[ad_1]

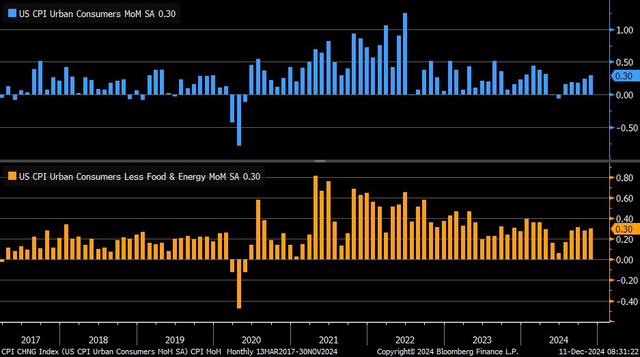

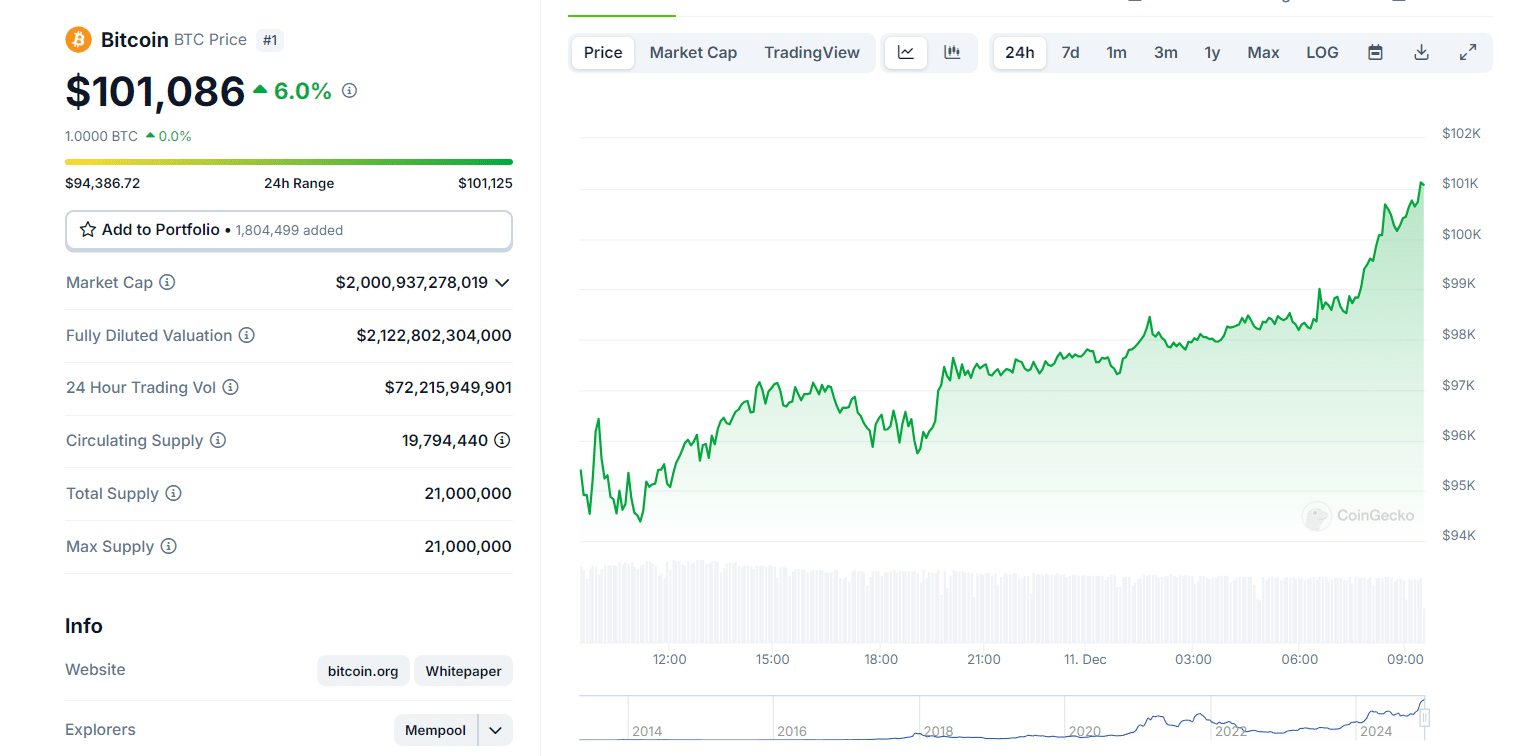

In the present day’s US Inflation report revealed that the Client Value Index (CPI) knowledge landed proper on the right track, displaying a 2.7% year-over-year improve and three.3% for Core CPI, fuelling Bitcoin worth again above $100K.

When inflation numbers match expectations, markets typically react favorably—crypto included. Off the information, BTC

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

rapidly broke $101,000, and an altcoin rally adopted go well with.

Inflation Report In the present day and Bitcoin Value Stability

Bitcoin’s repute as an inflation hedge retains it tethered to the ebb and circulate of financial knowledge. When costs soar, it turns into the go-to hedge. However when CPI cools, it doesn’t flinch both—decrease inflation is usually a sign the Fed may ease charges, and that optimism tends to ripple by way of BTC’s worth charts.

For November, CPI rose by 0.2% month-to-month, matching the October improve. Market forecasts held true, signaling that the Federal Reserve’s efforts to tame inflation may succeed. Bitcoin recovered 6% from the information.

What’s The Federal Reserve’s Subsequent Transfer?

The timing of the CPI knowledge couldn’t be sharper. With a quarter-point charge minimize wanting like a lock for the Fed’s subsequent assembly, all eyes are on the numbers. A strong November jobs report—227,000 positions added—has solely piled extra weight on the size for looser financial coverage.

Secure inflation numbers scale back the probability of surprising coverage modifications like aggressive charge hikes, which is mostly bullish for threat belongings, together with Bitcoin. Since tighter financial coverage usually restricts liquidity, markets interpret secure charges as a inexperienced flag for development investments like cryptocurrencies.

Bitcoin has proven outstanding resilience following its dip beneath $94,000 earlier this month.

This sentiment is pivotal in December, a traditionally unstable month. A mix of favorable CPI knowledge, a probable charge minimize, and regular financial development suggests BTC may keep its upward trajectory by way of the tip of the yr.

BREAKING:

*FED FUNDS FUTURES 25BPS DECEMBER RATE CUT ODDS RISE TO 97% AFTER CPI REPORT$SPY $QQQ

pic.twitter.com/PBrPHvoDg4

— Investing.com (@Investingcom) December 11, 2024

EXPLORE: 20 New Crypto Coins to Invest in 2024

Broader Market Implications From The Inflation Report In the present day

After the CPI outcomes have been introduced, monetary markets rebounded, with the S&P 500, Dow Jones, and Nasdaq all rebounding. Excessive company earnings from sure sectors, like expertise, defined pockets of development, whereas rising Treasury yields created some drag.

For cryptocurrencies, nevertheless, the story has an excellent larger affect. Secure inflation charges and potential financial coverage easing protect the liquidity surroundings obligatory for risk-on belongings to thrive. Bitcoin and the remainder of the crypto market may see a continued elevate from present macro developments.

All eyes are on the Fed’s December 17-18 assembly, the following key second that would shift the taking part in area for buyers. A confirmed charge minimize may additional solidify Bitcoin’s standing by making threat belongings extra enticing relative to bonds or money.

In the meantime, buyers ought to proceed monitoring month-to-month CPI updates as they continue to be a key affect on general market sentiment.

EXPLORE: Crypto to Hollywood: ‘Crypto Man’ and Streaming Giants HBO and Netflix Are Embracing Crypto Culture

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish US Inflation Data Hits 2.7%: Triggers Violent Bitcoin Price Pump Back Above $100K appeared first on 99Bitcoins.

[ad_2]

Source link