[ad_1]

Cryptocurrencies are identified for his or her volatility and may fluctuate quickly in worth. This makes it difficult to make use of them as a retailer of worth or a medium of change. Stablecoins have been created to resolve this drawback by providing worth stability. They’re digital currencies which are pegged to steady belongings like fiat currencies, treasured metals, or commodities. USDC and USDT stablecoins are the most well-liked representatives of such a digital belongings on the crypto market, however what precisely are they, and the way do they evaluate? The comparability between USDC vs USDT provides perception into their distinctive traits and the way they perform throughout the crypto trade.

Key Takeaways

- USDT has a better market capitalization and considerably bigger buying and selling quantity than USDC, making it the popular selection for merchants.

- USDC is thought for its transparency: common audits and clear compliance with regulatory requirements just like the SEC and MiCA contribute to its popularity.

- USDT’s backing consists of numerous belongings like U.S. Treasury Payments, however the stablecoin has confronted criticism for historic opacity and regulatory challenges.

- USDC advantages from a simple reserve construction, primarily backed by money and U.S. Treasuries, making certain transparency.

- USDT is extra battle-tested and broadly adopted, whereas USDC stands out for its stronger compliance and transparency.

What are Fiat-Backed Stablecoins?

Fiat-backed stablecoins are the commonest kind of stablecoins. They’re backed by fiat forex reserves held in a checking account. The quantity of underlying fiat forex held in reserves must be equal to the variety of stablecoins in circulation in order that the stablecoin is totally collateralized. If the stablecoin is pegged to the US greenback, then it’s known as a USD stablecoin.

Benefits of Stablecoins

Stablecoins provide a number of advantages, together with their regular worth, clear transparency, and excessive effectivity. A majority of these cryptocurrency are versatile, serving as a dependable retailer of worth, an efficient medium of change, or a constant unit of account. They’re significantly helpful for cross-border funds, small-scale transactions, and remittances. Notably, USDT and USDC stablecoins stand out for facilitating low-cost, quick interactions and enabling customers to accrue curiosity via decentralized finance protocols.

Compared to conventional finance, stablecoins have a number of distinct benefits. Their decentralized framework permits for fast, low-fee world transfers, circumventing the necessity for standard monetary intermediaries like banks. This facet is particularly interesting because it aligns with the growing demand for stablecoins on major exchanges. Moreover, stablecoins provide enhanced safety as an funding possibility, because of their basis in blockchain technology, which ensures tamper-proof transaction information and safeguards consumer funds. Moreover, many stablecoins adhere to regulatory compliance requirements and endure periodic audits, including an additional layer of belief and reliability for customers.

Why are there so many USD stablecoins?

The US greenback is the dominant world forex, and many individuals and companies world wide use it for commerce and commerce. USD stablecoins permit individuals to transact in USD with out a conventional checking account. Moreover, they supply an environment friendly method to transfer cash throughout borders, bypassing the charges and delays related to conventional remittance providers.

Stablecoins facilitate straightforward transfers and storage of worth for customers throughout cryptocurrency platforms, offering a secure possibility in comparison with the worth volatility of such digital belongings as Bitcoin and Ethereum.

What elements make a stablecoin secure?

The security of a stablecoin depends on a number of elements, together with its reserve belongings, the extent of transparency offered by the issuer, and the regulatory framework inside which it operates. A stablecoin backed by a big reserve of a trusted fiat forex and audited by a good third occasion is taken into account safer than a stablecoin backed by an unknown asset or an unaudited reserve.

MiCA’s Impression on Stablecoin Security

The EU’s Markets in Crypto-Property (MiCA) regulation is designed to supply a complete framework for cryptocurrency and stablecoin regulation throughout Europe. It mandates stablecoin issuers to acquire e-money licenses and cling to transparency and reserve necessities. MiCA ensures that solely compliant stablecoins with audited reserves and correct authorization are granted the suitable to function within the EU. This might profit USDC, which already follows strict regulatory protocols, whereas USDT may face larger challenges on account of its historic lack of transparency.

What Is Tether (USDT)?

Tether (USDT) is the oldest and hottest USD stablecoin that was launched in 2014 with the objective of making a bridge between cryptocurrencies and conventional fiat currencies. It’s pegged to the US greenback and backed by a reserve of fiat forex and different belongings. Tether is essentially the most broadly used stablecoin, with a market capitalization of over $70 billion.

You may be taught extra about Tether tokens in this article.

USDT Stability

In 2017, Tether was hacked, and 31 million USDT tokens have been misplaced. The venture bought criticized as many identified that as a substitute of taking duty and demonstrating accountability, they initiated an “emergency arduous fork” to save lots of face.

In 2017, Tether was hacked, and 31 million USDT was misplaced. As an alternative of taking duty and demonstrating accountability, they initiated an “emergency arduous fork” to save lots of face. This caught the eye of the New York Legal professional Normal when it was found that Tether was lending out its money reserves with out with the ability to adequately again their tokens with USD. They tried to absolve themselves of duty by antagonizing the Legal professional Normal as a substitute of offering a rational protection.

USDT Quantity

In response to CoinMarketCap, the present market capitalization of USDT is round $111 billion, and it’s the most generally used stablecoin on the earth. This makes Tether the third crypto asset by market capitalization, solely surpassed by Bitcoin and Ethereum.

Prompt article: What is volume in cryptocurrency?

What Is a USD Coin (USDC)?

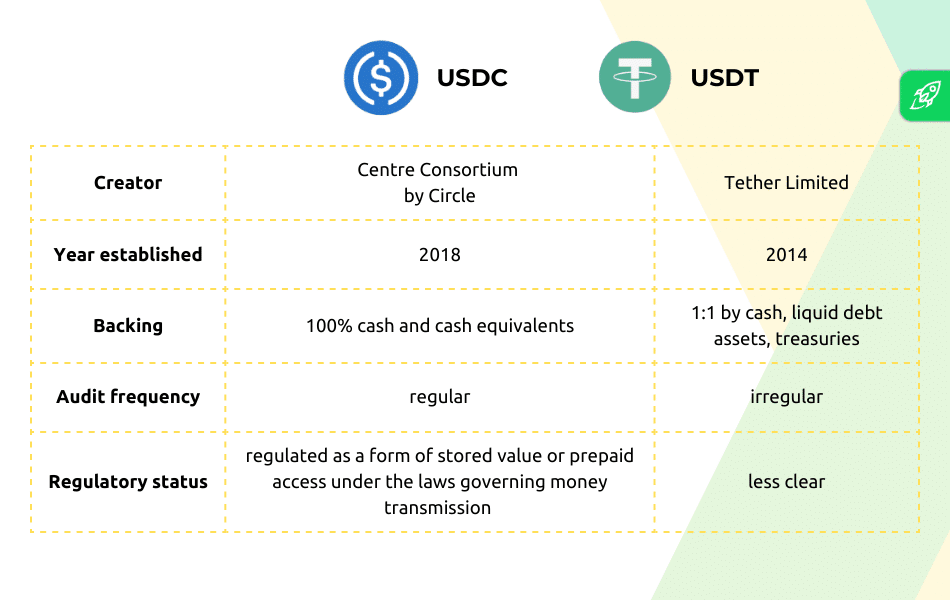

USDC, or USD Coin, takes second place within the record of the most well-liked stablecoins. It was launched in 2018 by Circle, a fintech firm primarily based in Boston.

The Centre consortium, which incorporates Circle and Coinbase, points and manages USDC. Centre is the one entity that may management USDC provide, just like the Federal Reserve controlling USD. Nevertheless, there’s a main distinction between USD and USDC — Circle has full authority over USDC, which isn’t the case with USD and the FR.

USDC Stability

USDC Stability is taken into account to be extra clear than USDT as a result of Circle offers month-to-month audits of its reserve belongings. Moreover, USDC is regulated by the US Securities and Alternate Fee (SEC).

In March 2023, Circle reported that $3.3 billion of the money reserves backing USDC tokens remained in Silicon Valley Financial institution, inflicting it to depeg and drop in worth in opposition to the greenback to 87 cents. As well as, related dollar-backed stablecoins similar to DAI and USDD have been depegged from their unique worth of $1. Nevertheless, it solely took USDC 2 days to return its peg.

USDC Market Capitalization

In response to CoinMarketCap, the present market capitalization of USDC is over $34 billion, and it’s the second most generally used stablecoin on the earth after USDT.

Tether vs USDC: Comparative Evaluation

An evaluation of the variations between Tether and USD Coin will be useful. Each are stablecoins, although they’ve some completely different key options and may every be examined earlier than investing. Let’s begin with the similarities they share.

They’re each stablecoins

USDC and Tether are nearly indistinguishable, differing in market cap. Each Tether and USD Coin are stablecoins, which means they’ve a set worth that’s pegged to the US greenback. This makes them much less risky than different different crypto belongings, to allow them to function a retailer of worth or a medium of change. Nevertheless, they can’t be handled as good substitutes for the US greenback because it’s not possible to deposit them right into a checking account or use them for funds.

One-to-one (1:1) worth ratio with USD

Each Tether and USD Coin preserve a one-to-one (1:1) worth ratio with the US greenback. Which means that for each USDT or USDC token issued, there’s a corresponding US greenback held in reserves.

Blockchain variation

Each Tether and USDC stablecoin had operated solely on the Ethereum blockchain, however gained illustration on a number of blockchains since then, which permits for fast transferral and low transaction charges.

Blockchain transparency

Each Tether and USD Coin present transparency by way of their blockchain transactions. This permits customers to trace their transactions and be certain that they’re getting what they paid for.

Speedy transferral

Each Tether and USD Coin will be transferred shortly and simply, which makes them very best for peer-to-peer transactions and remittances.

USD Coin vs Tether: What are the Key Variations?

Tether (USDT) and USD Coin (USDC) are two of the most well-liked stablecoins within the cryptocurrency house. Whereas each stablecoins share some similarities, there are additionally some key variations between them:

Launch date

Tether was launched in 2014, whereas USD Coin was launched in 2018. Which means that Tether has been round longer and has had extra time to ascertain itself out there.

Reserve Property

Each Tether and USD Coin are backed by a reserve of belongings, similar to fiat forex and different monetary devices. Nevertheless, considerations have arisen relating to the steadiness and transparency of Tether’s reserves, as the corporate has confronted accusations of utilizing unbacked reserves to help the worth of its stablecoin.

As of 2024, Tether (USDT) is primarily backed by U.S. Treasury Payments and different belongings. In response to Blockworks, roughly 58% of Tether’s reserves are held in U.S. Treasuries, with the remaining reserves consisting of money and money equivalents (about 9%), secured loans (round 9%), and numerous different investments, together with crypto holdings, company bonds, funds, and treasured metals. This numerous backing has drawn scrutiny and requires larger transparency and regulation.

In distinction, USD Coin (USDC) is backed by a extra easy reserve coverage, primarily consisting of money and short-term U.S. Treasuries. Round 75.6% of USDC’s reserves are held in U.S. Treasuries, whereas 24.4% stay in money at regulated monetary establishments. Circle, the issuer of USDC, ensures compliance with monetary laws by holding these reserves with regulated monetary establishments.

Circle has earned public belief by sustaining a optimistic popularity and offering detailed disclosures about its reserve belongings, whereas Tether continues to face controversy on account of perceived opacity and unregulated centralization. Tether’s lack of transparency has been highlighted by its omissions relating to the particular composition of USDT’s backing, contrasting sharply with Circle’s dedication to regulatory compliance and openness.

MiCA Compliance: USDT vs. USDC

Below MiCA, stablecoin issuers should get hold of e-money licenses to function throughout the EU. This regulatory framework might closely impression Tether (USDT) because it faces challenges in sustaining market entry on account of considerations over transparency and reserve administration. However, USDC, with its established compliance protocols and common audits, is best positioned to fulfill MiCA’s strict requirements. Because of this, European exchanges might prioritize USDC over USDT, affecting liquidity and market share within the area.

Commerce/liquidity quantity

Tether (USDT) constantly maintains a better market capitalization and bigger buying and selling quantity in comparison with USD Coin (USDC). In response to CoinMarketCap, USDT’s each day buying and selling quantity is roughly $50 billion, considerably overshadowing USDC’s $5 billion in each day transactions—roughly ten instances extra. This substantial distinction in liquidity and buying and selling quantity makes Tether a extra in style stablecoin amongst merchants and buyers, because it provides larger availability and market exercise.

Grow to be the neatest crypto fanatic within the room

Get the highest 50 crypto definitions you’ll want to know within the trade free of charge

USDC vs USDT: Concluding Ideas

Stablecoins are important to the crypto ecosystem, as they’re blockchain-based tokens with a steady worth linked to fiat forex. Steady tokens guarantee customers can conveniently switch and maintain worth throughout numerous crypto platforms with out the publicity to cost fluctuations widespread in digital belongings similar to Bitcoin and Ethereum. USDT, USDC, and BUSD (Binance USD) kind the majority of the stablecoin sector’s market cap, making them very best selections for buyers seeking to turn into a part of the stablecoin market.

Total, whereas each Tether and USD Coin are stablecoins designed to take care of a 1:1 worth ratio with the US greenback, there are some key variations between the 2. Tether has an extended historical past and a bigger buying and selling quantity, however it has confronted some controversy over the steadiness of its reserve belongings. USD Coin, however, has been extra clear about its reserve belongings. But, it has a smaller buying and selling quantity. Finally, the selection between Tether and USD Coin will depend upon the person wants and preferences of the consumer.

USDT vs USDC: FAQ

Is USDT totally backed?

Tether (USDT) claims that it’s totally backed by reserves, and up to date experiences counsel that its reserves are even over-collateralized. As of mid-2024, Tether has acknowledged that it holds $118.4 billion in reserves, surpassing the quantity of USDT in circulation, which is about $113 billion. This consists of a mixture of money, U.S. Treasury payments, and different belongings, offering a cushion past the 1:1 peg required for full backing.

Is Bitcoin a stablecoin?

No, Bitcoin isn’t a stablecoin. Not like stablecoins, that are designed to take care of a set worth, Bitcoin’s worth is very risky and may fluctuate considerably primarily based on market demand and different elements.

Is USDT equal to USDC?

Sure, USDT (Tether) and USDC (USD Coin) are each pegged to the U.S. greenback, and, due to this fact, equal in worth. They’re designed to supply stability within the face of market volatility, providing a constant worth of 1 greenback per coin.

Which stablecoin is greatest?

Deciding between USDT and USDC is difficult: each have their advantages and downsides and luxuriate in sturdy reputations and widespread recognition. To be taught extra about how these stablecoins evaluate to others, take a look at our article on the 5 greatest stablecoins here.

Is Usdt and USDC the identical?

No, they’re two completely different belongings. Each USDT (Tether) and USDC (USD Coin) are in style selections within the crypto group, serving as fiat-collateralized stablecoins throughout the cryptocurrency ecosystem. Regardless of their variations, these two sorts of cryptocurrency share the widespread objective of providing a steady, digital forex pegged to the US Greenback.

What’s the distinction between USDT and USDC?

USDT (Tether) and USDC (USD Coin) are each stablecoins designed to stay valued at $1. They differ in a number of elements: issuer, transparency, regulation, adoption, and blockchains they run on. USDT is issued by Tether Restricted, whereas USDC is launched by Centre Consortium. USDC complies with US anti-money laundering and know-your-customer laws and is topic to regulatory scrutiny. In the meantime, Tether Restricted has encountered authorized points and has been the main target of investigations by the New York Legal professional Normal. Nevertheless, USDC is much less adopted than USDT.

Is USDT higher than USDC?

There is no such thing as a easy reply to this query. When selecting between USDT and USDC, you will need to perceive the variations between the 2. USDT is extra established, whereas USDC is rising in recognition for its compliance and transparency. Finally, the selection of essentially the most appropriate stablecoin is dependent upon particular person preferences and necessities.

What’s the draw back of USDC?

USDC, like different stablecoins, faces widespread drawbacks similar to centralization dangers on account of its administration by a single entity, Circle, and regulatory dangers linked to the evolving monetary regulation panorama. It additionally carries counterparty dangers, counting on the trustworthiness of Circle and its banking companions. As well as, USDC is tied to the standard monetary system, inheriting its vulnerabilities, and is topic to good contract dangers inherent in blockchain know-how. Whereas providing stability, it lacks the excessive return potential of extra risky cryptocurrencies, presenting a restricted use case primarily as a steady medium of change or retailer of worth.

Seeking to purchase stablecoins like USDT or USDC? Think about using Changelly, a good cryptocurrency change that lets you purchase and promote all kinds of cryptocurrencies with ease. With Changelly, you possibly can shortly and securely buy stablecoins utilizing your credit score or debit card with out difficult verification processes. Moreover, Changelly provides aggressive charges and a user-friendly interface, making it an awesome selection for each rookies and skilled merchants. Begin shopping for stablecoins at the moment on Changelly!

Is USDC Nonetheless Protected?

Some buyers take into account USDC a safer stablecoin than USDT, as it’s extra clear and regulatory-compliant. Its common audits and real-time experiences on reserves present assurance that the token is backed by precise belongings. Conversely, USDT has been met with scrutiny on account of doubts surrounding its reserve backing and transparency.

What’s the distinction between USD and USDT?

USD (United States Greenback) is the fiat forex issued by the Federal Reserve Financial institution in the USA. USD is a bodily forex within the type of paper cash and cash, backed by the US authorities and used as a medium of change for items and providers.

USDT (Tether) is a digital, blockchain-operated stablecoin created to stay pegged to the US greenback. It’s issued by Tether Restricted and supposedly backed by reserves consisting of an equal quantity of USD.

The important thing distinction between USD and USDT is that USD is a bodily forex that the US authorities points and backs, whereas USDT is a digital forex. As an alternative of the federal government, it’s backed by an equal quantity of USD that Tether Restricted holds in reserve. Moreover, whereas USDT intends to take care of a gradual worth of $1, the worth of USD is topic to market forces like inflation and rates of interest.

Disclaimer: Please be aware that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native laws earlier than committing to an funding.

[ad_2]

Source link