[ad_1]

Crypto buying and selling could be a powerful activity. Not solely will it’s important to face all of the challenges related to common buying and selling, additionally, you will need to battle the extra volatility current within the crypto market.

Reversal candlestick patterns are one of many principal instruments {that a} dealer can use. These patterns will help establish bullish and bearish reversals out there and discover worthwhile buying and selling alternatives.

Howdy! I’m Zifa, a seasoned crypto author with over three years within the subject. As we speak, I carry you an all-encompassing information on reversal candlestick patterns. We’ll discover what they’re and how one can leverage them in your buying and selling strategy.

Key Highlights

- Reversal candlestick patterns will help spot market shifts. Nevertheless, you need to double-check with different alerts like quantity to remain on observe.

- Bullish reversals recommend potential progress, however don’t neglect to set cease losses to handle your danger properly.

- Bearish reversals trace at value drops, so use instruments like RSI or help/resistance ranges to filter out false alerts.

- Begin with easy patterns like Doji and Engulfing to construct your confidence earlier than shifting on to extra advanced setups.

What Is a Reversal Candle Sample?

A reversal candlestick sample is a bullish or bearish reversal sample fashioned by a number of candles. One can use these sorts of patterns to establish a possible reversal in property’ costs.

Numerous candlestick reversal patterns exist, however not all of them are equally robust or dependable. Among the hottest ones embody the bullish engulfing sample, the bearish engulfing sample, the bullish harami sample, and the bearish harami sample.

Bullish vs. Bearish Reversal Candle Patterns

Reversal candlestick patterns may be both bullish or bearish. Bullish reversal patterns happen when the market is in a downtrend and varieties a bullish reversal sample. Bearish reversal patterns happen when the market is in an uptrend and varieties a bearish reversal sample.

Full Listing of All Reversal Candlestick Patterns: Cheat Sheet

Right here’s an entire listing of reversal candlestick patterns, together with each bullish and bearish reversals:

Bullish Reversal Candlestick Patterns

- Hammer

- Inverse Hammer

- Bullish Engulfing

- Piercing Line

- Morning Star

- Morning Doji Star

- Three White Troopers

- Dragonfly Doji

- Tweezer Bottoms

- Deserted Child Backside

- Bullish Harami

- Bullish Harami Cross

- Bullish Kicker

- Bullish Assembly Strains

- Three Inside Up

- Three Exterior Up

- Bullish Stick Sandwich

- Bullish Breakaway

- Bullish Belt Maintain

- Ladder Backside

Bearish Reversal Candlestick Patterns

- Hanging Man

- Capturing Star

- Bearish Engulfing

- Night Star

- Night Doji Star

- Three Black Crows

- Headstone Doji

- Darkish Cloud Cowl

- Tweezer Tops

- Deserted Child Prime

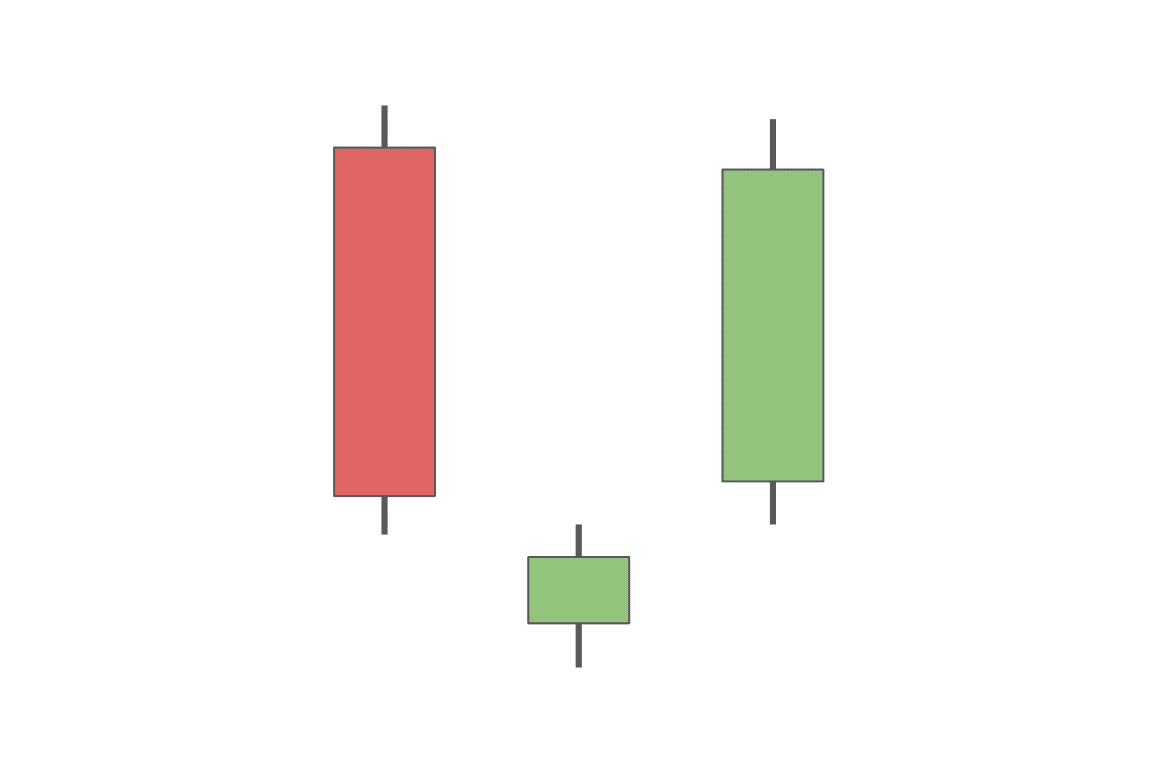

- Bearish Harami

- Bearish Harami Cross

- Bearish Kicker

- Bearish Assembly Strains

- Three Inside Down

- Three Exterior Down

- Bearish Stick Sandwich

- Bearish Breakaway

- Bearish Belt Maintain

- Upside Hole Two Crows

Every sample has its personal distinctive formation and implications. We’ll take a better take a look at the most well-liked patterns later on this article.

Learn additionally: Chart patterns cheat sheet.

Candlestick Efficiency

Candlestick reversal patterns are among the many strongest bullish and bearish reversal alerts out there. Due to their excessive accuracy, these patterns can be utilized to commerce each lengthy and quick positions.

With the intention to take advantage of candlestick reversal patterns, you need to use them along side indicators and complete market and technical evaluation. Don’t neglect that no sample or indicator is ever absolutely dependable per se.

Prime Bullish Reversal Candlestick Patterns

Though they could typically be unreliable, studying the best way to establish the highest bullish patterns that may sign reversal continues to be an immensely vital talent for any crypto dealer. Let’s overview a number of the mostly seen ones and be taught what they’ll imply.

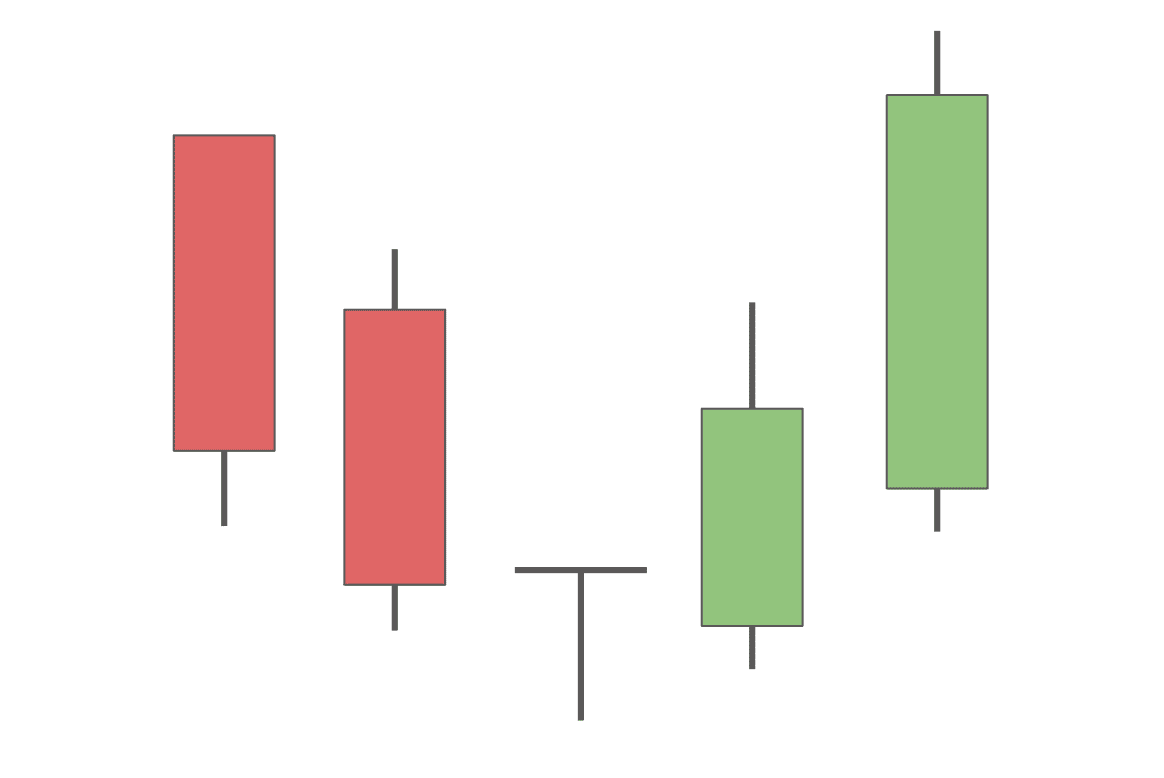

Three White Troopers

Three white troopers is among the most well-known three-candle reversal patterns. It’s fashioned by three candlesticks that every one have lengthy our bodies and the next shut than the earlier candle. Three white troopers all open inside the physique of the previous candle. Moreover, in addition they have quick wicks, which signifies comparatively low volatility and a powerful bullish pattern.

The three white troopers sample normally comes after a downtrend and confirms that bulls have taken over the market.

Dragonfly Doji

The dragonfly doji is a bullish reversal sample fashioned when the open, the excessive, and the shut are all equal or very shut to one another. It mainly has no physique. As a substitute, it has a extremely lengthy decrease wick however an virtually non-existent higher one.

This sample exhibits that though the asset’s worth briefly went down through the set time-frame because of promoting strain, it opened and closed at a excessive value. The dragonfly doji exhibits that the bulls presently have the higher hand out there, and we may even see a reversal from a bearish pattern to a bullish one fairly quickly.

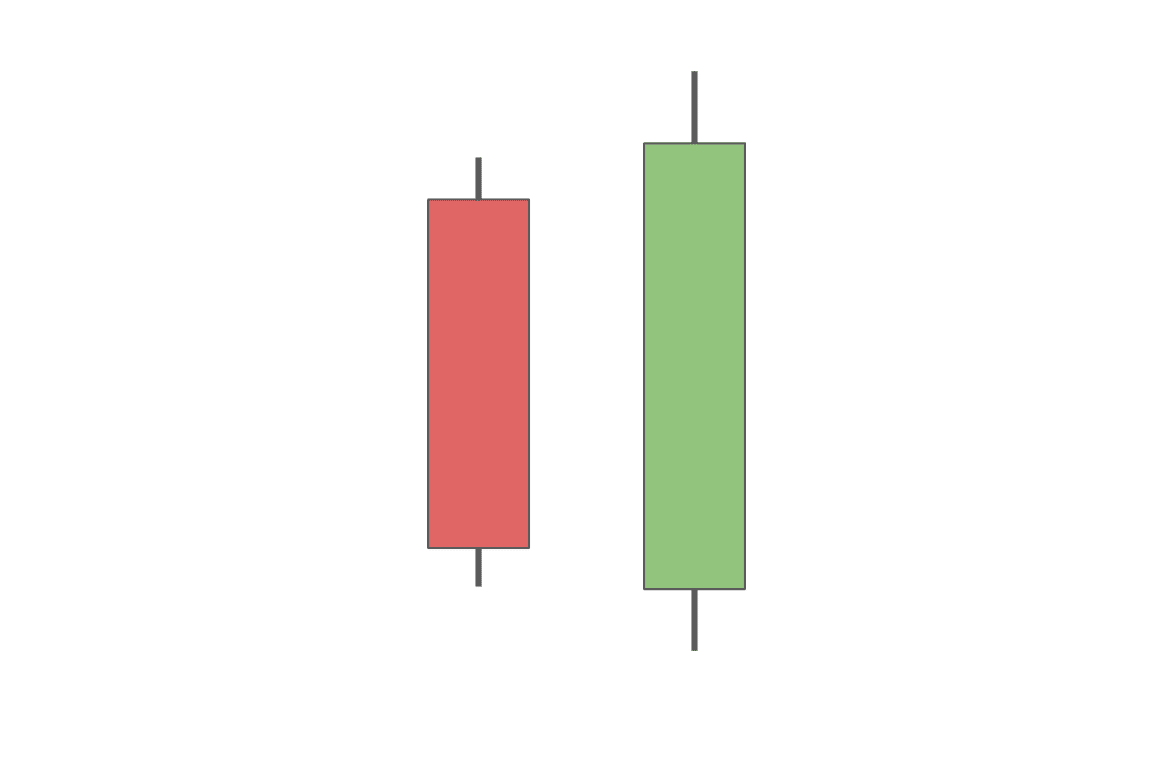

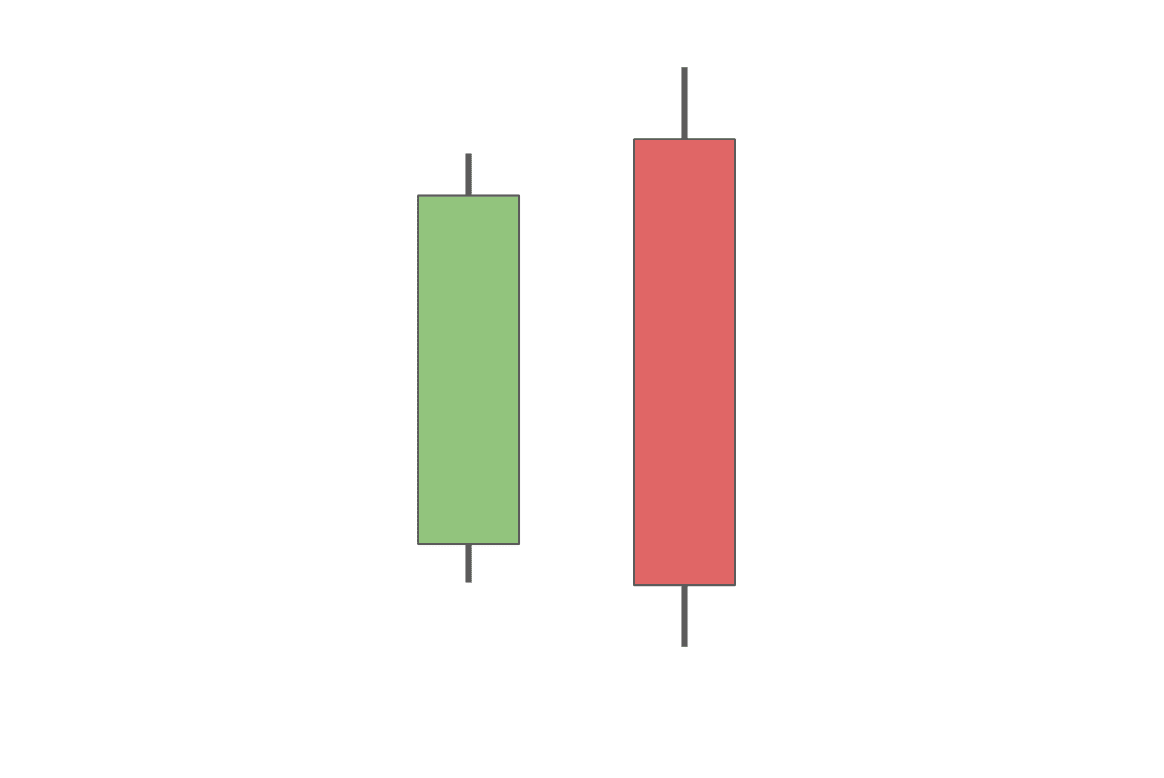

Bullish Engulfing

The bullish engulfing sample is a relatively easy sample fashioned by two candlesticks. The primary candlestick is bearish, and the second is bullish. Similar to the identify suggests, the second candle engulfs the physique of the primary one.

The engulfing is taken into account to be probably the most highly effective bullish reversal patterns because it exhibits that though the asset’s value touched a brand new low, it nonetheless managed to shut above the opening of the previous candle.

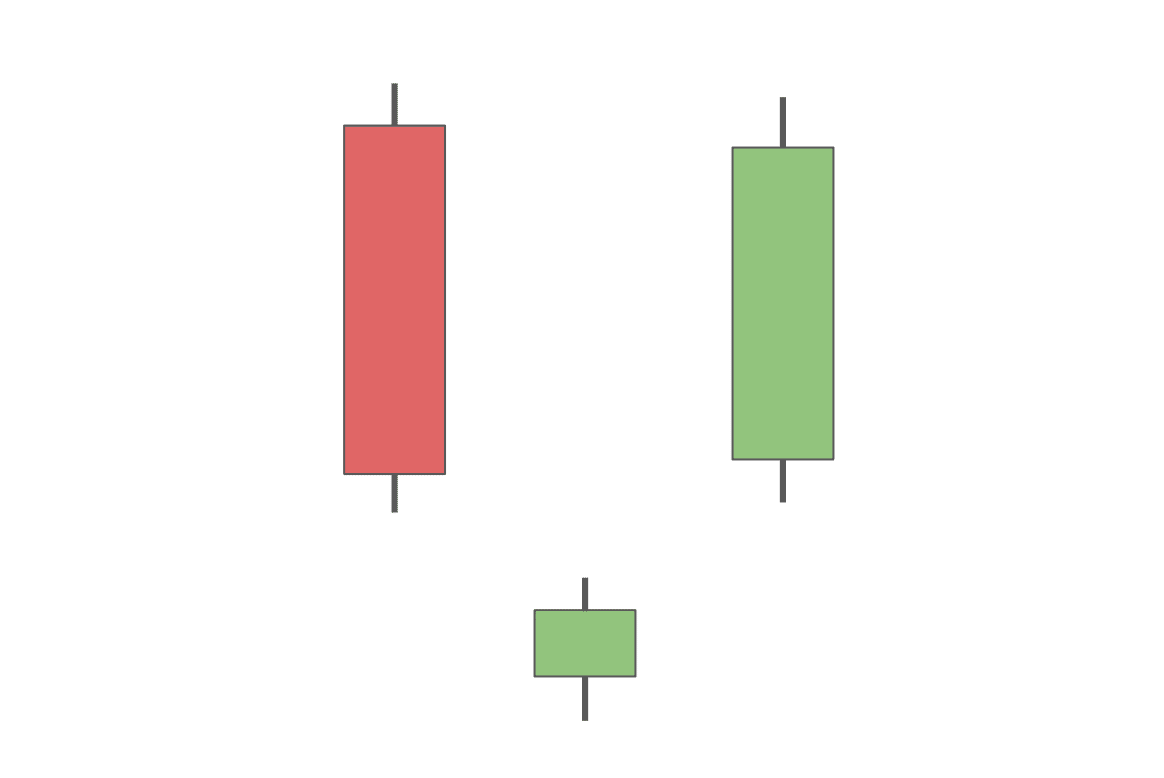

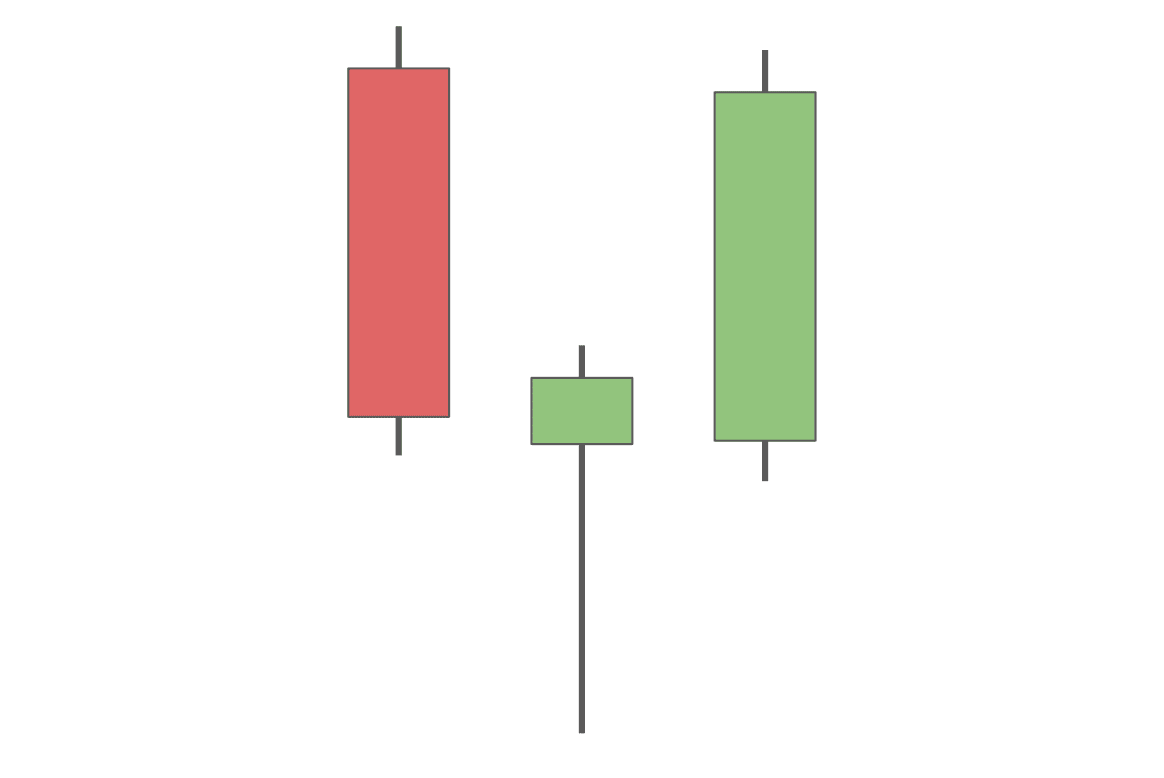

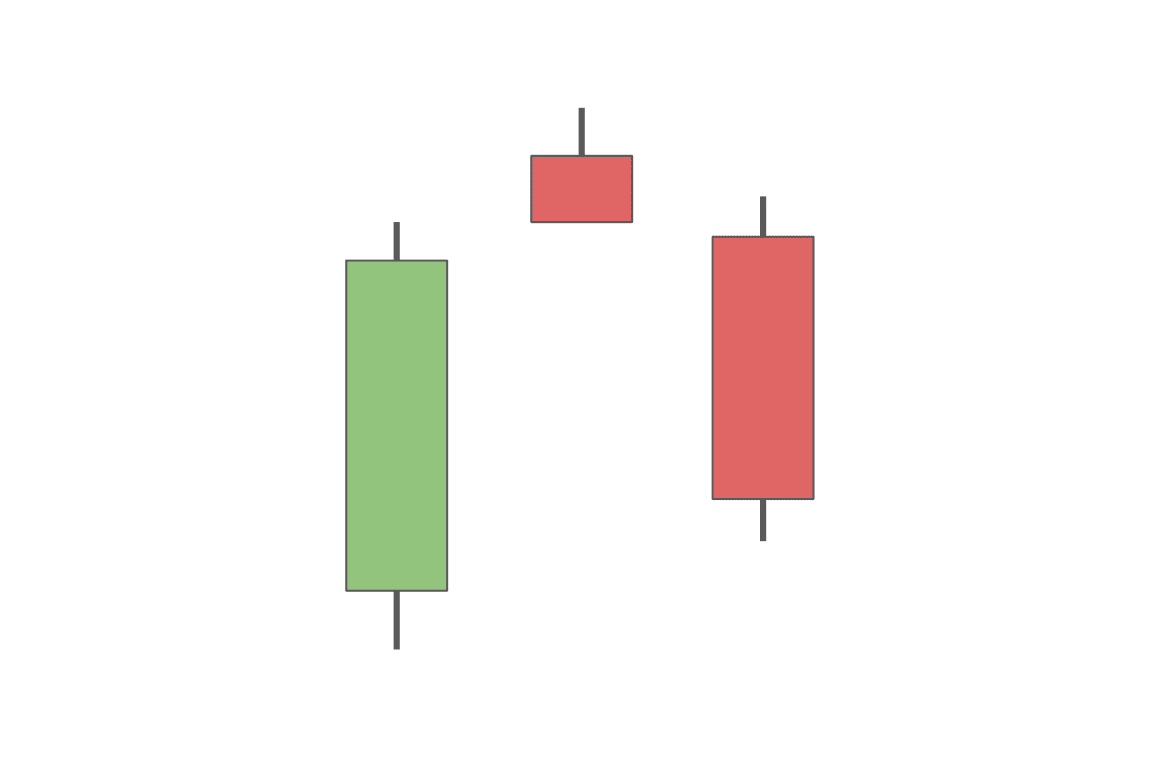

Bullish Deserted Child

The bullish deserted child is a bullish reversal sample that consists of three candlesticks: one bearish and two bullish ones. It’s actually much like the morning star however has one essential distinction. The deserted child — the second candle — is under the decrease wicks of each the primary and the third candlesticks within the sample. Generally, there may be a couple of “child” between the 2 massive candles.

The small second candle exhibits that the promoting strain has turn into weaker. Its distance from the opposite two candles alerts that promoting strain has presumably been exhausted.

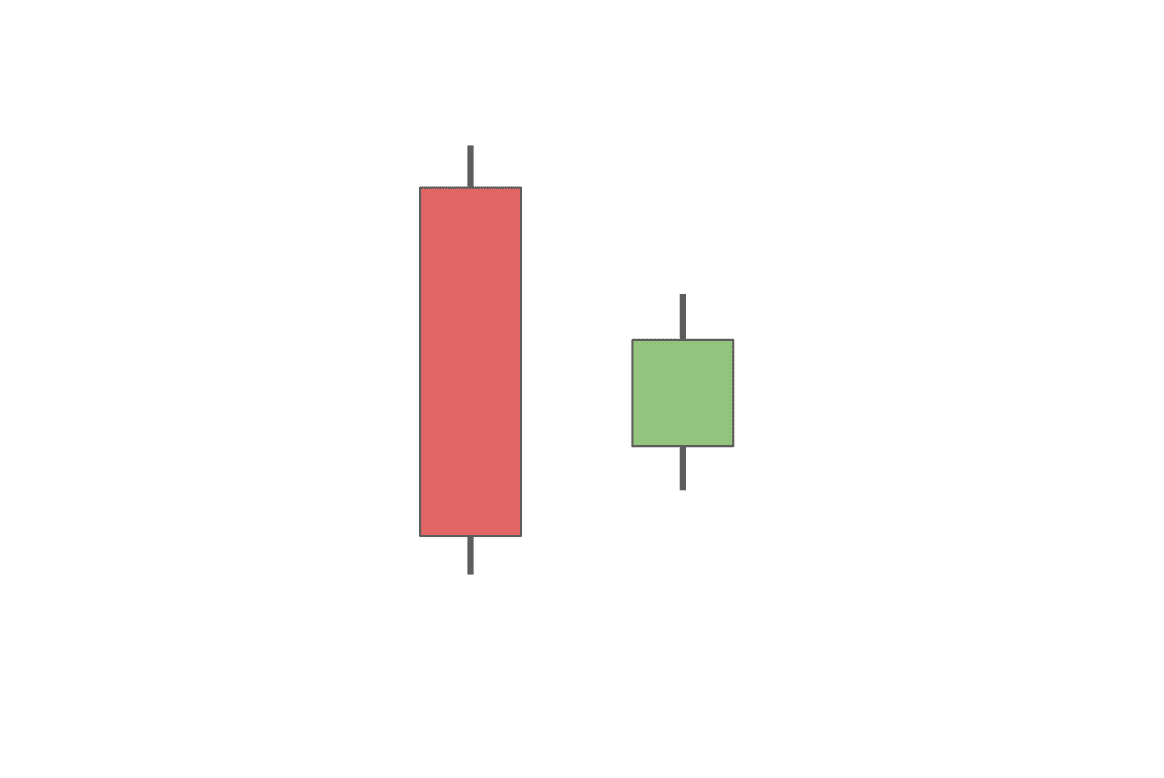

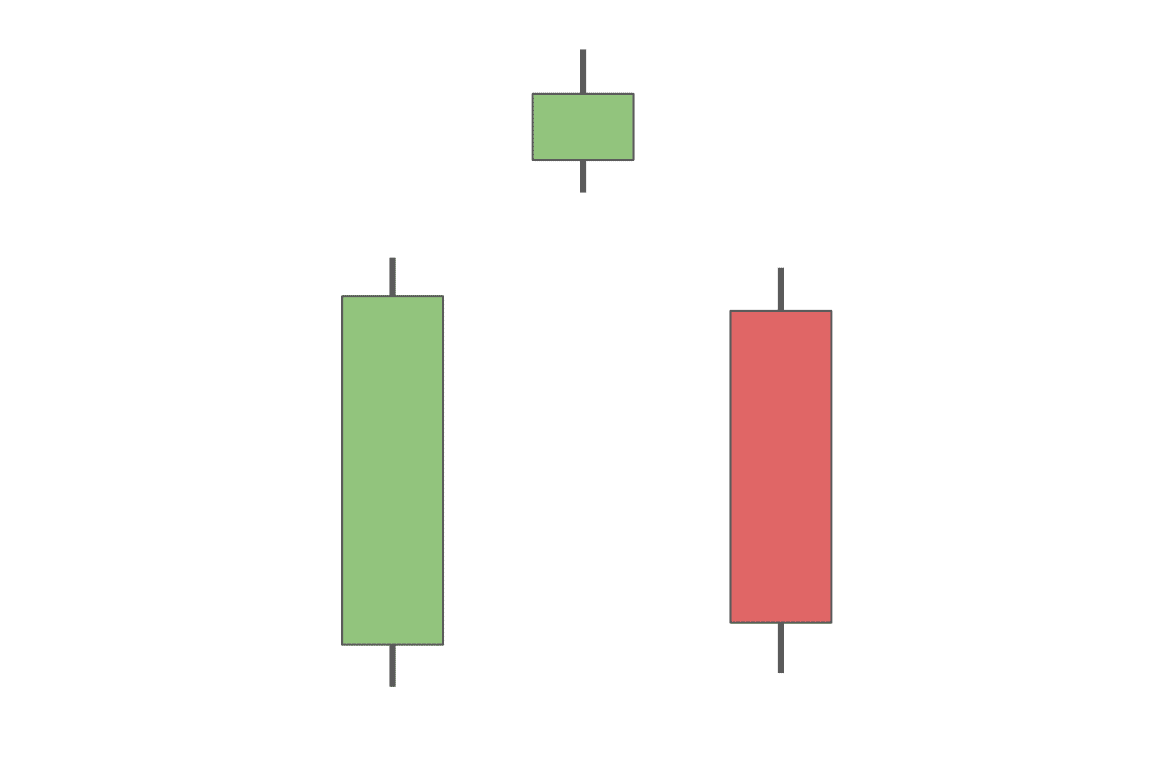

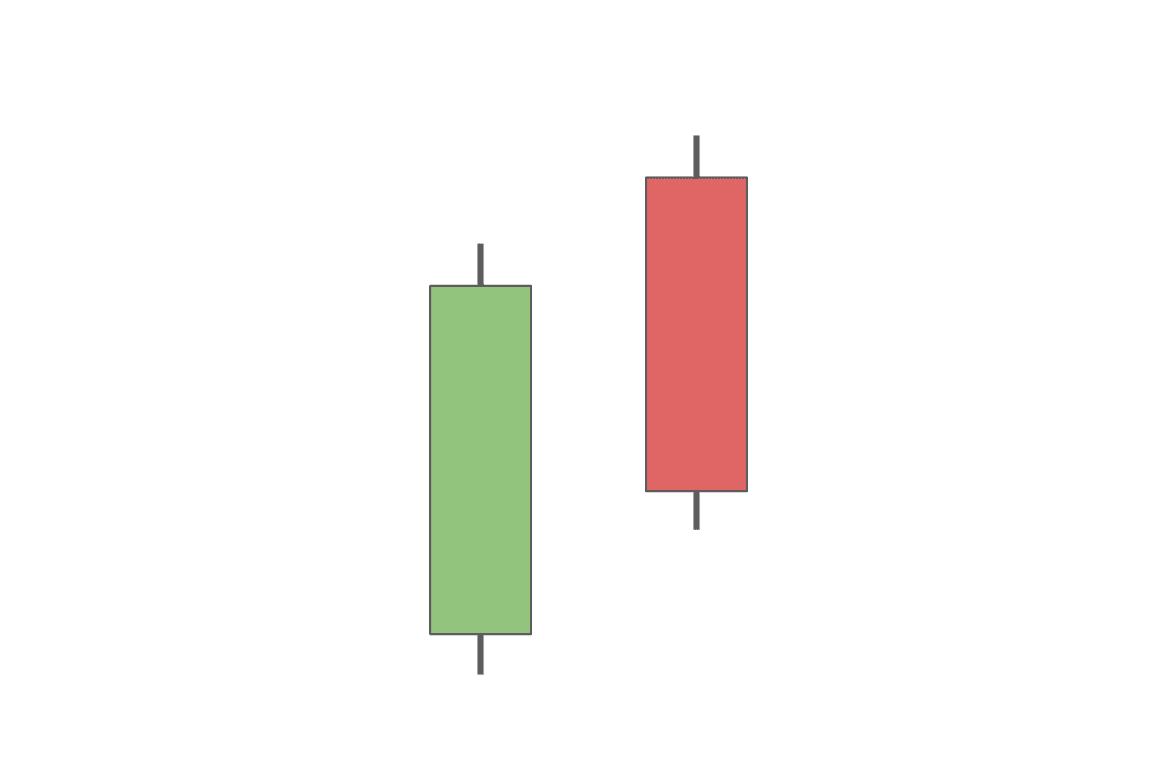

Morning Star

The morning star is a bullish reversal sample fashioned by three candlesticks. The primary candlestick is bearish, the second is a small bullish or bearish candlestick, and the third one is an enormous bullish candle.

The second candle finally ends up being so small as a result of though there’s a push to a brand new low, there may be additionally a rebound, which receives bullish affirmation by the third massive inexperienced candle.

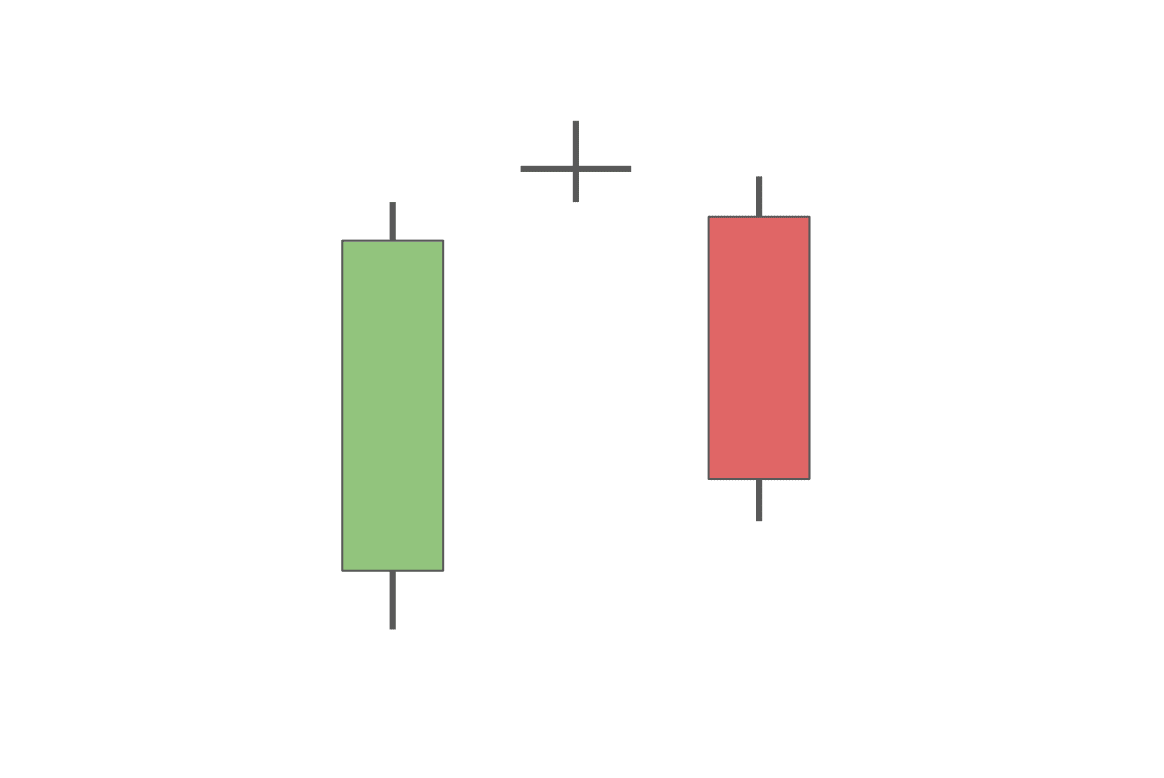

Morning Doji Star

The morning doji star is similar to the common morning star. The principle distinction is that on this case, the second candle’s physique is loads smaller — it’s a doji. Its small physique alerts indecisiveness out there, whereas its lengthy wicks mirror the continuing value volatility. These two components mixed, particularly alongside the opposite components of the morning star sample, sign a doable reversal.

Piercing Line

The piercing line is fashioned by two candlesticks, a bearish and a bullish one, which each have common or massive our bodies and wicks of common size. The second candle’s low is all the time under that of the earlier candle. Regardless of that, this bullish candlestick would possibly signify the start of a rally.

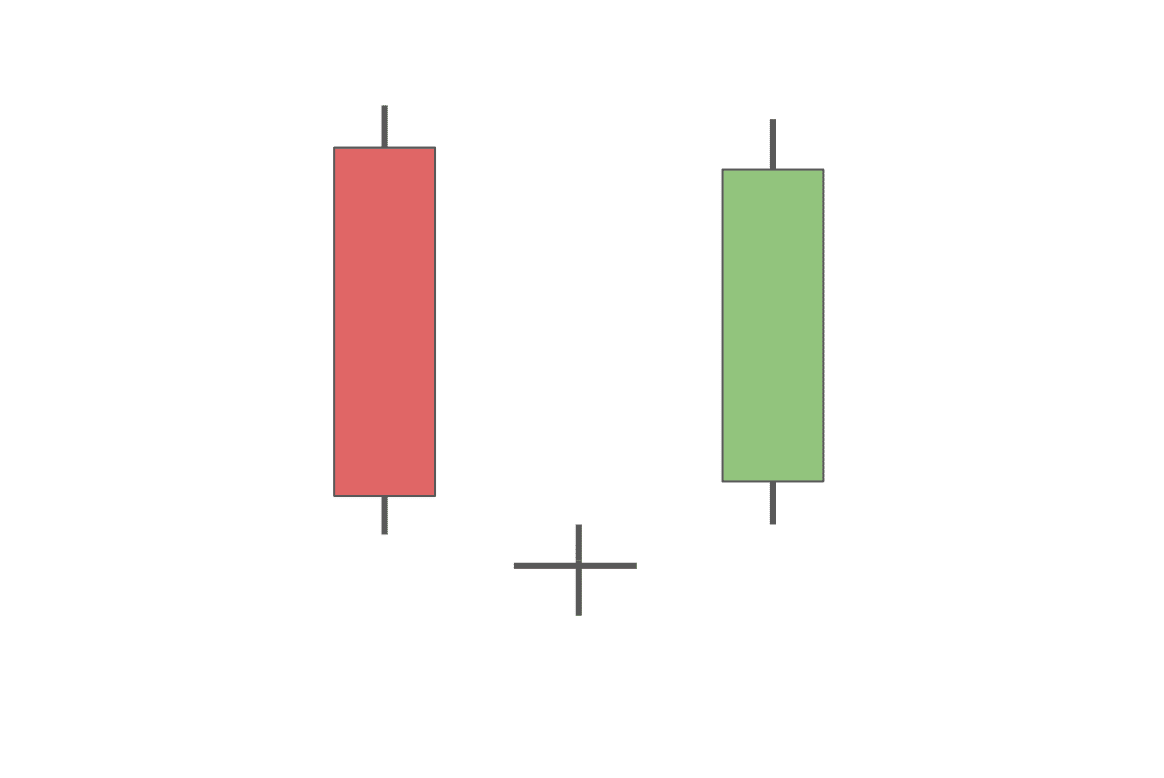

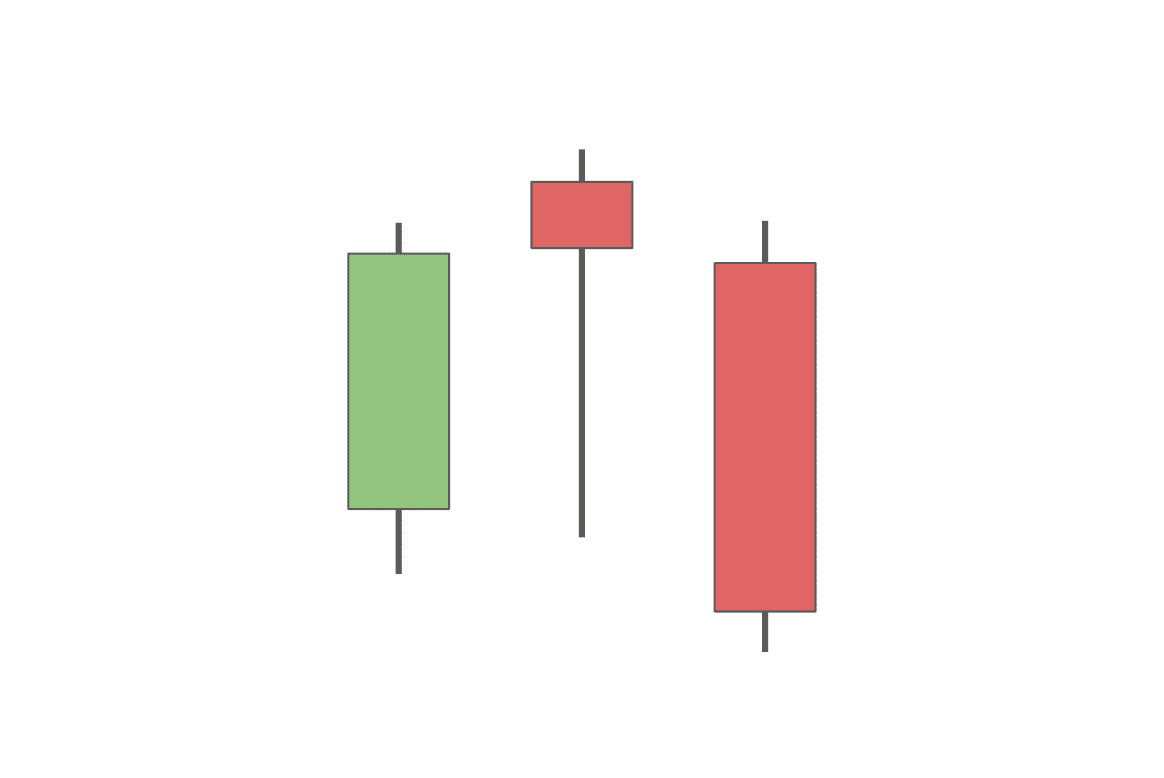

Bullish Harami

The bullish harami is fashioned by two candles, a bearish and a bullish one. The inexperienced candle is loads smaller than the pink one. This sample signifies that there has presumably been a change out there sentiment, and a rally could occur quickly.

Hammer Candlestick

A hammer is among the best patterns to identify: it has an simply recognizable form and is made up of 1 single candlestick. This candle has a small physique and a extremely lengthy decrease wick.

That lengthy decrease wick along side a brief higher one and a physique that’s on the smaller facet offers a reversal sign. It exhibits that whereas the asset briefly traded actually low, it managed to get well and continued being traded close to its excessive level and above the opening.

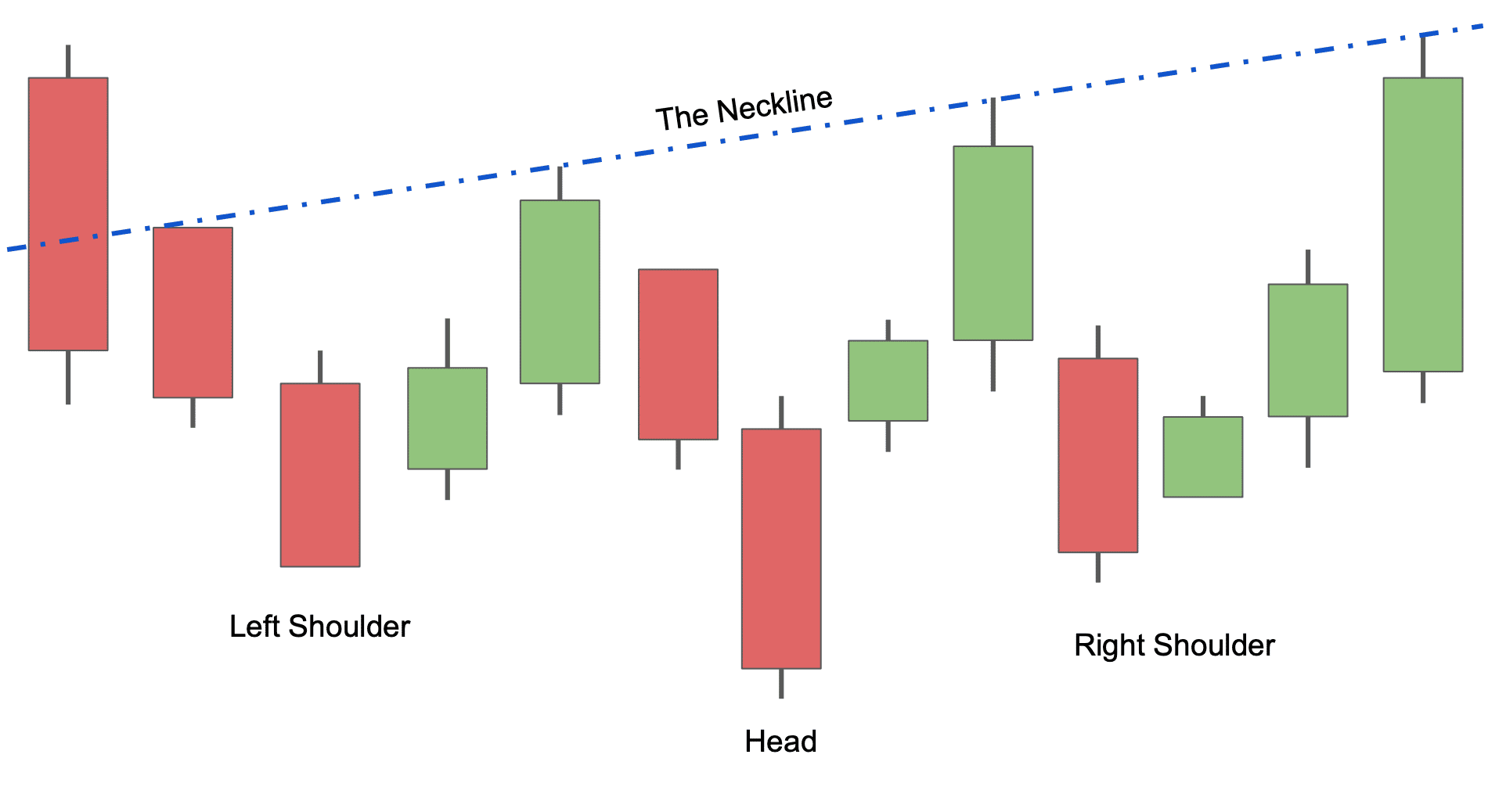

Inverse Head and Shoulders

The inverse head and shoulders is probably the most advanced bullish reversal sample on this listing. Made up of a number of candles, it’s normally acknowledged by its total form, which resembles three inverted triangles. The primary one varieties the left shoulder, the second is the pinnacle, and the third one represents the appropriate shoulder.

First, costs go right down to a brand new minimal, which sparks a short-lived value rise. Then, the pattern reverses, and the asset’s worth goes even decrease, solely to shoot again up once more and return down once more. These two excessive factors are referred to as the neckline. Lastly, the asset goes up one remaining time and normally continues rising.

The complexity of this sample makes it stronger: as a result of it takes longer to be accomplished, the rallies that come after it normally are typically stronger.

Prime Bearish Reversal Candles

Now that we’ve examined bullish reversal candles, let’s check out some bearish reversal candles.

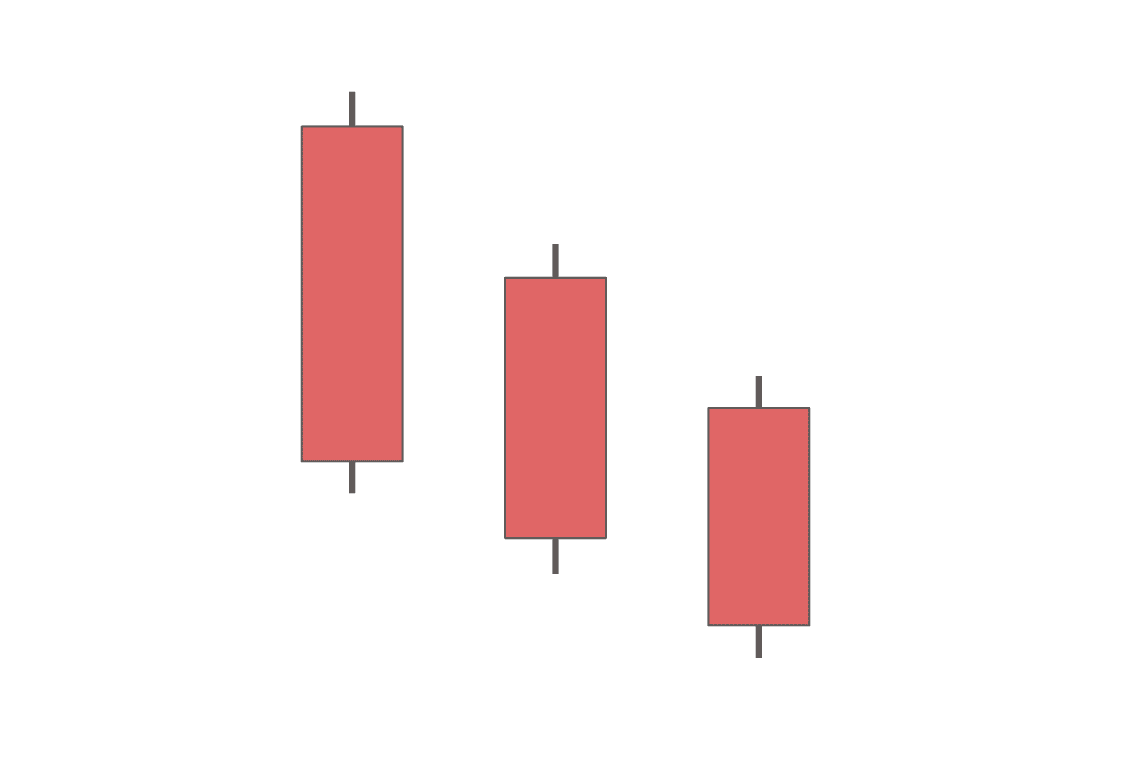

Three Black Crows

The three black crows is a bearish reversal sample fashioned by three consecutive candlesticks with decrease closes. All of them have small wicks — the opening value is usually additionally the very best, and the closing value is sort of the bottom.

That exhibits that the value continues to fall all through the set time-frame and retains on happening inside the candle. Three black crows is taken into account to be a extremely highly effective bearish sample. When preceded by a bullish pattern, it alerts a reversal.

Capturing Star Candlestick

The taking pictures star is a bearish reversal sample fashioned by one candlestick with a small physique, a protracted higher shadow, and a brief decrease shadow. It normally seems after a bullish pattern and alerts its ending.

This candlestick’s construction exhibits that though a brand new excessive has been hit, the pattern is beginning to reverse as there may be not sufficient shopping for strain.

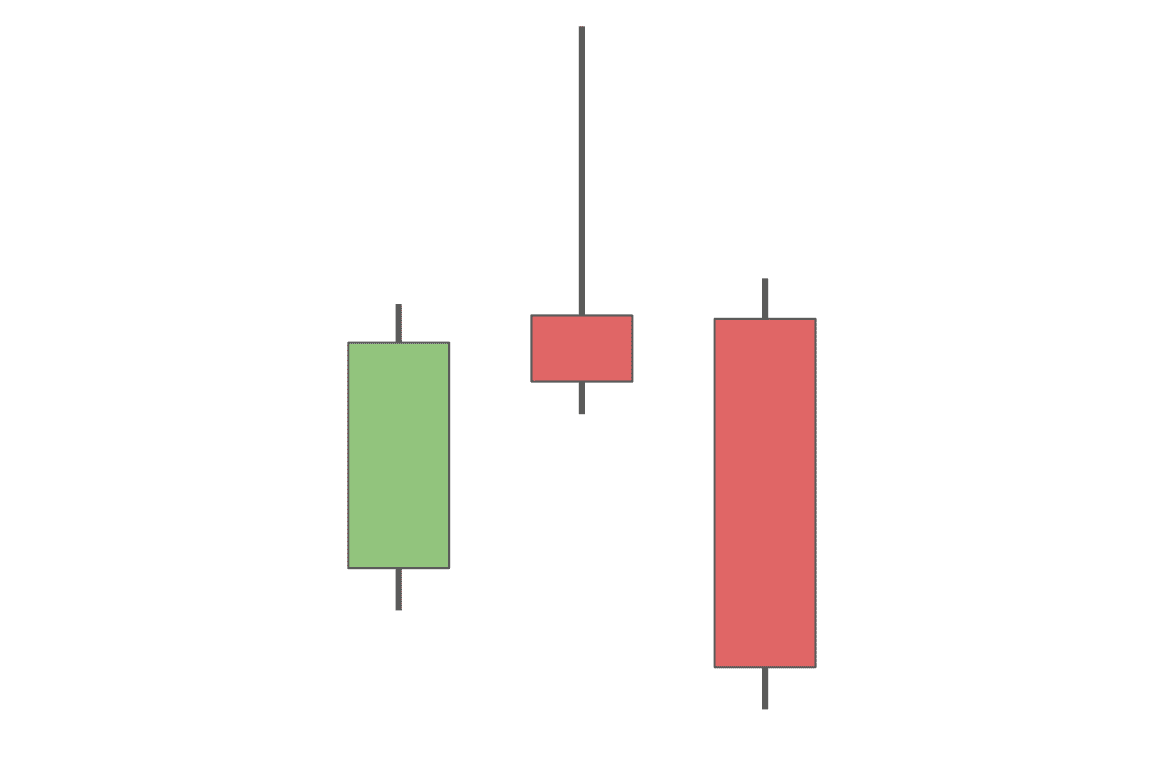

Bearish Deserted Child

The bearish deserted child is much like its bullish counterpart however turned the wrong way up. Similar to its cousin, it’s also made up of three candles, with the center one being comparatively small.

The principle distinction between them is that on this sample, the second candlestick is above the opposite two, not under. Moreover, the primary candle will probably be inexperienced, and the third one will flip pink, as this sample alerts the top of a rally and the start of a downtrend.

Night Star

The evening star consists of three candlesticks. The primary and the third candles each have a big physique, whereas the center one is relatively small.

The primary candlestick is bullish, and so is the second. Nevertheless, its small measurement exhibits that the rally has stalled, which is then confirmed by the third — bearish — candle. It normally alerts the start of a downtrend.

Night Doji Star

The night doji star is similar to the conventional night star sample, however its second candle is a doji with an virtually non-existent physique. Similar to the morning doji star, it exhibits indecisiveness out there, though this time, it alerts a doable reversal right into a bearish route.

Darkish Cloud Cowl

The darkish cloud cowl is one other robust sample. It’s fashioned by two candles, first a bullish after which a bearish one. Each of them are robust, with massive our bodies and average-sized wicks.

This sample exhibits a state of affairs by which the value of an asset tries to push to a brand new, greater place however in the end fails and closes under its opening. It alerts a bearish reversal pattern.

Hanging Man Candlestick

The hanging man is fashioned by only one candlestick. It has a small physique with a brief higher wick and a protracted decrease one. Primarily, it’s the similar because the hammer candle. This candlestick known as a dangling man when it comes on the finish of a bull run. Similar to its bullish counterpart, it alerts a doable value reversal.

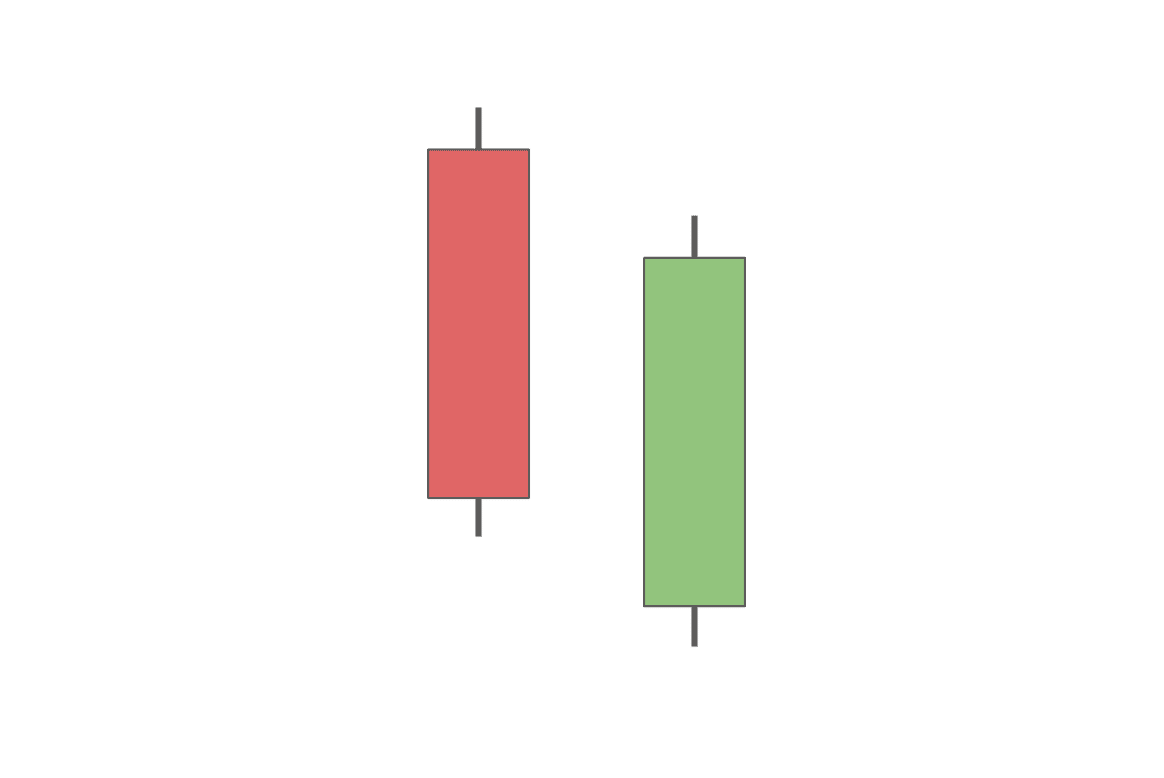

Bearish Engulfing

The bearish engulfing is the alternative of the bullish engulfing sample. This time, it’s the bearish candle that engulfs the smaller physique of the previous bullish one. It exhibits that though the asset’s worth briefly rallied above the very best level of the earlier candlestick, it nonetheless closed under each its personal opening and the opening value of the previous candle. This normally results in a bearish reversal.

How Is Reversal Completely different from Retracement?

In buying and selling, understanding the distinction between a pattern reversal and a retracement is essential. A pattern reversal signifies a major change out there’s route, marking the top of an current pattern and the beginning of a brand new one. This shift is commonly recognized by patterns like head and shoulders or double prime/backside, indicating a considerable change in market sentiment. These reversals normally have an extended period and are essential in signaling new tendencies.

Contrastingly, a retracement is a short lived reversal inside an ongoing pattern. It’s seen as a minor market correction and is normally short-lived. Instruments like Fibonacci retracement ranges or shifting averages assist establish potential help or resistance ranges throughout these actions. In contrast to reversals, retracements don’t signify an entire pattern change however are extra like transient pauses within the current pattern.

Turn into the neatest crypto fanatic within the room

Get the highest 50 crypto definitions that you must know within the trade without cost

Learn how to Use Reversal Candlestick Patterns

Reversal candlestick patterns are important for merchants to identify shifts in market tendencies. Patterns just like the bullish reversal doji, reversal hammer, and bearish engulfing sample can point out modifications from bearish to bullish tendencies and vice versa.

Merchants ought to use these patterns alongside affirmation alerts, like a subsequent greater or decrease candle shut, to validate potential pattern reversals. For example, a bullish reversal doji following a downtrend could sign an upcoming uptrend, particularly if adopted by the next closing candle.

What to Do When Reversal Candle Formations Seem

Upon recognizing reversal candle formations, merchants ought to act swiftly to evaluate potential market route modifications. Recognizing patterns comparable to bullish engulfing or taking pictures stars is essential. The bottom line is to know these indicators and combine them into your buying and selling technique successfully, managing open positions accordingly and probably capitalizing on new market instructions.

Entry Factors

Figuring out entry factors entails recognizing single, twin, or three-candlestick patterns. Merchants ought to enter a place within the route of the reversal on the opening of the subsequent candle, leveraging the potential pattern change with out awaiting additional affirmation.

Cease Loss

A stop loss is an important danger administration device. For bullish reversals, set it under the sample’s low; for bearish reversals, above the sample’s excessive. This technique helps safeguard in opposition to market actions that oppose the anticipated pattern.

Take Revenue

Setting a take revenue stage entails verifying it’s a minimum of twice the gap from the entry level to the cease loss. This ratio ensures a good risk-reward stability, aligning along with your danger administration technique and maximizing potential good points whereas minimizing potential losses.

Are All Reversal Candles Dependable?

Reversal candles, common in technical evaluation, should not all the time dependable indicators of market reversals. Whereas they are often helpful, their effectiveness varies relying on a number of components. The accuracy of those indicators usually relies upon available on the market context and the particular candlestick sample being analyzed. For example, an inverted hammer could point out a possible rally in a downtrend, but it surely requires affirmation from subsequent buying and selling durations to validate this prediction.

Merchants mustn’t solely depend on reversal candles for decision-making. As a substitute, they need to contemplate these patterns as a part of a broader buying and selling technique that features different technical indicators and an intensive evaluation of the present pattern. Understanding the restrictions of those patterns is essential in stopping over-reliance on them and making extra knowledgeable buying and selling choices.

Benefits and Limitations of Candlestick Patterns

Candlestick patterns are famend for offering visible cues about bullish and bearish tendencies out there, thus helping merchants in anticipating future value actions. Patterns just like the morning doji star sample and the hammer sample can sign potential shifts in market sentiment, serving to merchants to establish potential entry and exit factors.

Alternatively, there’s all the time one of many primary limitations of candlestick patterns — their subjective interpretation. Interpretations of the identical sample would possibly fluctuate and result in contrasting buying and selling choices.

Moreover, these patterns can typically produce false alerts, significantly in risky markets. To mitigate these limitations, it’s advisable to make use of candlestick patterns along side different types of technical evaluation, comparable to help ranges, continuation patterns, and momentum oscillators. This multifaceted strategy helps to validate the alerts offered by candlestick patterns and improve the reliability of buying and selling predictions.

Widespread Errors to Keep away from in Deciphering Candlestick Patterns

Deciphering candlestick patterns successfully is essential to profitable buying and selling, however there are frequent errors that merchants ought to be cautious of.

One such mistake is analyzing these patterns in isolation with out contemplating the broader market context. For example, a Doji candle could point out indecision out there, however its significance is healthier understood when seen in relation to the present pattern and surrounding candlestick formations.

One other error is overlooking the significance of quantity in validating candlestick patterns. Excessive buying and selling quantity can reinforce the credibility of a sample, comparable to a continuation candlestick sample, indicating a stronger market dedication to the present pattern or a possible reversal.

This holistic strategy reduces the danger of misinterpretation and permits for extra correct and reliable buying and selling choices.

What Is the three Candle Reversal Technique?

The three candle reversal technique is a technical evaluation methodology utilized in buying and selling to establish potential reversals out there pattern. It’s primarily based on the commentary and interpretation of a selected sequence of three candlesticks on a chart. Right here’s the way it usually works:

- Identification of a Pattern: Step one entails figuring out the prevailing pattern out there, whether or not it’s upward (bullish) or downward (bearish). This technique is best when utilized after a powerful and clear pattern.

- The Three Candle Sample: The technique appears for a selected sample of three candles:

- First Candle: That is according to the present pattern. For a bullish pattern, this may be an upward candle (normally inexperienced), and for a bearish pattern, a downward candle (normally pink).

- Second Candle: This candle begins to indicate the reversal. In a bullish pattern, it could open greater however shut under the midpoint of the primary candle. In a bearish pattern, it could open decrease however shut above the midpoint of the primary candle.

- Third Candle: The important thing candle that confirms the reversal. For a bullish pattern reversal, this candle ought to shut properly into the physique of the primary candle (ideally under it). For a bearish pattern reversal, it ought to shut properly above the physique of the primary candle.

- Affirmation and Entry: Merchants search for extra affirmation alerts on the fourth candle or by different technical indicators like quantity, help and resistance ranges, or momentum indicators. Entry factors are sometimes thought-about on the shut of the third candle or the open of the fourth, relying on affirmation.

- Danger Administration: As with all buying and selling methods, danger administration is essential. This entails setting applicable stop-loss orders and take-profit targets to guard in opposition to potential losses and lock in income.

The three candle reversal technique is common as a result of it’s comparatively easy and may be utilized throughout varied time frames and markets. Nevertheless, it’s vital to notice that no technique ensures success, and this strategy ought to be used along side different evaluation instruments and a transparent understanding of market situations.

FAQ

What’s the greatest reversal candlestick?

Probably the greatest-known and generally used reversal candlestick patterns is the Doji. A Doji candlestick signifies market indecision, the place the opening and shutting costs are practically an identical, usually indicating a possible reversal. One other robust contender is the Engulfing sample—both bullish or bearish—which entails a big candle absolutely protecting the earlier one, signaling a major shift in momentum.

What’s the greatest time-frame for day buying and selling?

The 15-minute time-frame is the perfect one for day buying and selling. It’s quick sufficient to assist you to make fast choices but lengthy sufficient to offer you a good suggestion of what’s going on out there.

What’s the greatest indicator for pattern reversal?

There isn’t any one greatest indicator for pattern reversal. Some common indicators that can be utilized to establish pattern reversals are the shifting common convergence divergence (MACD) indicator, the relative power index (RSI) indicator, and the stochastic oscillator.

What’s bullish reversal power?

The power of a bullish reversal refers back to the probability of the reversal really occurring.

What’s a reversal candlestick sample?

A reversal candlestick sample is a formation that happens on a candlestick chart indicating a possible change out there route. There are bullish and bearish reversal patterns.

How do you see a reverse candle?

One of the simplest ways to identify reserve candles is to memorize the most typical patterns, such because the bearish and the bullish engulfing, three white troopers, three black crows, and so forth.

What’s the strongest reversal candlestick sample?

Among the strongest candlestick patterns embody the bullish engulfing sample, the morning star sample, and the night star sample. These patterns are typically extra dependable than different ones.

What are bullish reversal candlestick patterns?

Bullish candlestick reversal patterns are formations that happen on a candlestick chart indicating a possible change out there route from bearish to bullish.

Disclaimer: Please word that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.

[ad_2]

Source link