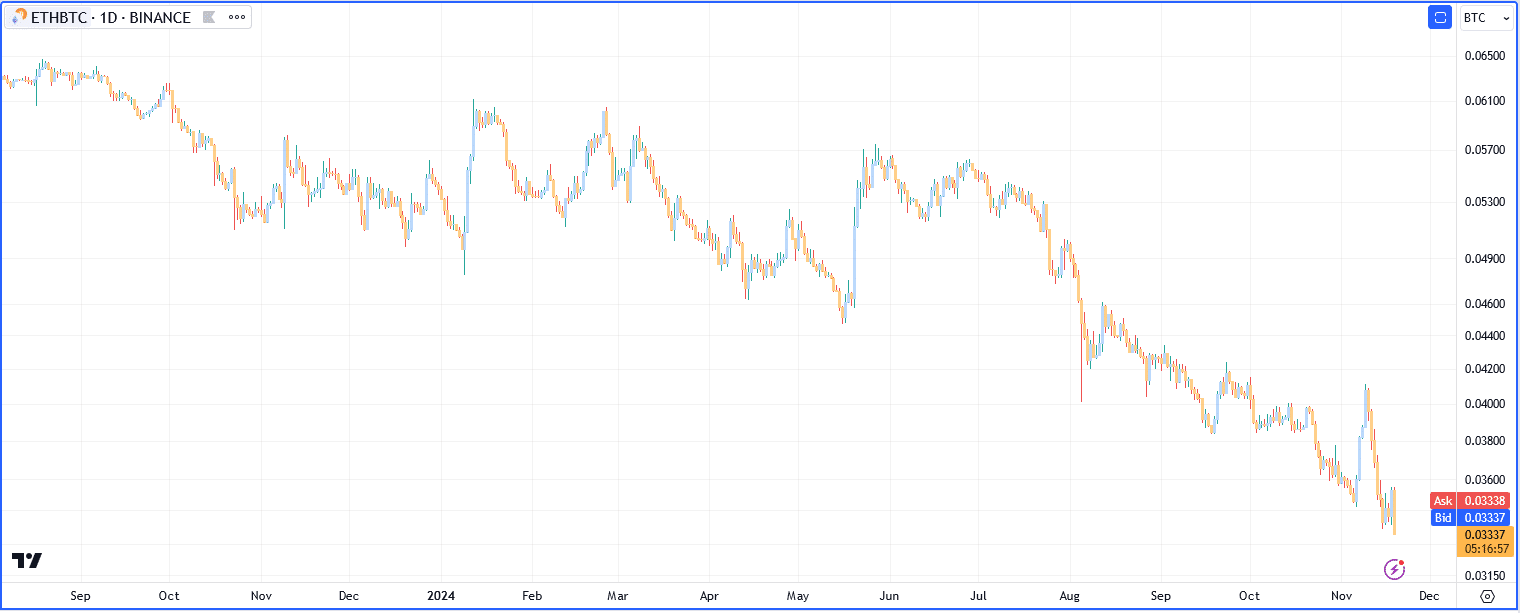

The fast information is grim. One other day, one other new ETH/BTC low.

We haven’t had an alt season since 2021, not even a mini one. When is Bitcoin’s dominance going to drop?

The bear case for alts is that many of the cash coming into Bitcoin is from ETFs now, and that cash can’t simply circulation to alts. Do you suppose JP Morgan will promote its Bitcoin as soon as it peaks to purchase Pepe? LOL. Zoom out on the month-to-month charts. Dominance has been rising nonstop since April 2022.

Our bull case at 99Bitcoins is that alt season will solely occur after Bitcoin maximizes its positive aspects.

For now, due to folks like Howard Lutnick, who’s BTC Über Alles, we received’t see a real alt season till 2025. Till then!

EXPLORE: US Bitcoin Reserve: World On Precipice of BTC Arms Race

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This text is offered for informational functions and doesn’t represent funding recommendation. You may lose all your capital.

The submit Trump Tips Howard Lutnick For Commerce Secretary: What Will It Mean For Bitcoin? appeared first on .

[ad_2]

Source link