[ad_1]

This week, the monetary world and Bitcoin worth are bracing for a cascade of critical economic reports, together with the Federal Open Market Committee minutes (FOMC), alongside a high-stakes occasion throughout the cryptocurrency market.

From Federal Reserve deliberations to the expiration of billions in Bitcoin and Ethereum options, an ideal storm of things may amplify volatility within the days forward.

Federal Reserve FOMC Minutes Set the Tone for Threat Property Like Bitcoin Value

Wednesday, November 27, marks the discharge of the Federal Reserve’s November assembly minutes—a date that holds Wall Street’s collective attention. Traders will comb via, in search of any shifts in technique, like rethinking the two% inflation benchmark or easing up on charges. Any lean towards financial loosening may jolt danger property to life, and crypto gained’t miss the get together.

“The Fed’s coverage path in these unsure instances may decide the trajectory of world monetary markets,” stated monetary analyst Mark Brown.

https://twitter.com/financefelix/standing/1861055149432545449

Inflation takes middle stage on Wednesday, November 27, as the PCE price index—the Fed’s go-to metric—will drop for buyers to view. Most forecasts put it at a modest 0.2% month-over-month and a couple of.3% year-over-year.

Stripping out meals and power, core PCE inflation may hit 2.8%, hinting at mounting financial pressure. Including weight to the day, Q3 2024 GDP revisions are set to offer a sharper learn on financial efficiency.

Additionally on the calendar is the revision of U.S. GDP figures for Q3 2024, which is able to present a recent lens into the nation’s financial well being. Irrespective of how the info lands—above or beneath projections—its shockwaves will ripple via the markets, shaking up the whole lot from blue chips to meme cash.

DON’T MISS: Best New Cryptocurrencies to Invest in 2024

Merchants Put together for Volatility with $10 Billion in Bitcoin and Ethereum Choices Expiring

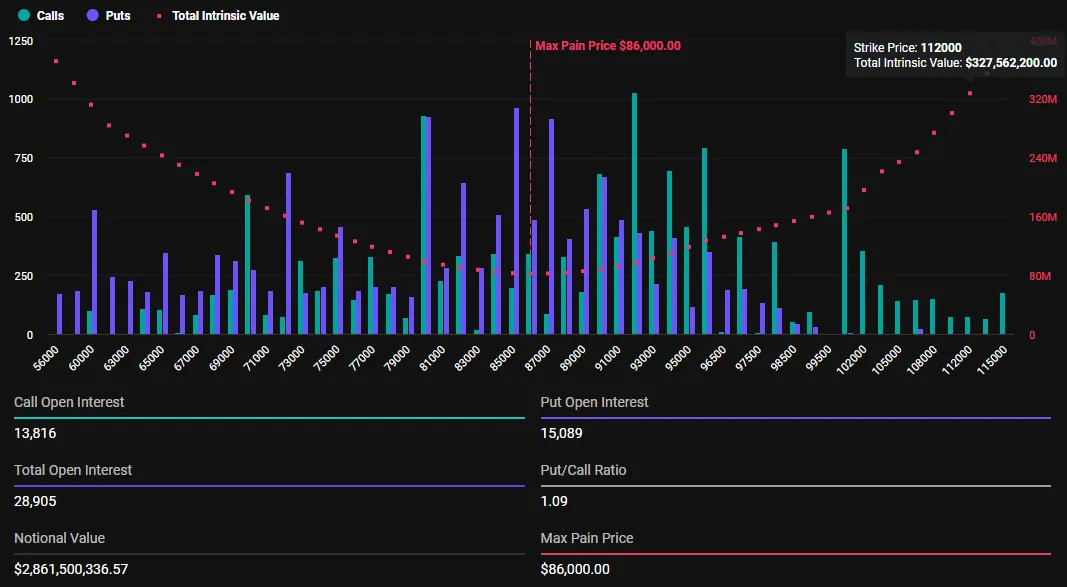

One other layer of pressure is that on November 29, $10 billion price of crypto choices hit their expiration dates, creating an electrical cost out there. Bitcoin leads the motion, with $9.1 billion tied up and a put/name ratio of 0.80, whereas Ethereum’s $1.24 billion wagers replicate a 0.77 ratio.

The max ache ranges—$77,000 for Bitcoin and $2,800 for Ethereum—are a battleground of diverging predictions, setting merchants on edge.

Mega choices expirations like these usually spawn short-lived market chaos as merchants scramble to reposition. “Pullbacks could come,” veteran dealer Peter Brandt remarked, “however the long-term bull run for crypto stands agency.”

Crypto Faces a Essential Intersection

The query stays whether or not cryptocurrencies will climate this twin problem with resilience or see intensified volatility that checks investor confidence. For now, all eyes are on this action-packed week that might redefine short-term narratives throughout each conventional and digital monetary landscapes.

Whether or not you’re a crypto fanatic or an financial observer, this week guarantees to ship key insights—and the potential for dramatic market shifts. Buckle up as a result of volatility is knocking on the door.

EXPLORE: 20 New Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up What Does FOMC Minutes Tomorrow Mean For Bitcoin Price and Crypto Bull run? appeared first on .

[ad_2]

Source link